Buckle Up Deflationists… You’re Getting Taken to the Cleaners

Economics / Inflation Jun 02, 2018 - 03:08 PM GMTBy: Graham_Summers

The current view trending in social media as well as most of the financial media is that Italy is about to trigger a systemic collapse of Europe.

The current view trending in social media as well as most of the financial media is that Italy is about to trigger a systemic collapse of Europe.

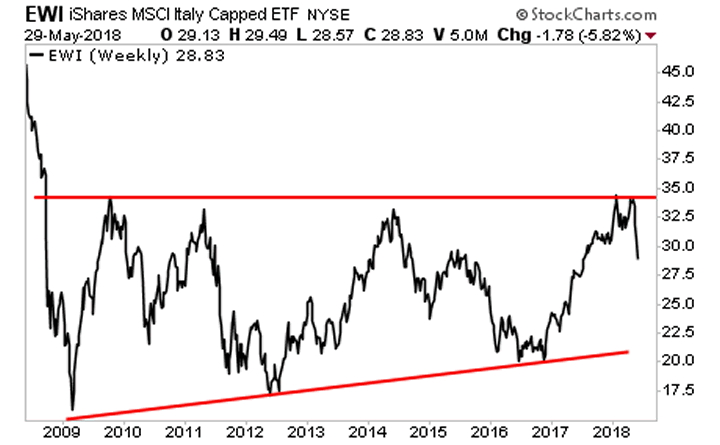

Those proposing this theory are using charts of Italy’s bond yields and stock market that focus on the last few years when the country was being priced at a ridiculously low risk.

The reality?

Long-term Italy’s stock market is trading within a very clear a defined channel. This is the “end of the world” that everyone is talking about. From the look of things Italy has had it at least three times before since 2009.

As I said yesterday…That. Is. Not. A. CRISIS.

Indeed, Italy is SO dangerous that the NASDAQ and Russell 2000 were effectively FLAT yesterday during the “meltdown.”

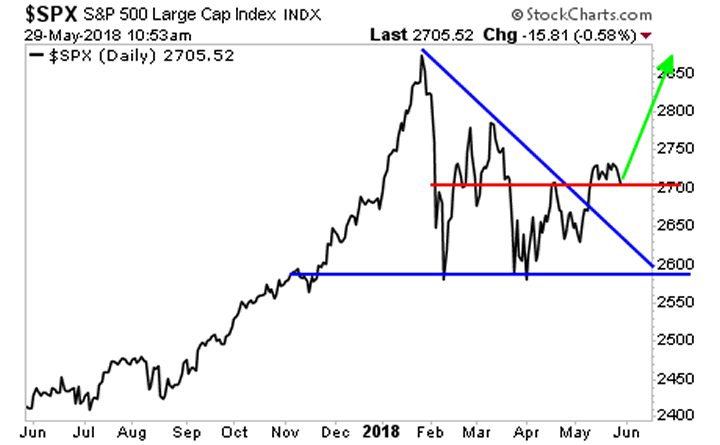

Currently, the S&P 500 is UP today. And this is just the start…

We are about to move into a “white swan” move in which the S&P 500 bounces off of support and makes a run to 3,000+ this summer.

This is the “White Swan” I’ve been forecasting since end of March 2018. It will mark THE blow-off top for the markets. What follows will be another crisis… the REAL crisis… NOT the bogus one everyone is panicking about right now.

It will take time for this to unfold, but as I recently told clients, we’re currently in “late 2007” for the coming crisis.

On that note, if you are growing concerned about the current Central Bank created bubble bursting…. we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.