Trump Crossed the Rubicon in Pull Out From Iran Nuclear Deal

Politics / Middle East May 13, 2018 - 03:42 PM GMTBy: Michael_T_Bucci

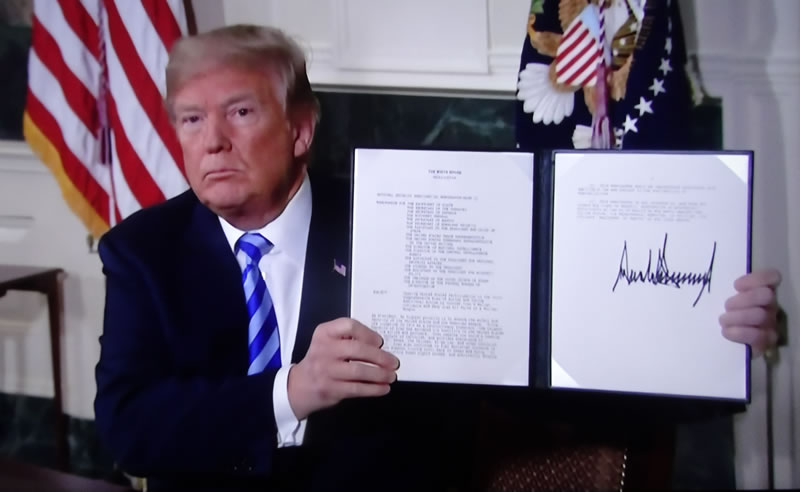

Trump crossed the Rubicon and the world is reacting. He decided to pull out of the Iran nuclear agreement (JCPOA) signed in 2015 by Iran, the United States, Germany and all permanent members of the Security Council (P5+1), the fruit of more than a decade of planning. He then lit another match handed him by John Bolton and the “war parties” in Washington, Tel Aviv and Riyadh to widen sanctions by including any nation doing business with Iran (“secondary sanctions”).

In short, unless JCPOA is perpetuated in defiance of Trump by treaty signatories minus the U.S., the agreement will be void. The Iran treaty withdrawal, together with the imposition of sanctions against Iran and any nation violating the Trump mandate has forcibly quickened the turn of the global wheel that already was heading away from American diktats to forge alternatives in global cooperative governance and more trustworthy alliances.

Trump’s latest shove of the wheel could now enlist the strongest EU nations (Germany, and France) to assist this momentum away from America, which in the real world will further isolate America from ninety-five percent of the world’s population. But in Trump’s world he aims to control it in the style of world autocrat, iconoclast and renegade through bullying, insults, sanctions, Tomahawk missiles and, if necessary, threatening to use “The Bomb”.

The headline at Brussel’s EurActiv after the Trump announcement read: “Trump becomes number one threat to European economy” (May 9). “Trump’s action has inflamed a transatlantic relationship already strained by his threat to impose tariffs on European products, along with his 2017 withdrawal from the Paris climate accord” (Politico, May 9). Germany, with France and Britain, has said it remains committed to the nuclear deal and has no intention of breaking off business ties with Iran as long as the Islamic Republic upholds its side of the agreement (Deutsche Welle, May 11). Some 120 German companies run operations with their own staff in Iran and some 10,000 German businesses trade with the country.

Der Spiegel (May 12) wrote “Clever resistance is necessary, as sad and absurd as that may sound. Resistance against America.”

At the time of Trump’s announcement, former Fox News staffer and US Ambassador to Germany Richard Grenell tweeted: “As @realDonaldTrump said, US sanctions will target critical sectors of Iran’s economy. German companies doing business in Iran should wind down operations immediately.” That dictatorial command might seem good international diplomacy to Fox News fans, but was taken correctly by Chancellor Angela Merkel and most Germans as an insult to their leaders, industry, sovereignty and nation.

Whether or not Mrs. Merkel’s meeting with Vladimir Putin results in an agreement to work together to uphold the Iran accord, it presently remains the desire of Russia, France, Britain and Germany to defend their respective “interests” against American threats that have no basis in international law, let alone morality. Quite possibly it now has become all too clear to Europe that it needs the protection of another superpower (like Russia) to defend itself against Donald J. Trump.

Furthermore, as the largest buyer of Iran oil, China certainly isn't going to passively watch their lifeblood interrupted without a strong response.

Trump is resolving for Europeans one nagging question: “Can Trump be trusted?” As it stands the answer is NO, Trump cannot be trusted. And since Donald J. Trump is president of the United States and represents it, it translates to the United States cannot be trusted.

Since crossing the Rubicon, the future is uncertain but scenarios should be examined and one is this:

A sort of "mini-Axis" could evolve based, for now, solely on the sanction issues, but having the potential to enlarge into a full-Axis as more destructive maneuvers by Trump catapults most of the developed world (West and East) to form stronger ties and alliances with each other despite their preexisting differences ("the enemy of my enemy is my friend"). One Axis foreseeable is: EU-Russia-China vs. US-Israel-Saudi Arabia.

Trump is a president that was elected by less than one-half of voters. He will not be held entirely responsible for whatever will happen to the United States in the future. The Trump voters must share in that responsibility.

May 9 might be looked upon by future historians as the “official” beginning of the end of the American Empire.

If Donald J. Trump isn’t evicted from office by Americans, the world will evict America from the global community.

(c) 2018 Michael T. Bucci

Michael T. Bucci is a retired public relations executive from New Jersey currently residing in New England.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.