Alleged SEC Probe Leaves Bitcoin Market Confounded

Currencies / Bitcoin Mar 02, 2018 - 05:57 PM GMTBy: Mike_McAra

The market is hectic. The attention span of most investors is short. The long-term implications of one particular trend among governments the world all over has far reaching implications for the future of digital currencies. The question now is if this often overlooked factor tells us anything anything about the way the Bitcoin market behaves, the way digital currencies react to unexpected news and how to navigate the current complex short-term environment.

The market is hectic. The attention span of most investors is short. The long-term implications of one particular trend among governments the world all over has far reaching implications for the future of digital currencies. The question now is if this often overlooked factor tells us anything anything about the way the Bitcoin market behaves, the way digital currencies react to unexpected news and how to navigate the current complex short-term environment.

The factor we’re writing about is government regulation and, specifically, the alleged recent move by the SEC to target Bitcoin companies. In a Wall Street Journal article, we read:

The Securities and Exchange Commission has issued dozens of subpoenas and information requests to technology companies and advisers involved in the red-hot market for cryptocurrencies, according to people familiar with the matter.

The sweeping probe significantly ratchets up the regulatory pressure on the multibillion-dollar U.S. market for raising funds in cryptocurrencies. It follows a series of warning shots from the top U.S. securities regulator suggesting that many token sales, or initial coin offerings, may be violating securities laws.

The wave of subpoenas includes demands for information about the structure for sales and pre-sales of the ICOs, which aren’t bound by the same rigorous rules that govern public offerings, according to the people familiar with the matter. Companies use coin offerings to raise money for everything from file-sharing technology to pet passports.

We haven’t heard much from the SEC regarding Bitcoin recently, but this is important news, right? After all, it trends in the media, so it has to be important? Well, not necessarily. This depend mainly on the way traders react to such news. Let your imagination run. The government is going after Bitcoin companies. This might be the tip of the iceberg. Traders will run for the hills. Except, they haven’t.

Let’s break this down. There is an overreaching theme repeating itself in countries all over the world. It is the slow push toward Bitcoin regulation. Either countries adopt laws specifically targeting Bitcoin or government agencies strike out on their own and tackle Bitcoin where their expertise is applicable. The long-term implications for Bitcoin are significant. Digital currencies will likely become an asset like other assets, and their trading will become regulated like trading stocks, bonds and so on.

Zooming in on the current situation also tells us something important. Namely, the Bitcoin market doesn’t react to news of regulation in the way you would suspect it too. Not at all. Granted, we will have to wait for the next couple of days to see if the situation remains the same, but so far we’ve seen Bitcoin detached from regulatory efforts. An easy explanation would be that the currency “wants to go higher” as if it had a will of its own. We don’t want to limit you to easy explanations. And so, in our opinion, the current situation is rather a sign that Bitcoin traders disregard “fundamental” news and rather focus on the price action. In light of this, the analysis of trends might be crucial.

Bitcoin Doesn’t Budge

The general situation in Bitcoin has been one with several important factors in place. Right now, we have one more indication in the form of Bitcoin not reacting to news regarding the currency. This adds to the factors we have discussed recently:

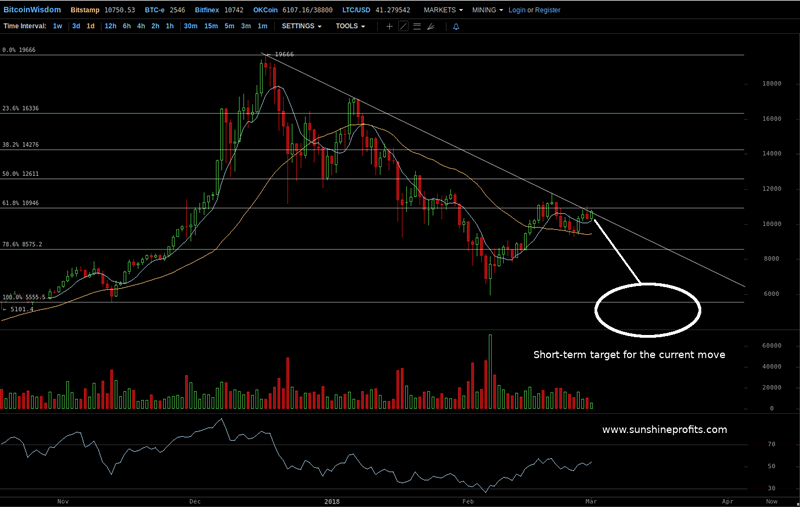

(…) Right off the bat, it’s pretty obvious that Bitcoin is not going down at the moment of writing. On the other hand, the move up is not on high volume. Actually, this might be a slightly bearish indication as we are seeing a move up on unremarkable volume. The first element of the trio is weakened but not completely invalidated. Second, even though we have seen a move up, we haven’t seen a move to the 61.8% retracement level, let alone the 38.2% level. Third, staying calm even further, the declining resistance line based on the recent tops is not broken either. Two out of three bearish factors are unchanged and one is weakened. From this point of view, the move up is nothing to call home about. Mind, we’re not saying that Bitcoin can’t go up from here – it always can and there are no guarantees in the market. What we’re saying is that, applying analysis devoid of emotionality, we arrive at the suggestion that the current market environment is not changed from what we saw a couple of days ago. (...)

At the moment of writing, Bitcoin is still below the 61.8% Fibonacci retracement. This means the bearish indications from this source are maintained. The 38.2% retracement is still relatively far away and the most important bearish indication remains in place.

On the face of it, we have a slightly bullish hint from the fact that Bitcoin is now above the declining trend line based on recent tops. However, we have to remember that the currency hasn’t really closed above this level yet and even if it does so, we would still have to see a couple daily closes above this line to view it as broken. So, in short, no bullish indication after all.

Today, we would like to add that in the last couple of days we have seen a very weak move up on low volume. This is a bearish indication. Additionally, the RSI is above 50. In downtrends, this might actually be yet another bearish indication. So, all the hints are still very much tilted to the bearish side. Mind, we’re not saying that Bitcoin can’t go up. Our take is that the current short-term situation is bearish and that waiting for a move up might not be the best of ideas as the currency might reverse sharply to the downside, not leaving time to react.

If you have enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.