2018: The Year Of The Margin Call

Stock-Markets / Stock Markets 2018 Feb 25, 2018 - 04:08 PM GMTBy: John_Rubino

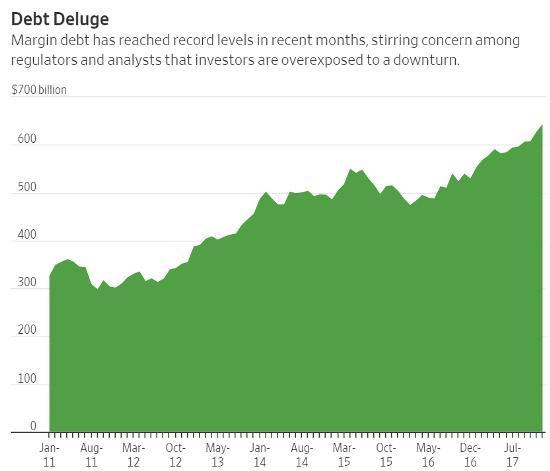

Indicators of a market top began piling up way back in 2014, and since then most have gone on to unprecedented extremes. Every analyst has their favorite harbinger of financial doom, but the easiest to understand — and the most tragic — is probably margin debt.

This is money borrowed by (usually individual or “retail”) investors against their existing stocks to buy more stocks. Investors tend to do this when markets are rising and using leverage seems like an effortless way turbocharge their gains. But eventually the market turns down, leaving stock portfolios insufficient to cover related margin debt and generating “margin calls” in which brokers demand more money and/or start liquidating customer portfolios. This sends the market down sharply and indiscriminately, as fairly-valued babies are dumped along with overvalued bathwater. The result: a quick, brutal bear market.

Margin debt hit record highs several years ago and has just kept on going. From yesterday’s Wall Street Journal:

Investors’ Zeal to Buy Stocks With Debt Leaves Markets Vulnerable

Investors borrowing record sums to bet on stocks exacerbated this month’s selloff, after they were hit with calls to reduce those obligations and forced to sell shares to raise cash.If that debt, known as margin loans, continues to rise at the current pace, analysts warn that big selloffs and sudden bouts of volatility in the stock market could become more commonplace.

Retail and institutional investors have borrowed a record $642.8 billion against their portfolios, according to the Financial Industry Regulatory Authority, as they try to pocket bigger gains by ramping up their exposure to stocks.

So-called net margin debt was worth 1.31% of the total value of the New York Stock Exchange last year, according to Goldman Sachs data stretching back to 1980, eclipsing the previous peak of 1.27% reached in the buildup to the tech bubble in 2000.

Lending against securities is a key profit center for brokerages, as firms charge interest on the money that is used and say they have found they better retain clients who take on the debt. These loans can also factor into brokers’ compensation, incentivizing many to extend money to clients regardless of whether they need it or not.

Margin debt has been on the rise for years and is generally considered a gauge of investor confidence. The long-running stock rally has helped push debt levels higher since investors tend to be more willing to take loans against investments that are rising in value. However, it can also precipitate a steep market downturn as it did before the burst of the dot-com bubble and the financial crisis of 2008.

The growing loan balances have caught the attention of Wall Street’s watchdog. Finra in January published an investor alert after the total value of margin loans broke $600 billion for the first time, saying investors may be underestimating the risks of trading on margin and may not understand how margin calls work.

Why This Matters

“So-called net margin debt was worth 1.31% of the total value of the New York Stock Exchange last year, according to Goldman Sachs data stretching back to 1980, eclipsing the previous peak of 1.27% reached in the buildup to the tech bubble in 2000.”

When an indicator exceeds its dot-com bubble extreme, it’s in mania territory. The reason equities seem relatively sedate this time around is that they’re just part of a much broader bubble. Bonds around the world are an historic bubble – one that may be starting to burst as interest rates rise. Real estate prices in trophy cities have exceeded their 2007 extremes. Debt levels in the developed world (and China) have blown through their previous cyclical peaks. And of course cryptocurrencies are generating dot-com level excitement and fear of missing out. This “everything bubble” is completely unprecedented.

“The growing loan balances have caught the attention of Wall Street’s watchdog. Finra in January published an investor alert after the total value of margin loans broke $600 billion for the first time, saying investors may be underestimating the risks of trading on margin and may not understand how margin calls work.”

The “may not understand” part is, as usual at market peaks, an understatement. Towards the end of a long cycle like the current one, a whole new generation of investors emerges who, never having experienced falling prices, eagerly embrace tools that magnify their genius. This is a rite of passage that all investors have to go through on their way to cautious middle age, but with each new debt binge the stakes get higher. Now we’re talking total wipeout rather than painful but survivable life lesson, and systemic collapse rather than one or two bad years.

By John Rubino

Copyright 2018 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.