Bitcoin Breaks Records and Sits at Cusp of All-Time High…Here’s Why

Currencies / Bitcoin Feb 23, 2017 - 05:29 AM GMTBy: Jeff_Berwick

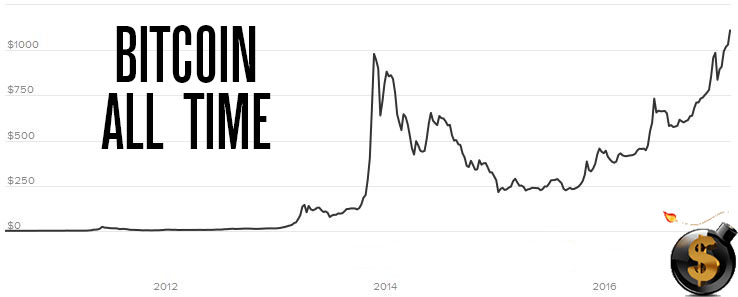

We have been the biggest proponent of bitcoin in the financial space since it was $3 in 2011.

It now sits just a few dollars from its all-time high (ex-Mt. Gox which wasn’t a legitimate high) of $1,150. And, bitcoin has remained above the $1000 price level for a record stretch of time - seven days!

The price is currently $1122.19 as of the writing of this article and continues to climb.

This upside has been fueled by the potential SEC approval of the new Winklevoss bitcoin ETF (COIN) scheduled for Saturday, March 11th.

As it currently stands, rules and regulations state that wholesale investors are prohibited from taking positions on bitcoin. However if the ETF is approved, it will likely result in a deluge of money managers piling into the market. This could spark a trading frenzy pushing bitcoin much, much higher.

Right now there is only one way to get exposure to bitcoin on a stock exchange and that is through the Bitcoin Investment Trust (OTC: GTBC). Except it is not an ETF, does not track the price of bitcoin very well and it is listed on the OTC market which the majority of fund managers are unable to trade.

GBTC, however, announced last month that they are applying to get listed on the New York Stock Exchange as an ETF.

If either or both of these instruments gain approval, there’s no telling how high the value of bitcoin will go, but I told subscribers that it could be over $5,000 by the end of 2017.

Of course, the Securities & Exchange Commission (SEC) is a criminal enterprise that uses violence (laws/police/jail) to manipulate the markets in favor of its lobbyists who pay the most bribes. (Donald Trump proudly proclaims that he has bribed almost every major politician in the US.)

So, there is really no way to know what the SEC will do. It depends who pays off whom. The SEC may not approve the bitcoin ETFs because, if they did, they would cause a massive spike in bitcoin. This spike would allow bitcoin to further compete with the financial system of which the SEC is a part.

While we wait to see what happens, we featured another cryptocurrency in the TDV newsletter (subscribe here) this month. And, just like bitcoin, ethereum and monero, which we also featured in the last few years, it spiked dramatically right after our recommendation.

We featured it at $17.15 and it is currently at $21.95 for a near 28% gain. But, if we are right, it will go much, much higher.

Bitcoin hitting its all-time high just a few days before the TDV Internationalization and Investment Summit, Anarchapulco, and Cryptopulco starting this weekend is incredible timing. And spirits should be very high!

If you hurry you can still make it down to Acapulco for these great conferences. But if you can’t we'll be recording all the presentations in professional, HD quality and you can watch them all from the comfort of your own home…and we are offering a discount if you pre-pay for the videos prior to the conference.

You can find out more here!

Last year, a number of our speakers pounded the table that bitcoin was a buy near $400. It has since nearly tripled. So, you’ll want to hear what experts like G. Edward Griffin, Roger Ver, Ed Bugos, David Morgan, Bix Weir, myself and many more have to say for 2017.

Learn more about it here.

And for those attending the conferences we’ll see many of you starting tomorrow (Thursday) night in the lobby bar of the Mundo Imperial hotel at 7pm for a pre-conference cocktail party.

Salud!

And subscribe to The Dollar Vigilante newsletter to keep one step ahead of the game. The EJW’s may turn out to be more dangerous than the SJW’s… especially for your pocketbook, unless you are prepared.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.