Fed Monetary Policy Is Impotent Against These Trends

Interest-Rates / US Bonds Jan 24, 2017 - 12:01 PM GMTBy: John_Mauldin

Chris Wood of CLSA has a marvelous newsletter called, aptly, GREED & fear. He began his January 5 issue talking about bond yields possibly bottoming out.

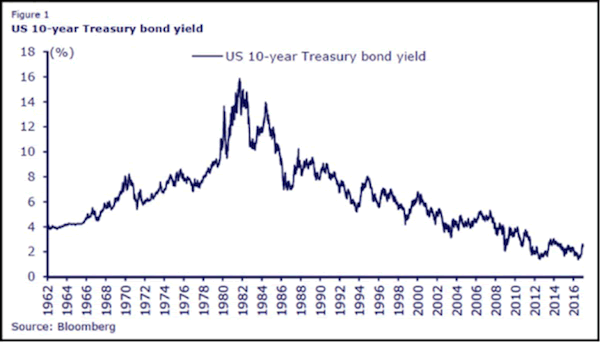

For perspective, he starts with this long-term view of the 10-year US Treasury yield.

Source: Greed & Fear

This multi-decade downtrend encompasses the careers of virtually everyone in the financial industry today.

There will be no return to unconventional monetary policies in America

Here’s Chris:

An inflection point may have been reached in world financial markets, or at least such is what market participants began to think in the final weeks of 2016. The inflection point referred to is the postulated end to the 35-year-old bull market in Treasury bonds, and the related decline in interest rates that went with it. Remember that the 10-year Treasury bond yield peaked at 15.84% in 1981 and hit a low of 1.36% in July of last year (see Figure 1).

Such a view… also assumes the end of lower for longer, clearly assumes that deflationary pressures have also peaked and that inflationary pressures are set to return. It also assumes that there will be no return to unconventional monetary policies in America, even as these policies continue for now in Japan and the Eurozone….

Now, it is true that there have been countless wrong predictions made before of the end of the bull market in Treasury bonds.

Monetary policy is increasingly impotent

This possible inflection point in bond yields, if that’s what it is, would seem to be the result of another inflection point: the impending Trump presidency. Chris is not convinced:

It is, of course, this perceived inflection point in policy, and the related hopes for the return of animal spirits to the American economy, which has been the key trigger for the dramatic sell-off in the American bond market and almost equally dramatic rally in the US dollar since Donald Trump’s victory. But from a Federal Reserve perspective, these market moves have already served to tighten financial conditions significantly.

Meanwhile, the current establishment consensus, most particularly in Washington, is that monetary policy is increasingly impotent and that the “heavy lifting” should now be done by fiscal policy. This explains why just about the only issue which Donald Trump and Hillary Clinton agreed on during last year’s presidential campaign was infrastructure stimulus.

While GREED & fear will be the first to admit that tax cuts and deregulation are clearly positive triggers for animal spirits and growth, extreme skepticism is warranted on the hopes currently being invested in the powers of fiscal easing and related infrastructure spending even if it is assumed that a Republican-controlled Congress, containing many fiscal conservatives, is really willing to sign up to The Donald’s spending plans.

I agree, too, that the jury is still out on the infrastructure spending issue.

Export-heavy countries are at risk

Meanwhile, the much-discussed protectionist threat represented by the President-elect remains harder to call. GREED & fear’s view is that the most-substantive proposal out there is the draft legislation currently before the House of Representatives discussed here in some detail last month. While not proposing outright tariffs, this draft legislation, which some are calling a “border tax,” has in some respects the same practical effect, as it would remove the tax deductibility against corporate tax of imports, while profits would no longer be taxed at the US rate for exports.

There is apparently huge lobbying currently going on against this legislation by corporate America, which is not surprising given annual imports in America are US $2.7tn and given the money that has been invested by American companies in their supply chains in the era of globalisation, be it in Mexico, Asia, or elsewhere. Still, this week’s news of Ford abandoning plans for a US $1.6bn Mexican plant in favor of Michigan is a sign of the direction in which the political winds are blowing.

To extend Chris’s last point, I hear many critics say Trump can’t win by going after companies one at a time. But he doesn’t need to. Making examples of a few high-profile companies already sends a message to others.

This shift will create vulnerabilities in export-heavy economies. For that reason, Chris favors “domestic demand” stories (i.e., countries large enough and wealthy enough to sustain growth within their own borders).

Get a Bird’s-Eye View of the Economy with John Mauldin’s Thoughts from the Frontline

This wildly popular newsletter by celebrated economic commentator, John Mauldin, is a must-read for informed investors who want to go beyond the mainstream media hype and find out about the trends and traps to watch out for. Join hundreds of thousands of fans worldwide, as John uncovers macroeconomic truths in Thoughts from the Frontline. Get it free in your inbox every Monday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.