British Pound Sterling Volatility In Crucial Week of Brexit Talk

Currencies / British Pound Dec 06, 2017 - 06:03 PM GMT Sterling fell versus the dollar earlier this week as Brexit talk between the UK and EU falter at the last minute. British Prime Minister Theresa May is on the race to break the deadlock on the issue of Irish border. Irish border is one of the three key issues required to be settled before the U.K can move on to the next stage of Brexit talk. The next phase of talk involves trade negotiation at the crucial EU summit on December 14.

Sterling fell versus the dollar earlier this week as Brexit talk between the UK and EU falter at the last minute. British Prime Minister Theresa May is on the race to break the deadlock on the issue of Irish border. Irish border is one of the three key issues required to be settled before the U.K can move on to the next stage of Brexit talk. The next phase of talk involves trade negotiation at the crucial EU summit on December 14.

Early on Monday, Ms. May met with EU leaders Jean Claude Juncker and Donald Tusk in Brussels to settle the terms of Brexit with the EU. The UK is reportedly prepared to accept that Northern Ireland may remain in the EU’s custom union and single market. However, the potential agreement fell through at the last minute due to the intervention from Northern Ireland’s Democratic Unionist Party (DUP). The Unionist party currently provides the Tories with a working majority in the Commons. The DUP leader Arlene Foster has indicated that she could not accept any Brexit deal that separates the Northern Ireland from the rest of the UK.

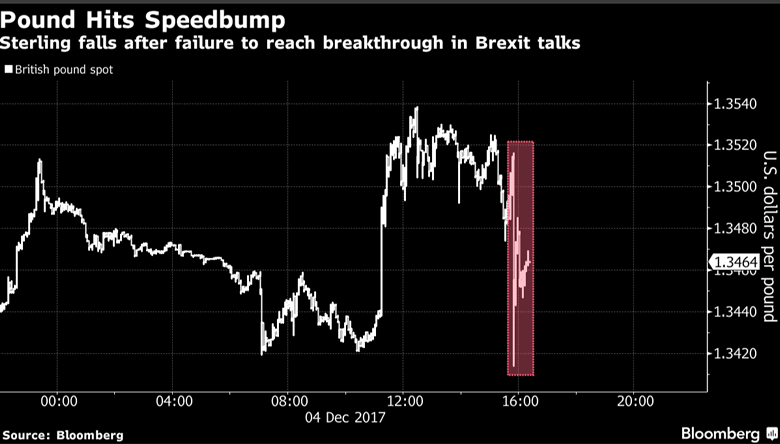

Pound fell versus the dollar and reversed earlier rally as news about the failure to reach agreement started to surface

The EU says it will only recommend the start of talks about future trade arrangements when sufficient progress has been reached on three key issues: Status of expat citizens, the “divorce” bill, and the Northern Ireland border. On the “divorce bill”, the UK has increased its offer up to 50 billion Euros. On the issue of EU citizens in Britain, the UK agrees that they don’t need to pay to apply for settled status if they already have permanent residence. However, those who apply for the first time for the right to stay will need to pay some fees.

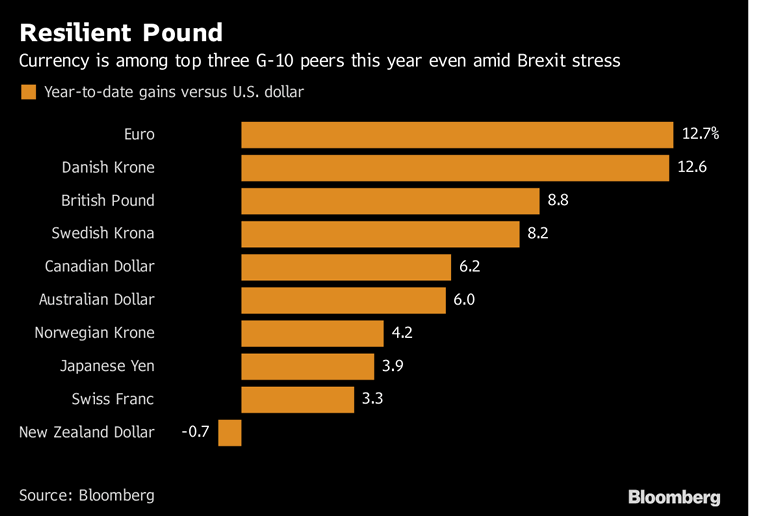

The Sterling will remain volatile ahead of the upcoming EU leaders summit on December 14. However, a “no deal exit” would mean substantial wealth losses in both the UK and EU. It’s therefore in everyone’s best interest to seek progress. Interestingly, despite the lingering uncertainties around the U.K’s exit from the EU, Sterling is still very resilient and ranks the top three best performing currency among G-10 peers this year

Sterling Technical Outlook

Technical positioning of two Sterling pairs confirm that the markets are becoming less sensitive to the ups and downs of the Brexit process. With some more breakthrough on the negotiation, Sterling could see more recovery in 2018, especially if the talks progress sufficiently to open up negotiations on trade.

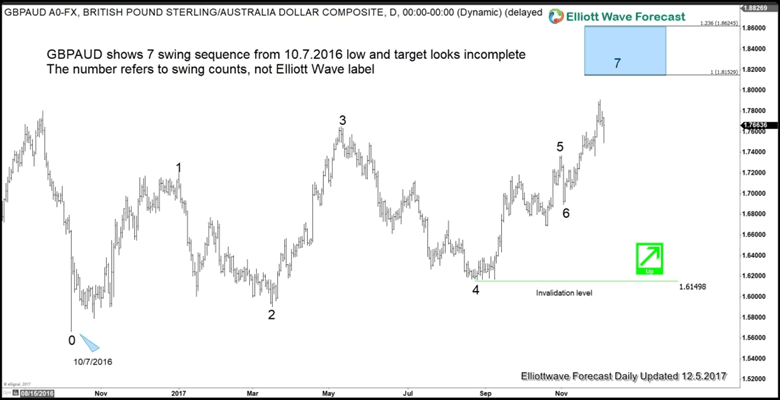

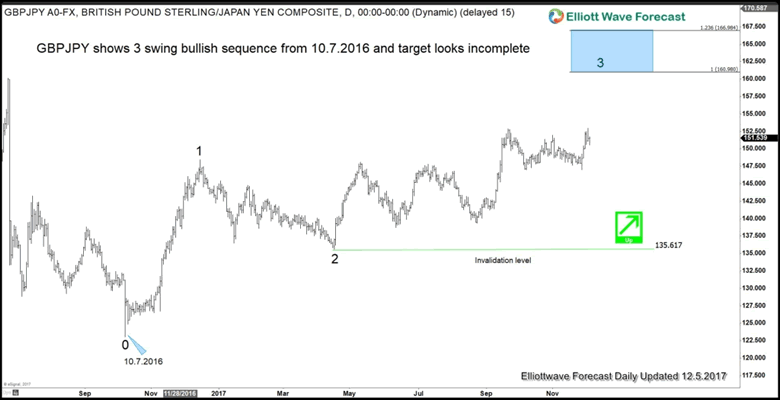

We will take a look at two Sterling Crosses below: GBPAUD and GBPJPY

GBPAUD Daily Technical Chart

GBPAUD Daily chart shows a 7 swing bullish sequence from 10.7.2016 low and it appears the pair still could extend higher to 1.815 – 1.862 area, provided that pivot at 8/25 low (1.615) stays intact. Please note that these numbers refer to swing counts and do not denote Elliott Wave labels, such as impulsive 5 waves.

GBPJPY Daily Technical Chart

GBPJPY also show 3 swing bullish sequence from the same pivot at 10.7.2016 low. The pair also appears to have scope to extend higher towards 161 – 167 area, as far as pivot at 4/17 low (135.6) stays intact.

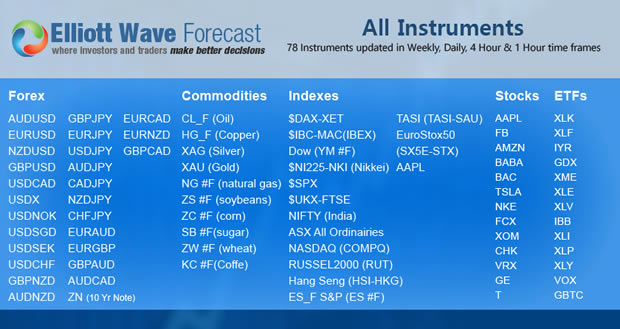

If you enjoy this article, check our work and join Free 14 days Trial to see Elliott Wave Forecast in 78 instrument, as well as getting access to Live Trading Room, Live Session, and more.

By Ayoub Ben Rejeb

https://elliottwave-forecast.com

ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 52 instruments including Forex majors & crosses, Commodities and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup .

Copyright © 2017 ElliottWave-Forecast - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.