Potential Bottoming Patterns in Gold and Silver Precious Metals Stocks Complex...

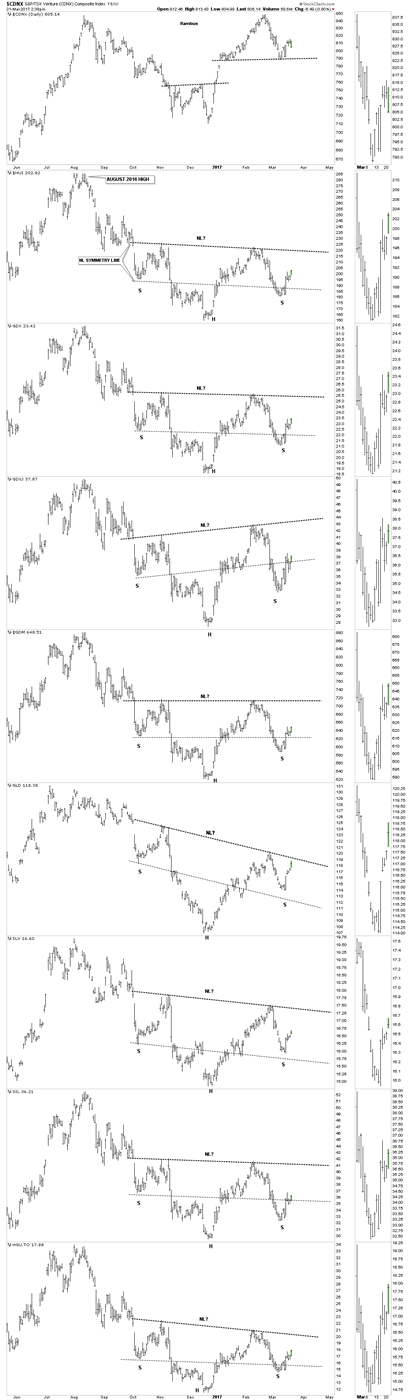

Commodities / Gold and Silver Stocks 2017 Mar 22, 2017 - 10:22 AM GMT There is a combo chart for the PM complex I've been following, on the short term 10 month daily look, which shows a potential H&S bottom forming. I put a neckline symmetry line on the charts to get a feel for where the low for the right shoulder may form. Some are fairly parallel to the neckline like GLD, SLV and the HUI with GDXJ and SIL being the most unparalleled. The CDNX is showing the most weakness as it probably has to do with some of the small cap energy companies.

There is a combo chart for the PM complex I've been following, on the short term 10 month daily look, which shows a potential H&S bottom forming. I put a neckline symmetry line on the charts to get a feel for where the low for the right shoulder may form. Some are fairly parallel to the neckline like GLD, SLV and the HUI with GDXJ and SIL being the most unparalleled. The CDNX is showing the most weakness as it probably has to do with some of the small cap energy companies.

GLD is trading the closest to the neckline so it may give an early heads up for the PM stock indexes. Keep in mind these potential H&S bottoms won't be complete until the necklines are broken to the upside.

Precious Metals and Indices Daily Chart

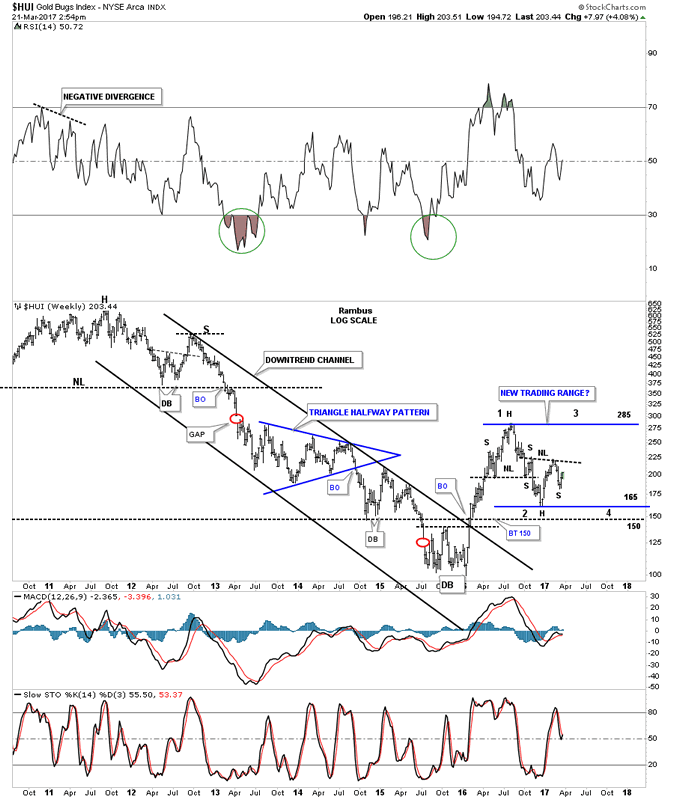

This next chart is a long term weekly look at the HUI which shows the potential big trading range with the first reversal point starting at the August 2016 high. Reversal point #2, which may be underway should take the HUI up toward the 286 August high which would be the area to look for the 3rd reversal point to the downside.

Note how the top of the trading range formed a H&S top for the first reversal point and now it looks like a H&S bottom for the 2nd reversal point. Interesting to say the least.

Gold Bugs Index Weekly Chart

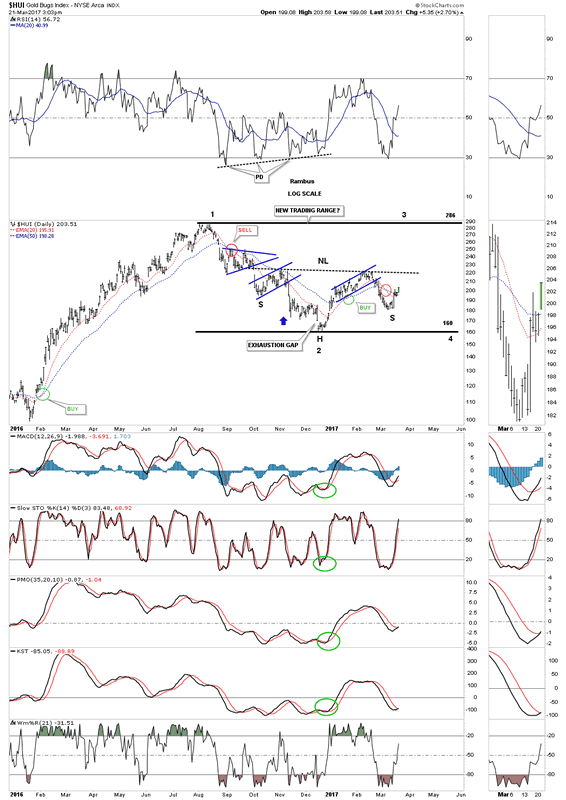

Below is a daily chart for the HUI which shows the potential H&S bottom forming inside the large trading range.

Gold Bugs Index Daily Chart

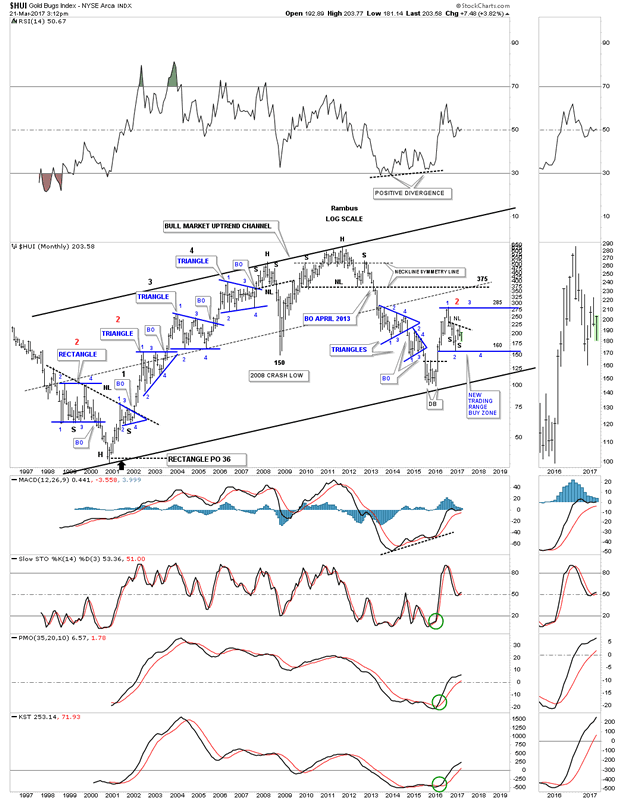

The 20 year monthly chart for the HUI shows you a good look at all the consolidation patterns that formed during the bull market years. During the bull market the HUI formed one consolidation pattern on top of the next. I have all the reversal points labeled on each consolidation pattern. Most of the consolidation patterns lasted anywhere from14 to18 months or so.On that basis we are likely less than half way through this present pattern. The red numbers on the left side of the chart shows the same height for each consolidation pattern. As you can see our current pattern is also the same height.

This is a good area to see a H&S bottom build out just like the H&S top that built out at the first reversal point which is defining the trading range.

Gold Bugs Index Monthly Chart

Markets are live entities, Each day new patterns can slowly emerge Chart patterns are the sum total of actions of all the traders who participate. With an open mind, we must evaluate and re evaluate and constantly be on the lookout for clues. Stay tuned , as the Precious Metals Markets are getting interesting once again.

All the best

Gary (for Rambus Chartology)

FREE TRIAL - http://rambus1.com/?page_id=10

© 2017 Copyright Rambus- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.