Precious Metals Outperform Markets In August – Gold +4%, Silver +5%

Commodities / Gold and Silver 2017 Sep 02, 2017 - 12:33 PM GMTBy: GoldCore

– All four precious metals outperform markets in August

– All four precious metals outperform markets in August

– Gold posts best month since January, up nearly 4%

– Gold reaches highest price since US election, climbs due to uncertainty and safe haven demand

– S&P 500 marginally higher; Euro Stoxx, Nikkei lower for month

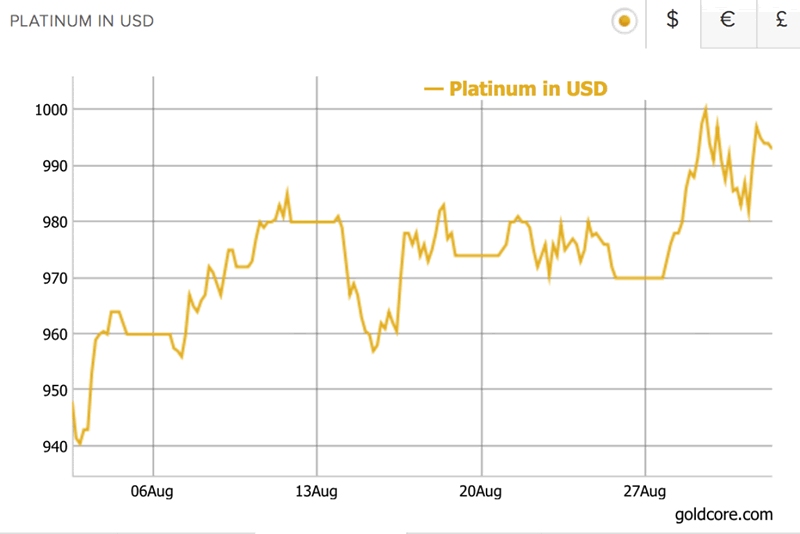

– Platinum is best performing metal climbing over 5%

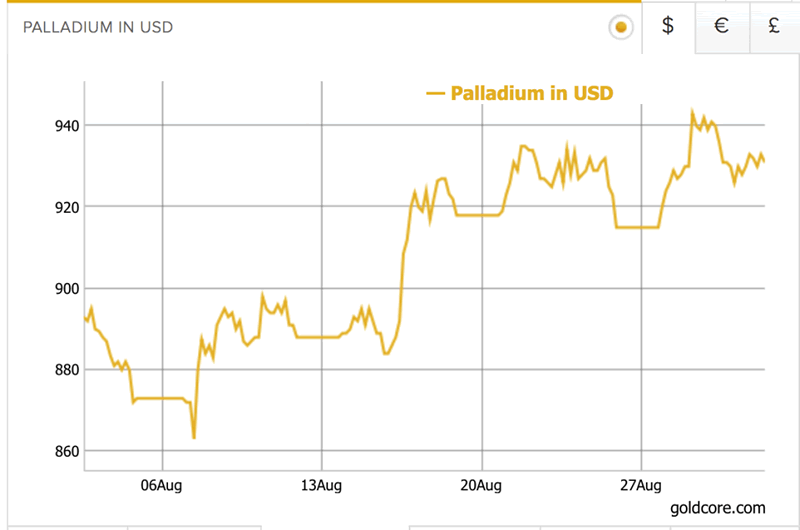

– Palladium climbs over 4% thanks to seven year supply squeeze

– Fear, uncertainty and political sanctions are amongst biggest drivers for precious metals

– Never been a better time to diversify and rebalance portfolios with stocks and bonds near record highs and looking vulnerable

Editor: Mark O’Byrne

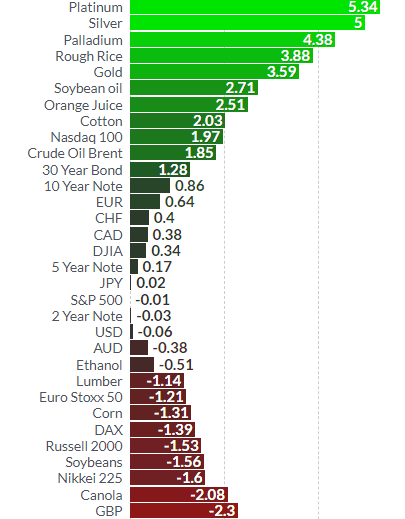

Market Performance in August (Finviz.com)

All four precious metals have made gains in the month of August.

Whilst platinum and palladium’s leading performances can largely be attributed to industrial factors they have also benefited from the safe haven demand which is driving gold and silver prices.

Safe haven demand really came into its own this last month. Issues with North Korea have stepped up a level whilst markets have finally begun to question the complacency they have been feeling in regard to the US political and financial situation, geopolitical risk and the increasingly uncertain outlook for the global economy.

Ultimately very little is known about what will happen with the US debt ceiling, increasingly overvalued stocks (both the NASDAQ and the S&P500), Trump’s plans for corporate tax, dealings with North Korea and (not forgetting) Venezuela.

We are living in very uncertain times indeed and investors decided to allocate funds to the ultimate safe havens – the precious metals.

Gold shines as investors rush into safe havens

This week gold rose to its highest point so far in 2017 as tensions between North Korea (but really, the rest of the world) and the US ramped up. For the month of August the price is up 3.59%.

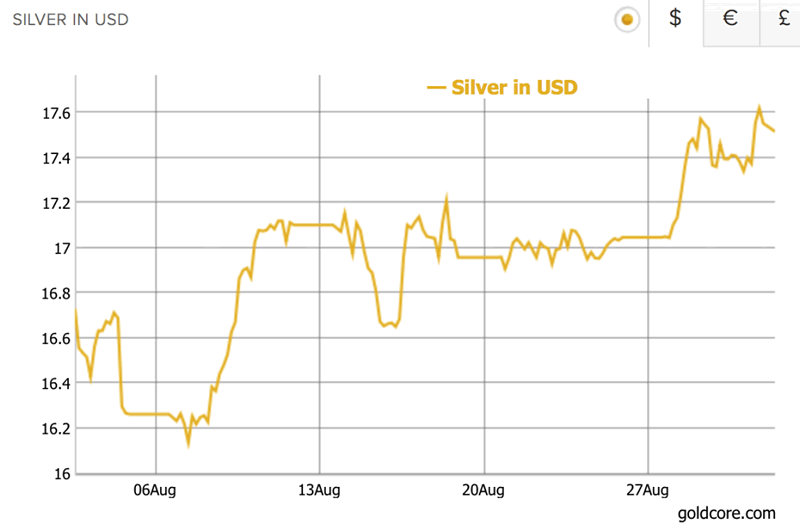

Silver was also up thanks to safe haven demand, but its 5% climb was also in part due to manufacturing demand. Currently, about 55% of all silver consumed is for industrial use.

Gold has so far risen in every month, bar June.

Gold’s climb has in part been due to ongoing demand from countries such as China and India, but it has primarily been driven by the desire in the West to own a safe haven. This is not surprising given the ongoing concerns regarding North Korea, Venezuela, the Middle East and a lack of cohesion in the Trump administration.

One of the dampeners on gold and silver has been the Federal Reserve’s plans to raise interest rates. However, when they did so it had little effect. Expectations for further hikes are falling. Going forward Yellen and team are expected to slow down on further interest-rate increases which has provided an additional boost for the gold price.

In the very short-term storm Harvey in Houston, Texas has also impacted the price of gold and silver. As a result of lost income and recovery operations, US GDP is expected to be lower in the third-quarter than was initially expected.

In the long-term investors will look to gold and silver as they begin to price risk into the market. Yesterday we expressed our concerns over market complacency whilst other financial organisations have begun to warn clients about the overpriced equity markets and lack of perceived risk.

It is also worth noting an expected climb in demand from China. Mark Tinker, Head of AXA Framlington wrote in a note that China’s pricing of assets in yuan (together with the plan by the Hong Kong Stock Exchange to sell yuan-priced physical gold contracts) could allow them to trade out of the banking system in the US

“Having accepted payment for oil or gas in RMB, the seller, be it Russia or Saudi Arabia or anyone else for that matter, does not have to worry about having excess RMB, they can simply trade it back into gold,” Tinker said. “We are moving to a multi-polar world.”

Platinum gains as Russia feels the pain

Platinum has performed very well so far in the second half of the year. This most recent surge has likely come about thanks to further sanctions being placed on Russia by the US. Russia is the world’s second biggest producer of the metal.

The World Platinum Investment Council outlined the following arguments for platinum’s role as a safe haven investment asset:

– Supply demand fundamentals are strong and ETF holdings are stable, despite price volatility

– Risks of supply declines are underestimated – cost pressure and falling mining investment continue – Downside risks to platinum automotive demand are overestimated

– Futures positioning follows poor sentiment with high correlation to price

– Platinum is undervalued against its past, its production cost and against gold

Palladium climbs on Vauxhall’s woes

Palladium is currently at a 16 year high. There is a major tightening in the supply of palladium because of increased demand for it in engines. 67% of palladium supply is used in car engines to clean exhaust gases from gasoline engines. There is obviously a major push for ‘clean’ transport and the Vauxhall emissions scandal and obviously helped boost demand.

Inventories of palladium supply are down by abut 45% this year, whilst supply trails demand by the most in the seven years.

Despite the increase in supply, there has been a significant number of redemptions in the the two main U.S. and European palladium ETFs – the ETFS Physical Palladium Shares and the ZKB Palladium. By the 22nd August $49 million had been traded in. Supply in the spot market is reportedly so tight that companies are being forced to trade in multiple ETF shares in order to redeem them with the issuer in exchange for physical palladium.

ETFs are now being treated like palladium warehouses.

It is also important to note that, like platinum, palladium is also hugely affected by the sanctions on Russia.

It is also important to note that ETFs are a risky way to invest in precious metals and most investors would be better served owning actual precious metals rather than paper or digital proxies.

Conclusion: Stars aligning? Outlook good for rest of 2017

Earlier this week we explained how investors shouldn’t always be focused on price. Whilst it is nice to look at the metrics for August and see that all precious metals are up, we should instead focus on why they are up and most importantly the diversification benefits for our portfolios.

Precious metals are largely climbing because the perceived risk in the political and financial system is also climbing. Interestingly many commentators do not feel some risky issues have been wholly appreciated by the markets.

Problems such as North Korea are such serious risks that even someone who pays no attention to markets could spot it. The issue is that you have an overvalued stock market and a US President who cannot get his people together. This means that the US debt ceiling issue might ground the U.S. government to a halt.

These issues are ones which have not yet been fully priced into the markets. They likely will be in the coming months and then the safe haven role of the precious metals and gold in particular will come into its own.

Gold Prices (LBMA AM)

01 Sep: USD 1,318.40, GBP 1,020.18 & EUR 1,107.98 per ounce

31 Aug: USD 1,305.80, GBP 1,013.17 & EUR 1,098.31 per ounce

30 Aug: USD 1,310.60, GBP 1,014.93 & EUR 1,096.71 per ounce

29 Aug: USD 1,323.40, GBP 1,020.34 & EUR 1,097.36 per ounce

25 Aug: USD 1,287.05, GBP 1,003.90 & EUR 1,090.90 per ounce

24 Aug: USD 1,285.90, GBP 1,003.26 & EUR 1,090.44 per ounce

23 Aug: USD 1,286.45, GBP 1,004.33 & EUR 1,091.68 per ounce

Silver Prices (LBMA)

01 Sep: USD 17.50, GBP 13.53 & EUR 14.69 per ounce

31 Aug: USD 17.34, GBP 13.47 & EUR 14.62 per ounce

30 Aug: USD 17.44, GBP 13.49 & EUR 14.60 per ounce

29 Aug: USD 17.60, GBP 13.59 & EUR 14.62 per ounce

25 Aug: USD 17.02, GBP 13.26 & EUR 14.40 per ounce

24 Aug: USD 16.93, GBP 13.20 & EUR 14.36 per ounce

23 Aug: USD 17.06, GBP 13.32 & EUR 14.48 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.