Bitcoin Breaks Out To New All-Time Market Cap Highs…How High Can It Go?

Currencies / Bitcoin Dec 24, 2016 - 09:36 AM GMTBy: Jeff_Berwick

Bitcoin has had quite a month, rising from $725 to a high of $911 today.

Bitcoin has had quite a month, rising from $725 to a high of $911 today.

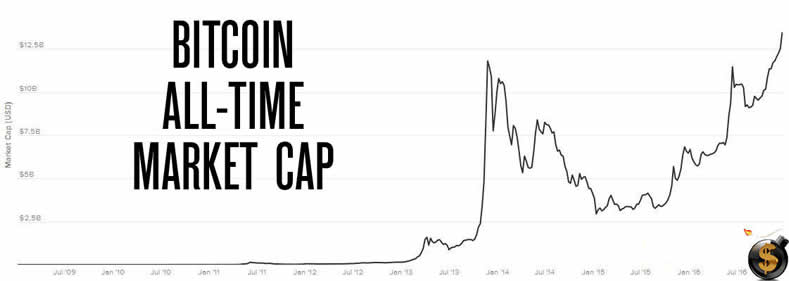

This also means it has broken out to new all-time market capitalization highs overtaking its previous highs in 2013.

The Dollar Vigilante has been covering bitcoin regularly since recommending it at $3 in 2011.

Part of what is driving bitcoin’s price movement is the financial turmoil in China. A weakening yuan in combination with increasingly strict capital controls in the country have driven investor’s capital out of mainland China and into bitcoin.

Likewise, since the Chinese government considers bitcoin to be a commodity rather than a currency, it is impervious to foreign exchange regulators - meaning that it is nearly impossible for them to limit its upside.

But, in my opinion, China is only one of numerous reasons bitcoin has been rising.

But, with it breaking out to all-time highs now, it begs the question, how high can it go?

Let’s look at the total market cap compared to other money and sectors.

Bitcoin is currently near $14 billion of total market cap. If you multiply the total amount of bitcoins available (currently just above 16 million) by its current price you get its market cap near $14 billion.

At $14 billion, bitcoin has nearly the same market cap as silver.

But, when compared to Bill Gates, with a worth of $75 billion, bitcoin is still worth much less than the world’s richest man.

When comparing it to companies, like Apple, the world’s highest market cap company at $620 billion, bitcoin is still only worth 2% of the value of Apple.

And, compared to the total value of all gold in the world of $7.8 trillion, bitcoin is only 0.17% of that value.

Gold is likely the most similar item to compare bitcoin to. Like bitcoin, it is a store of wealth and considered by many to be money.

And given the ease of use of bitcoin and how digital the world is becoming, it is fair to posit that at some point bitcoin may be worth as much as gold.

If that were to happen the price of each bitcoin would have to be valued at $487,500.

Another item that could be compared to bitcoin is the value of all fiat money in the world. It is estimated, by the CIA Fact book, that there is about $28.6 trillion of coins, bank notes and bank deposits in the world.

If bitcoin were to replace all fiat currencies, something in which we speculate is certainly a possibility, the value of each bitcoin would be worth $1,787,500.

Will that happen anytime soon? Of course not. Could it happen? Absolutely.

So, if you think you have missed the boat on bitcoin by not buying it earlier… there are plenty of reasons to think that it hasn’t even begun yet.

We have created an entire page with information on bitcoin for you HERE.

As well, we are offering our book, Bitcoin Basics with a subscription to TDV at a discounted price at that page. And, of course, we happily accept bitcoin. In fact we prefer it.

To learn even more make sure to attend our TDV Internationalization & Investment Summit this February and Anarchapulco right after where most of the biggest names in the bitcoin world gather each year.

We’ve been telling you to pay attention to bitcoin since it was $3 in 2011. But, even now at well over $800, it is still in its early days and massive price increases are not only possible, but quite likely.

Start by checking out this page on bitcoin HERE.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.