Why US Commercial Real Estate Is the Next ‘’Big Short’’

Housing-Market / US Housing Apr 03, 2017 - 01:20 PM GMTBy: STRATFOR

A small but growing group of hedge funds are positioning themselves to profit from the collapse of the real estate market. Sounds like 2007, right? It’s actually happening right now.

A small but growing group of hedge funds are positioning themselves to profit from the collapse of the real estate market. Sounds like 2007, right? It’s actually happening right now.

But this time, hedge funds (along with Deutsche Bank and Morgan Stanley) aren’t targeting subprime mortgages—they’re going after commercial real estate.

It’s no secret retailers and malls have been struggling for years, but it looks like the perfect storm is set to hit them in 2017.

Commercial Catastrophe

Bearish bets against commercial loans jumped 50% year-over-year in February—and with problems piling up for malls, it’s no wonder.

Around $3.5 billion in retail loans were liquidated in 2016. Investment firm Gapstow Capital said losses on mall loans have been “meaningfully higher than in other areas.”

This is because malls are reliant on retailers like Macy’s, J.C. Penny and Sears. Unfortunately for these landlords, their tenants’ businesses are failing, which brings us to…

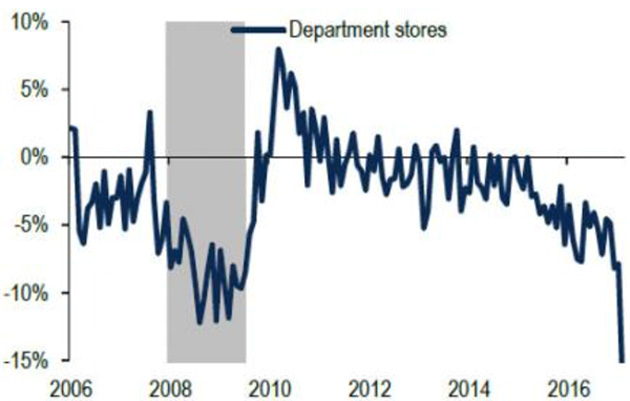

Chart #1: Department Store Sales Have Collapsed

Source: Bank of America

As a result of falling sales, retailers are shutting up shop at a rate that has not been seen since the 2008 financial crisis.

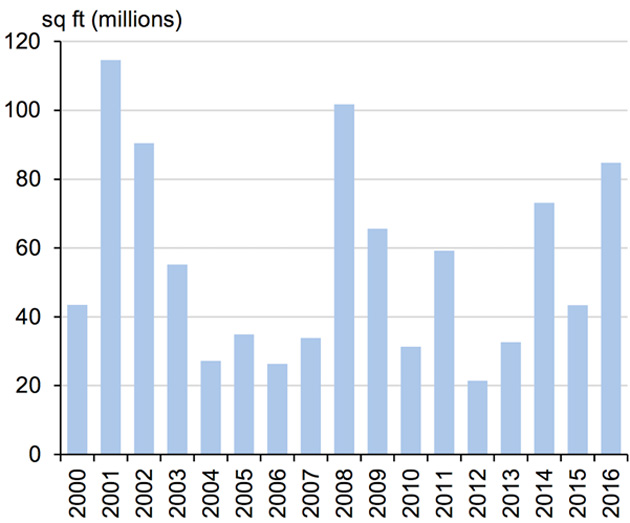

Chart #2: Store Closings in 2016 Were the Highest Since 2008

Source: Credit Suisse

…and they plan to close hundreds more over the coming years, which is very bad news for malls.

Most malls are dependent on one or more of these big retailers. When anchor stores close, it reduces foot traffic, and that hurts other retailers. This begins a cycle of blight, leading other tenants to leave.

Alder Hill (a hedge fund started by associates of billionaire David Tepper) is bearish on commercial loans and expects 2017 to be a “tipping point.” Morningstar Credit Ratings estimates roughly 40% of the loans due this year won’t be paid.

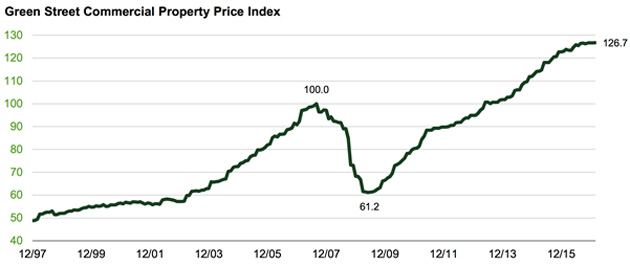

This comes at a bad time for the industry. Commercial real estate prices have been on a tear since 2009, but with vacancies rising, prices have stagnated.

Chart #3: Commercial Property Prices Have Topped Out

Source: Green Street

This, coupled with new rules that came into effect in December (which force banks to hold at least 5% of the loans they make on their books), has caused loan growth to stall.

As a result, leading retail analyst Jan Rogers Kniffen expects around one-third of American malls to close in the coming years. So, what are the implications of this commercial collapse?

Investment Implications

The majority of holders of commercial debt are savings institutions like pension funds and insurance firms. Herein lies the real crux of this problem. When a mall starts to falter, the end result is usually big losses for lenders. This happened recently when Hudson Valley Mall was liquidated and investors lost $42 million.

If pension funds and insurance firms are forced to write down billions in bad loans, it will likely create huge uncertainty in markets. During uncertain times, it’s important for investors to have a predefined investment strategy so they can avoid getting caught up in the high emotion of markets. In our free report, 3 Proven Strategies to Invest in Uncertain Markets Like These, we detail three strategies you can use to invest during such times.

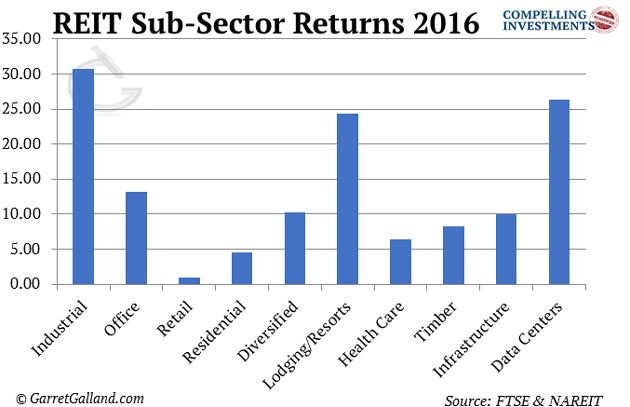

Getting into specifics, investors would be prudent to avoid retail real estate investment trusts (REITs) if we see a commercial collapse. As the chart below shows, retail REITs dragged the overall sectors’ performance in 2016.

This trend has continued into 2017. The largest retail REIT, Simon Property Group, is down over 9% since January. At the same time the largest healthcare REIT, Welltower, is up over 4%.

George Soros once said that you make large amounts of money by finding a popularly held public precept that’s wrong and betting against it. Major players in The Big Short like Michael Burry and Steve Eisman gave us the perfect example of this in 2008 when they made billions from betting against the real estate market.

We might be in the early innings of a commercial collapse, but given the prevailing trends, it looks inevitable.

Become the Best-Informed Investor You Know

The world is more interconnected than ever before. Only those investors who understand how current world events are linked can prepare for what’s going to happen. Sign up for Mauldin Economics’ free weekly newsletters for a bird’s-eye view of macroeconomic reality.

David Galland

Managing Editor, The Passing Parade

Garret/Galland Research provides private investors and financial service professionals with original research on compelling investments uncovered by our team. Sign up for one or both of our free weekly e-letters. The Passing Parade offers fast-paced, entertaining, and always interesting observations on the global economy, markets, and more. Sign up now… it’s free!

© 2017 David Galland - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.