Zimbabwe High Court Overturns Reserve Bank’s Decision To Ban Cryptocurrency

Currencies / BlockChain Jun 03, 2018 - 01:17 PM GMTBy: Jeff_Berwick

In a stunning display of cryptocurrency’s potential to liberate humanity, Zimbabwe just lifted its ban on the digital money after its own Reserve Bank failed to appear in court to defend themselves.

It all began on May 12 when the Reserve Bank of Zimbabwe (RBZ) arrogantly “issued a directive to all financial institutions to stop all forms of transactions related to cryptocurrencies and to wind down all accounts tied to cryptocurrencies within 60 days.”

A few days later, every crypto exchange in the country was ordered to shut down their operations, including Golix, the nation’s largest exchange, whose headquarters I had just visited during my recent trip to Zimbabwe.

These banksters are trying everything to stop crypto’s disruption, but thankfully, the laughable directive was quickly challenged in court by Golix.

The court date was set, but surprisingly, no one from or representing the Reserve Bank showed up to defend their case, resulting in a default judgment and the lifting of the cryptocurrency ban.

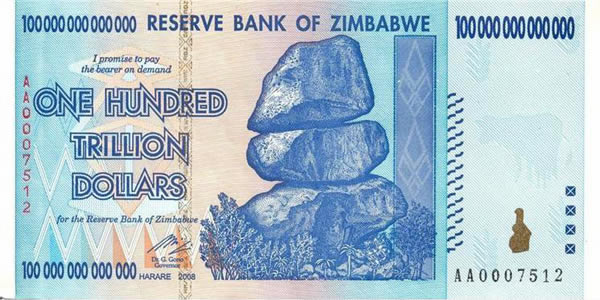

It’s somewhat surprising these rogue criminals wouldn’t even bother to show up. But, they probably knew they’d have nothing to defend their attempt at keeping Zimbabwe in debt slavery. It truly exposes the illegitimate and undeserved authority of these parasitical bureau-rats---the audacity of declaring an outright ban on the only money worth a damn in a country notorious for its fiat failures.

During my time in Harare, while speaking to locals and learning the truth about the nation’s currency crisis, I uncovered a way to live in Zimbabwe for nearly free. And, it’s actually a beautiful place in spite of the destructive government.

Bitcoin trades at 50-100% higher prices within those borders because the people are so desperate for a currency that’s worth more than the paper it’s printed on.

As enticing as it may be to just enter the Zimbabwe crypto market and sell your Bitcoins at a 50% premium, it’s a bit more complicated than that.

As the CEO of Golix explained to me in person, it’s almost impossible to get your money out of the country.

For example, if you put Bitcoin into their exchange, the only way to liquify is through a local bank account, but these accounts do not allow you to transfer money outside of the country because there are so many strict capital controls---and that’s only scratching the surface.

But, if you want to live in and/or invest in the country, which has massive potential (if the politicians stay out of the way), there are plenty of opportunities.

I’ve gone into more detail about the complex Zimbabwe situation in a past issue of The Dollar Vigilante newsletter, which you can subscribe to HERE.

I suppose the RBZ realized how overboard they’d gone in attempting to prohibit digital cash in what’s effectively a cashless society---by necessity.

In an earlier era, these tyrants would’ve gotten away with their financial terrorism, but watching a private company led by an anarcho-capitalist defeat a central bank in court via surrender is one of the most promising signs of crypto’s influence we’ve seen in a while.

Power to the people.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2018 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.