Stock Market, Gold Miners GDX Update

Stock-Markets / Stock Market 2017 Apr 17, 2017 - 10:48 AM GMTBy: Brad_Gudgeon

We entered into a Mercury Retrograde period on April 9, which I have said before is like trading in the Bermuda Triangle, difficult at best! Typically, this usually portends a turn in the precious metals market within about 2-4 trading days. As far as the stock market is concerned, the normal indicators tend not to work as well.

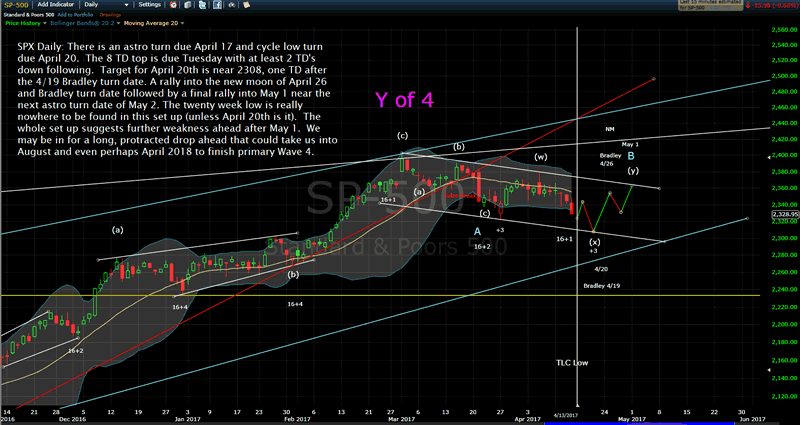

My original thinking was, we would see more stock market selling after Easter than before. Next week (4/21) has Venus squaring Saturn for the second time in weeks. Venus turned direct yesterday. We have a Bradley turn due on 4/19 and another on the new moon 4/26 (which should be near a 3 week top). The 8 TD cycle top is Tuesday next week and we have another astro turn based on Saturn on the 17th (Monday). Typically, 8 TD tops turn back down at least 2 trading days. I have a TLC low due Monday, so a rally back up from Monday is expected into Tuesday, perhaps near SPX 2343 (the low Monday? 2321-24ish).

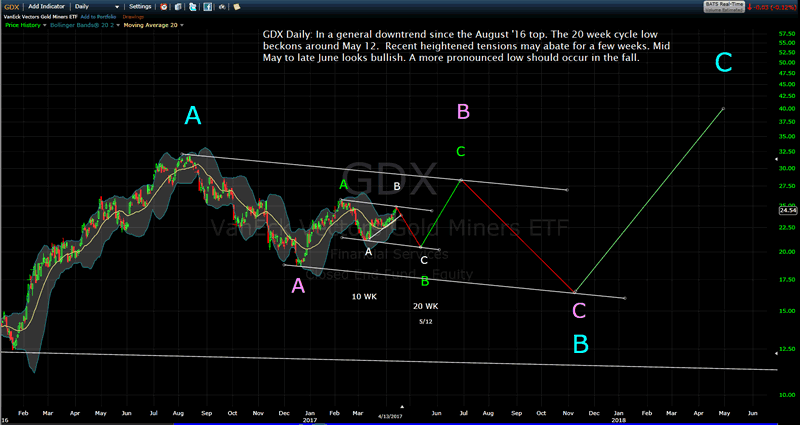

Pluto turns retrograde on the 20th. Pluto rules debt, so that should be on the minds of politicians this week (after Tuesday). Gold could easily be topping on the 20 week cycle with fits and starts next week, but rolling over likely. Mars is still aspected strongly (as I said a few weeks ago, Trump will likely be tested in the coming weeks on the war stage), but the read on gold is saying to me we likely start dropping into mid May. Mid May to late June looks higher to me, but overall down for the year as a whole on gold. We'll see.

The expected stock market 20 week low looks like a basic non-event to me, which to me means this top in early March may not be bested for some time or is a part of a larger topping process, so longer term investors need to take heed.

My basic thinking is: we see recovery from early selling Monday, bounce into Tuesday and then go down into Thursday to around SPX 2308. By May 1, the 2360's could be beckoning. After that, it gets tricky again: probably down.

S&P500 Daily Chart

GDX Daily Chart

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com.

Copyright 2017, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.