Who Are You Going to Trust, the Fed or $76 Trillion in”Smart Money”?

Stock-Markets / Inflation Nov 12, 2017 - 05:32 PM GMTBy: Graham_Summers

Let’s talk about inflation.

Let’s talk about inflation.

There are two types of inflation in the world… the “inflation” that you and I experience in the form of a rising cost of living induced by Central Banks devaluing our currencies…

…and the inflation that Central Banks are “targeting” in the bizarre claim that somehow hitting said targets will unleash economic growth.

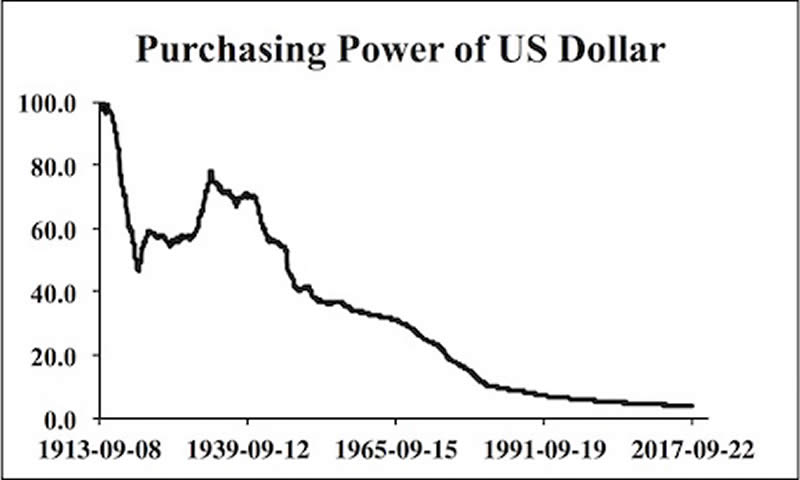

Inflation #1 is depicted in the chart below. This is the reason why everything “costs” more today than it used to.

Inflation #2 is some kind of nebulous concept that Central Bankers talk about without ever admitting that they themselves change how they define “inflation” to suit their political purposes.

Indeed, hearing a Central Banker talk about how we need to target inflation in light of the above chart is like hearing a raging drunk talk about targeting an appropriate level of drinking.

Jokes aside, inflation is a painful reality for the world. And the bad news is that it’s about to worsen dramatically.

Why does this matter?

Because the Bond Bubble trades based on inflation.

When inflation rises, so do bond yields to compensate.

When bond yields rise, bond prices FALL..

And when bond prices fall, the Everything Bubblebursts.

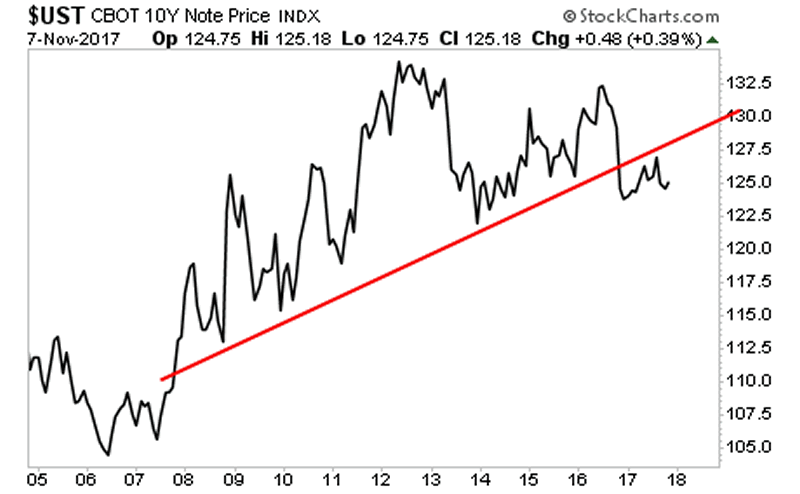

The sovereign bond market is over $76 trillion in size. It’s the “smart” money in the financial system. So when it starts to “speak” it’s smart to listen.

With that in mind, take a look at the chart for the 10-Year US Treasury. We’ve already taken out the bull market begun in 2007. The single most important bond in the world is tracking lower just as housing prices did in 2006 before the housing bubble burst.

Put simply, BIG INFLATION is THE BIG MONEY trend today. And smart investors will use it to generate literal fortunes.

Imagine if you’d prepared your portfolio for a collapse in Tech Stocks in 2000… or a collapse in banks in 2008? Imagine just how much money you could have made with the right investments.

THAT is the kind of potential we have today. And if you’re not already taking steps to prepare for this, it’s time to get a move on.

We just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay ou as it rips through the financial system in the months ahead

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2017 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.