Reverse H&S Pattern in Gold

Commodities / Gold and Silver 2017 Sep 12, 2017 - 09:48 AM GMTBy: P_Radomski_CFA

Last week, we received quite a few messages in which readers asked about the long-term reverse head-and-shoulders pattern in gold and related ratios. In today’s alert we discuss this in greater detail.

Last week, we received quite a few messages in which readers asked about the long-term reverse head-and-shoulders pattern in gold and related ratios. In today’s alert we discuss this in greater detail.

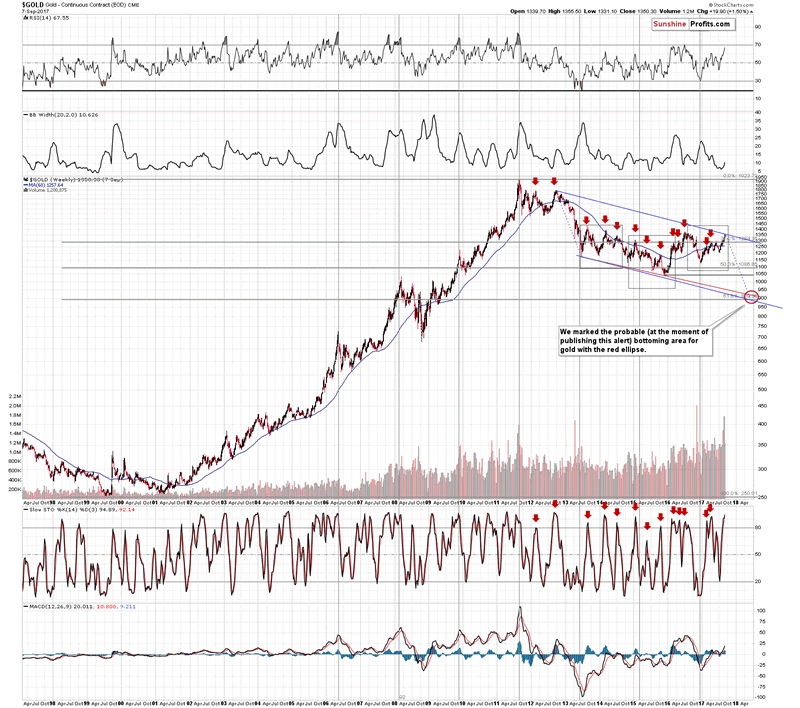

Let’s jump right into the gold chart (charts courtesy of http://stockcharts.com).

The shape of the head and shoulders may not be evident on the chart, so we marked it with grey rectangles (one for the head and two for the shoulders). Generally, there are several characteristics regarding the reverse head and shoulders pattern that either makes it reliable or rather insignificant. We’ll discuss the less important ones first.

The pattern should be characterized by U-shaped bottoms, it should be symmetric and it should be confirmed by volume. Neither of the above bottoms (head or shoulders) are U-shaped. Is the pattern symmetrical? Somewhat – the distance between the head and each of the shoulders is rather similar, but the head itself is not symmetric.

The volume should generally decline until bottoming along with the price in the right shoulder, with small upswings along with the price (in the final part of the left shoulder and the head). The volume should increase significantly only after the right-shoulder bottom. This is not what we can observe on the above gold chart. The volume was more or less steady between the first half of 2013 and the final part of 2015, with a visible uptick in Q3-Q4 of 2014 – not during a rally in gold, but during a decline in its price. The volume increased in 2016 and it’s been steady since that time except for what we saw two weeks ago. The volume picked up significantly in the second part of the head and it didn’t really decline before the right-shoulder bottom was formed – the volume spiked shortly beforehand and then it declined, but it was simply a seasonal issue (end of the year).

So far, the things that should confirm the reverse head and shoulders pattern in gold, suggest otherwise. Having said that, let’s move on to the key issue.

Even if the above confirmations did indeed confirm the pattern instead of invalidating it, there would be no bullish implications for gold at this time. Why? Because there is no pattern to speak of – yet. In case of the neck level based on the daily closing prices and the recent closes, there was no breakout above the neck level of the pattern.

The whole point of a pattern is that it has implications once it is completed and that’s not the case with the discussed reverse head and shoulders pattern in gold. If there were any meaningful implications of a given pattern before it was completed, then the part of this pattern would be a different pattern that would have a different name. For instance, a head-and-1.5-shoulders pattern or something more fancy. Either way, since the incomplete reverse H&S pattern is not known to be any pattern by itself, it does not have any implications – at least at this time.

If the pattern was completed, then the previously discussed confirmations (or more precisely, invalidations) would come into play and they would make the strength of the signal rather weak. Still, for now, there are no implications thereof as the pattern simply does not exist yet.

sts Metals

If you haven’t already signed up to our free gold newsletter, it may be a good idea to do so now – you’ll stay updated on our free articles (including the follow-ups to the above article) and you’ll also get 7 days of free access to our premium daily Gold Alerts as a starting bonus. Sign up today.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.