Silver On Sale – 4% Fall On Massive $2 Billion of Futures Selling

Commodities / Gold and Silver 2017 Mar 03, 2017 - 03:04 PM GMTBy: GoldCore

Silver fell a very sharp 85 cents from $18.40 per ounce to as low as $17.65 per ounce yesterday for a 4.25% price fall soon after the London bullion markets closed yesterday despite no market news or corresponding sharp moves in other markets.

Silver fell a very sharp 85 cents from $18.40 per ounce to as low as $17.65 per ounce yesterday for a 4.25% price fall soon after the London bullion markets closed yesterday despite no market news or corresponding sharp moves in other markets.

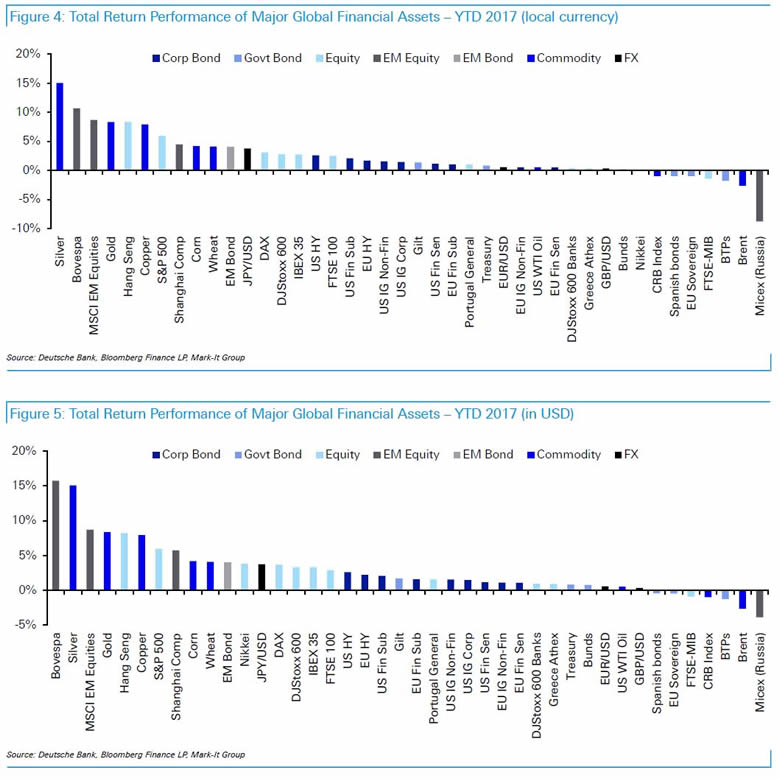

Silver had surged 15% in the first two months and had seen ten consecutive weeks of gradual gains. It had made convincing closes above the psychological $18 an ounce level and the 200 day moving average (DMA) at 18.155 and made 3-month highs only yesterday.

Silver Prices (LBMA)

03 Mar: USD 17.66, GBP 14.44 & EUR 16.76 per ounce

02 Mar: USD 18.33, GBP 14.93 & EUR 17.42 per ounce

01 Mar: USD 18.33, GBP 14.89 & EUR 17.40 per ounce

28 Feb: USD 18.28, GBP 14.70 & EUR 17.24 per ounce

27 Feb: USD 18.34, GBP 14.77 & EUR 17.33 per ounce

24 Feb: USD 18.27, GBP 14.56 & EUR 17.23 per ounce

23 Feb: USD 18.00, GBP 14.42 & EUR 17.06 per ounce

Silver investors were gaining confidence and dealers were experiencing robust demand for silver coins and bars. Suddenly at almost exactly 1630 GMT yesterday as European markets were closing, some entity decided to dump $2 billion worth of silver contracts into the futures market in minutes. A huge 23,000 silver contracts which is the equivalent of 1.15 million ounces of silver was dumped on the market:

Source: Zero Hedge

“Over 23,000 Silver futures contracts suddenly puked into the market as soon as Europe closed…” as noted by Zero Hedge.

Silver quickly fell over 4% and gave up much of the gains of the last month. Gold fell $14.90 or 1.2% to $1235.00.

Rate hike expectations and the risks of a rate hike on March 15 are being attributed for the sharp silver price fall.

However, one would have thought that this was already priced into the market and therefore why the sudden 4% fall in minutes yesterday. It was unusual as there was no breaking news, no bearish silver or gold related news and indeed no important news or announcements from the Federal Reserve.

Indeed, most other markets were becalmed with no major moves in most markets except for gold and silver.

GATA Chairman Bill Murphy’s “Midas” commentary at LeMetropoleCafe.com reviewed the smash in detail, as with commodity broker J.B. Slear’s minute-by-minute tracking of the smash as contracts were dumped on the market in great bulk “starting at 11:25 a.m. for 40 minutes straight:”

1,071 contracts at 11:25.

5,648 at 11:30.

2,798 at 11:35.

1,175 at 11:40.

2,815 at 11:45.

3,319 at 11:50.

1,517 at 11:55.

2,357 at 12:00.

5,861 at 12:05.

4,702 at 12:10.

“That’s a total of 30,192 contracts in 40 minutes.”

Banks have been found guilty of manipulating most markets in recent years including the gold and silver markets. GATA has amassed a huge amount of evidence over the years and as recently as December came new revelations of silver fixing: Silver Fixing By Banks Proven In Traders Chats

Therefore, it stands to reason to suspect that the massive sell off may again have been by a bank or a proxy hedge fund or other institutional fund manipulating the silver market – either for private gain and trading profits or indeed on behalf of the official sector and central banks.

It could be a combination whereby banks realise that central banks are quietly pleased for gold and silver prices to be manipulated lower and banks can profitably manipulate markets believing that they are above the law.

Worst case scenario they get a slap on the wrist and a fine that is small in the light of their massive profits. Some poor patsy “lone wolf” kid trader is found to take the blame and the senior managers and executives get way with this criminal activity.

Golden Opportunity for Silver Buyers

The important point to remember here is that small retail bullion buyers and investors appear to be being defrauded by the largest players in the market – massive banks with massive liquidity provided to them by central banks.

It is also important to remember that this creates an opportunity. The suppression of gold and silver prices means that precious metals remain undervalued – especially versus the assets that banks and central banks favour – property, stocks and especially bonds.

Silver Coins VAT Free in Ireland, UK and EU

Manipulation is an opportunity for investors as it allows them to accumulate physical gold and silver at artificially depressed prices.

The history of gold market ‘fixing’ and manipulation is of short term success followed by ultimate failure and much higher prices. This was seen after the ‘London Gold Pool’ failed spectacularly in the late 1960s. This was followed by gold and silver’s massive bull markets in the 1970s.

The gold and silver beach balls have been pushed near the bottom of the very small ‘precious metals pool.’ The lower they are pushed in the short term, the higher it will surge in the medium and long term.

Access breaking news and research here

Gold Prices (LBMA AM)

03 Mar: USD 1,228.75, GBP 1,005.12 & EUR 1,168.05 per ounce

02 Mar: USD 1,243.30, GBP 1,013.17 & EUR 1,181.14 per ounce

01 Mar: USD 1,246.05, GBP 1,007.18 & EUR 1,182.50 per ounce

28 Feb: USD 1,251.90, GBP 1,006.90 & EUR 1,180.79 per ounce

27 Feb: USD 1,256.25, GBP 1,011.16 & EUR 1,187.41 per ounce

24 Feb: USD 1,255.35, GBP 1,000.89 & EUR 1,185.18 per ounce

23 Feb: USD 1,237.35, GBP 992.97 & EUR 1,173.13 per ounce

Silver Prices (LBMA)

03 Mar: USD 17.66, GBP 14.44 & EUR 16.76 per ounce

02 Mar: USD 18.33, GBP 14.93 & EUR 17.42 per ounce

01 Mar: USD 18.33, GBP 14.89 & EUR 17.40 per ounce

28 Feb: USD 18.28, GBP 14.70 & EUR 17.24 per ounce

27 Feb: USD 18.34, GBP 14.77 & EUR 17.33 per ounce

24 Feb: USD 18.27, GBP 14.56 & EUR 17.23 per ounce

23 Feb: USD 18.00, GBP 14.42 & EUR 17.06 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.