Bitcoin Price Hits Record High!

Currencies / Bitcoin Feb 24, 2017 - 03:25 PM GMTBy: Jeff_Berwick

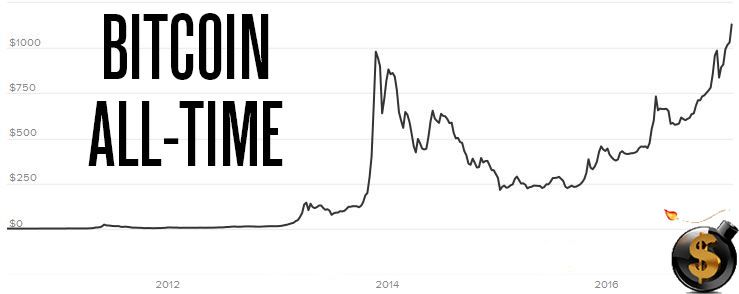

Bitcoin has just smashed through its all-time high in US dollar terms.

Bitcoin has just smashed through its all-time high in US dollar terms.

The US dollar was the last all-time fiat currency to crack as bitcoin has been hitting all-time highs in every other government/mafia mandated currency over the last few years.

On CoinDesk bitcoin hit an all time high of $1206.60 which is the highest it’s been since Mt. Gox in 2013, which doesn’t count, because it was likely inflating bitcoin prices before it was shut down.

In fact, bitcoin exemplifies what The Dollar Vigilante is all about. The old statist/communist/fascist power structures are collapsing and the free market is creating new solutions which make the old, evil systems obsolete.

When we first started The Dollar Vigilante in 2010, we said that we expected all fiat currencies to collapse within 10 years (by 2020). Everyone thought we were crazy.

After a few years a lot of people began agreeing with us. But then they asked, “what will replace criminal government fiat paper currencies?”

In 2010 my response was, “I’m sure the market will come up with something.”

By 2012 my answer was, “bitcoin!”

Bitcoin’s rise is pretty incredible given that it only started in November 2008, when a paper was published by Satoshi Nakamoto, “Bitcoin: A Peer-to-Peer Electronic Cash System” This paper created a peer-to-peer network “for electronic transactions without relying on trust".

Initial bitcoin transactions involved 10,000 BTC purchasing pizzas delivered by Papa John’s. But by June 2011 Wikileaks began accepting bitcoin for donations. Then The Electronic Frontier Foundation began to accept them as well.

I then wrote the forward for “The Book of Satoshi: The Collected Writings of Bitcoin Creator Satoshi Nakamoto” in 2014 and then was involved in the creation of the world’s first bitcoin ATM in 2015. And it’s been no looking back since.

In this trailer for a bitcoin documentary I explained how the government can stop bitcoin… “only by turning off the internet”.... I didn’t go on to explain, however, that they can’t.

The host of CNBC's Mad Money, Jim Cramer, played himself in a courtroom scene and said he didn’t believe bitcoin was a true currency. "There's no central bank to regulate it; it's digital and functions completely peer to peer".

In fact, this is a large part of what makes bitcoin so popular. By bypassing central banks, bitcoin also bypasses the price inflation inevitably caused by central banks. Additional bitcoin are generated by solving mathematical equations that give the solver a certain amount of bitcoin.

Central banks don’t control bitcoin, nor do they have control over the amount of bitcoin issued.

By October 2012, 1,000 merchants or more were able to process bitcoin and welcomed their use. Services like OkCupid and Foodler also began to take bitcoin, which further added to the young currency’s credibility.

More recently the Cabinet of Japan has given bitcoin the status of real money (not that it matters). Bitcoin is used in Japan regardless. Steam took it as payment for video games and Uber switched over to it in Argentina.

China’s central bank has increased “oversight” (AKA criminal acts) of bitcoin but Chinese traders are using peer-to-peer marketplaces to buy and sell. As a result, Yuan volumes on the marketplace have gone up a lot - which can’t be pleasing to Chinese authorities. Good.

Peer to peer networks are informal. After making an initial contact, users can get in touch directly without using the platform. Bitcoin can be traded in chat rooms as well.

There are plenty of ways to trade bitcoin other than via formal exchanges. The total volume of bitcoin is surely a lot higher than its formal exchange volume. And hopefully a lot of it is used to avoid extortion (taxes).

All of this may spell much higher prices for bitcoin. How about $5,000 per bitcoin. There’s not much at the moment that can seem to slow it down.

Bitcoin hitting its all-time high just a few days before the TDV Internationalization and Investment Summit, Anarchapulco, and Cryptopulco starting this weekend is incredible timing. If you hurry you can still make it down to Acapulco for these great conferences.

If you can’t we'll be recording all the presentations in professional, HD quality and you can watch them all from the comfort of your own home…and we are offering a discount if you pre-pay for the videos prior to the conference.

You can find out more here!

For those attending the conferences we’ll see many of you starting tonight in the lobby bar of the Mundo Imperial hotel at 7pm for a pre-conference cocktail party.

Given bitcoin’s all-time high today, it’s bound to be quite the party. And we are just getting started!

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.