Sell Gold in May and Go Away

Commodities / Gold and Silver 2017 May 07, 2017 - 02:10 PM GMTBy: Submissions

By Jack Huyn: Recently I have read some commentaries state that the old saying "Sell in May and Go Away" might work great for stocks, but it's not the wisest choice when it comes to gold this year. According to these commentaries, gold maintained its upward momentum in April following a very positive first quarter. Despite last week’s retreat to $1,225/ounce, gold's fundamental case remains solidly intact, and additional gains are anticipated as 2017's second half approaches.

Many experts cite the chief drivers for gold rise: global trade wars, growing geopolitical tensions, global debt concerns and central-bank policies regarding money creation and currency valuation targets, strong demand for physical gold (as seen during the first quarter in the metal's largest buyers' markets: China, Russia, India and also throughout Europe), robust gold demand from individual investors.

But my point of view on gold price trend is contrary to that of many bulls. I will "sell in May and go away" from gold and wait for about ten months to buy this "inflation hedge asset".

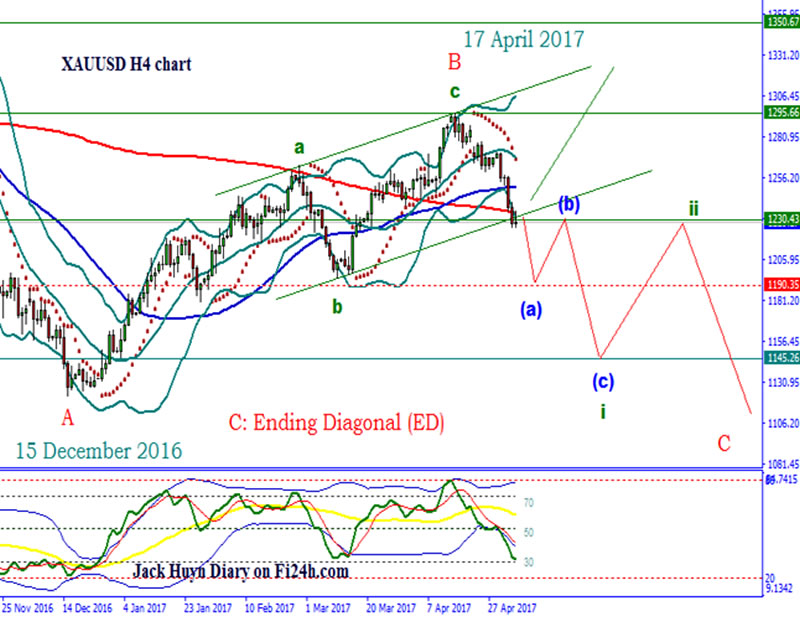

Technically, gold’s uptrend channel from the bottom established on 15 December 2016 to the top on 17 April 2017 is still valid when the current price stays around the lower trendline of the above-mentioned price channel. In short term, a strong bounce from this zone will help gold bulls expect an uptrend to break over $1,295 resistance zone. However, my Elliott Wave analysis is inclined to the downside outlook to reach $1,190 then bounce up to $1,230 before following another downtrend.

For intermediate term, the third leg (wave C) of the Zigzag (ZZ) wave pattern is expected to follow an Ending Diagonal (ED) wave pattern. Now we’re just in wave i of C, so the intermediate term downtrend has much time to develop.

The gold prices have crashed for recent trading sessions and as a result investors get worried a lot. A safe asset that has been shinning for long has suddenly lost its sheen. At this stage, on the one hand there are investors who are not sure about what to do with their investments in gold, on the other hand there are those who are wondering whether there is an opportunity to buy gold at the current prices and make a quick profit.

Do not let yourself come into such a dilemma.

By Jack Huyn

Disclosure:

Please be informed that information I provide is for educational purposes only and not intended as investment advice. Information and analysis above are derived from utilising methods believed to be reliable, but I cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

http://www.fi24h.com/2017/05/sell-gold-in-may-and-go-away.html

About Jack Huyn

Jack Juyn is a technical analyst specializing in Elliott Wave Theory, with more than 10 years of experience in analyzing and forecasting the trend of such markets as gold, currencies, stocks, commodities (coffee, black pepper, rubber…). Before becoming an independent technical analyst and freelance forex trader, Jack Huyn worked for many financial advisory organizations. At present, Jack Huyn is a Technical Analysis Advisor for www.fi24h.com. Contact Jack Huyn at huynjack@gmail.com.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.