Financial Markets Boyz are Back in Town

Stock-Markets / Futures Trading Sep 06, 2008 - 10:43 PM GMTBy: Dominick

Volume finally started to pick up this week, but it was all downhill for several days after opening Tuesday morning over 1300 on the S&P 500. Though we had some targets for a move higher, we've been skeptical of gap openings in either direction for the past several months and, as usual, looked to see the market set up a trade for us rather than guessing or assuming. The last two updates included important numbers we'd use to gauge price action and plan our trades. Among them were 1306, 1264, and 1292.

Volume finally started to pick up this week, but it was all downhill for several days after opening Tuesday morning over 1300 on the S&P 500. Though we had some targets for a move higher, we've been skeptical of gap openings in either direction for the past several months and, as usual, looked to see the market set up a trade for us rather than guessing or assuming. The last two updates included important numbers we'd use to gauge price action and plan our trades. Among them were 1306, 1264, and 1292.

The opening of the week was close enough to 1306 to keep us from scrambling to try and chase a move. While looking for a long entry we saw the market stair-step lower and each time it lost one of our levels we were forced to enter on the short side, covering as we approached our next target. 1264, a level the market has recognized for months, was a big number that we would either look to buy or sell aggressively depending on the reaction at the level. We risked a scalp long off the bounce there knowing to do a quick TMAR (take the money and run) if there wasn't any momentum to the move. Losing 1264 became a major signal to get short.

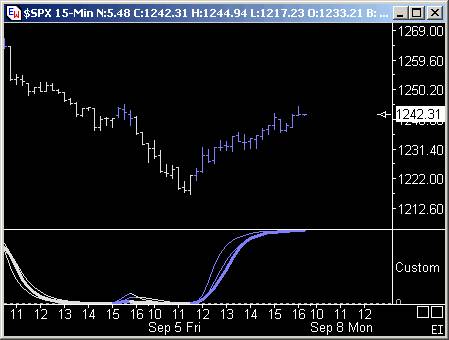

The best way to trade a trending market, in either direction, is with trailing stops that move along with the market. We had our stops as low as 1223 Friday morning knowing that after four days straight down, bears would be looking to take profits and get an early start on the weekend. It didn't hurt that we had a long signal from our 15-minute trend cycle oscillator,

or this chart:

In our real time chat room members were advised to cover shorts on a move above 1223 and to get long with a tight stop. On top of the points gained shorting the market all week, this single entry point yielded over 20 points in a single afternoon to the unbiased traders at TTC since our target was 1242-1246!

But despite the snap back rally that had the markets actually closing positive on the day, we still don't have confirmation of a bottom being in place for stocks. Next week a crucial market to watch will be the dollar, as it looks to top out in either the C of an ABC correction or 3 of a larger impulse up.

We won't guess which count is correct, but if we see confirmation that the impulse is invalidated, rest assured the dollar bears are going to have their way with the greenback. Though we won't necessarily look to trade the dollar index directly, this market will implications for many others.

Now, for limited time only, is your chance to join this community of traders . Beginning Saturday August 30 until September 8, TTC will be accepting new members.

If you're looking for a community of traders to discuss ideas with in real time, if you need more eyes to watch indicators, oscillators and other markets, then TTC is the place for you. And now, through this weekend only, is your last chance to join. Because we take the quality of our service very seriously, we strictly limit membership and work to develop members' trading skills. TTC does not issue trade signals because we teach you how to trade. We don't spoon feed you because we teach you how to take care of yourself. So, whether you're a novice trader who wants to get better, or a more experienced pro that's wants to share what they've learned and go to an even higher level in multiple markets and timeframes, TTC is the place for you.

And if you join TTC, be ready to stay. It usually takes a month or so for traders to comfortably incorporate our techniques into their trading, but once they do, members don't often leave. In fact, it was this dedication and sense of community that inspired us to work with the Northwest Territorial Mint to produce a custom commemorative “Unbiased Trader” precious metal medallion – and only members will be able to purchase them later this year. Professionally designed and proof struck in association with the Northwest Territorial Mint, these gorgeous medallions will be available in 5 oz .999 fine silver or 1 oz pure gold varieties. Last year's supply sold out quickly, so join now to reserve your chance to purchase your own “Unbiased Trader” TTC medallion.

Have a profitable and safe week trading, and remember:

"Unbiased Elliott Wave works!"

By Dominick , a.k.a. Spwaver

www.tradingthecharts.com

This update is provided as general information and is not an investment recommendation. TTC accepts no liability whatsoever for any losses resulting from action taken based on the contents of its charts, commentaries, or price data. Securities and commodities markets involve inherent risk and not all positions are suitable for each individual. Check with your licensed financial advisor or broker prior to taking any action.

Dominick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.