Could Cars Be the Death of Us This Time Around?

Interest-Rates / Debt Crisis 2017 Feb 02, 2017 - 04:25 PM GMTBy: Harry_Dent

The shining star of the 2009-2016 recovery has been auto sales.

The shining star of the 2009-2016 recovery has been auto sales.

We weren’t surprised. In fact, we saw it coming. After all, cars are the last large purchase people make before stepping quietly into their years of increased saving and decreased spending. From around the age of 57 to 64, one task takes center stage: save for retirement. In the durable goods sector, housing peaks first around age 40, then furnishings at age 46. Only automobiles continue to grow after the peak in spending at age 46.

We’re in the midst of updating our consumer expenditure data. The biggest change thus far is how QE and super-low interest rates have shifted the new car sector. In the 1990s, spending peaked at around age 54. But now, older Americans have been buying better cars later into life, into age 62. In general, auto sales don’t so much grow as move sideways in a plateau between ages 41 and 62 and the steep drop-off now occurs after 66, not after 54.

We’re in the midst of updating our consumer expenditure data. The biggest change thus far is how QE and super-low interest rates have shifted the new car sector. In the 1990s, spending peaked at around age 54. But now, older Americans have been buying better cars later into life, into age 62. In general, auto sales don’t so much grow as move sideways in a plateau between ages 41 and 62 and the steep drop-off now occurs after 66, not after 54.It makes sense. My car leases have gone as low as 2%. Back before 2008, I was paying as much as 5% to 6%! That makes hundreds of dollars of difference in my car payments and allows you to buy a better car.

But time has proved that low rates weren’t enough for an industry with highly aggressive lending practices (I’m talking worse than mortgages and home loans) and an inevitable demographic cliff…

In the last boom, subprime mortgage lending peaked at $44 billion per quarter. Subprime lending for cars peaked at $42 billion! That’s surprising given that the housing industry is so much larger… and you’re buying an asset so much bigger than a car.

In this current boom, the auto subprime loans exploded again, this time without mortgage loans for company. Subprime auto loans have hit as high as $38 billion in Q2 2015, while subprime mortgages have been flat, around $20 billion.

So, basically, car dealers have been willy-nilly extending credit to more and more people who have less than 620 credit scores… all to boost sales further. And they’ve been pushing loan terms out to six years, sometimes even seven, while keeping interest rates at insanely low levels, just like they did into 2007.

It’s no wonder we’re once again faced with a massive auto-loan debt bubble, and a “booming” industry.

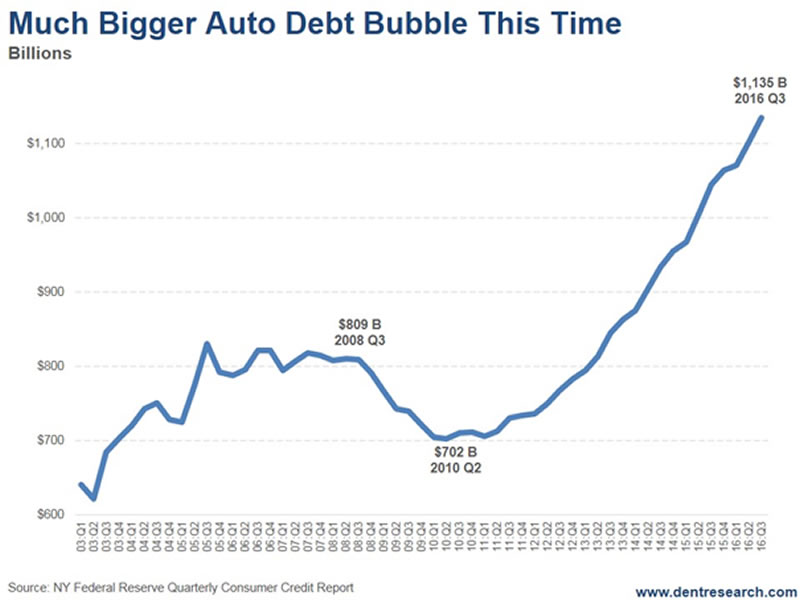

Just look at this insanity…

From 2003-2007, auto debt rose by $210 billion. From 2011-2016, it has surged more than twice as much, by $433 billion, to $1.135 trillion, higher than all credit card debt. And it’s still rising rapidly.

Whatever happened to learning from your mistakes? Not repeating history? Clearly the lessons of the last bust in the economy, housing and cars, has been lost on this industry.

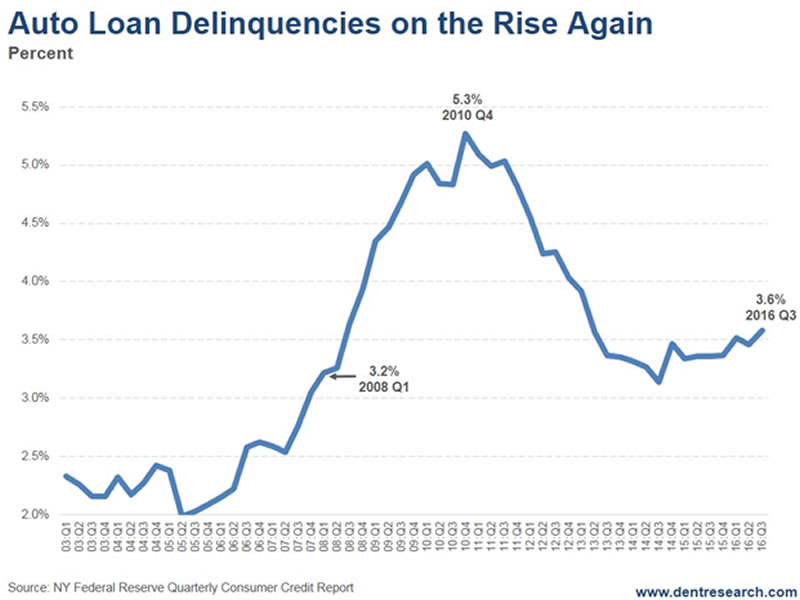

Now there are early signs that trouble is brewing and that the wheels are starting to come off this bus. Auto loan delinquencies are rising again. But this time around they bottomed at 3.2% and have risen to 3.6%. Last time they started at 2.0% and were at 3.2% in Q1 2008, when the recession started. They reached 5.3% in Q4 2010. So, they’re starting higher and will almost certainly go much higher as well, to 6.5%-plus in the next downturn.

This rise in subprime auto debt and delinquencies it yet more evidence that we’re on the verge of the next downturn…

And you know what I think! What we now face will be the worst downturn since the Great Depression… and the final bubble crash will finally lead to serious debt deleveraging and deflation, unlike last time when we were spared by $13 trillion in QE globally.

I really don’t believe the public will buy letting central banks double down and print $25 to $30 trillion to bail us out this time. I really see no way out of this.

And by the time we come out of this next crash, the auto boom will be over demographically and will not be as strong in the next boom.

But I do see opportunity, which I detail in my book The Sale of a Lifetime. Have you read your copy yet?

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2017 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.