Venezuela's Great Bolivar Scam, Nothing but a Face Lift

Currencies / HyperInflation Aug 19, 2018 - 04:10 PM GMTBy: Steve_H_Hanke

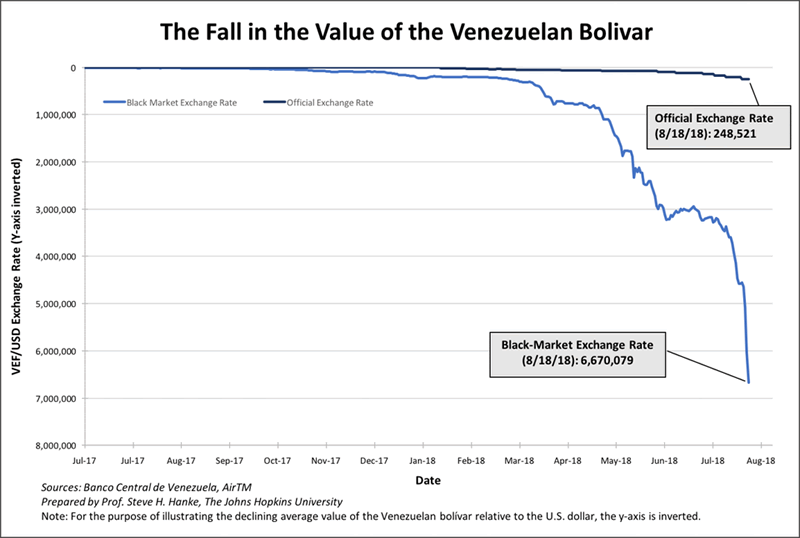

In the days leading up to Venezuela’s currency reform, which is set for August 20th, the bolivar has taken yet another deep dive. The chart below shows the bolivar’s free fall and the massive gap between the official exchange rate of 248,521 VEF/USD and the black-market (read: free-market) exchange rate of 6,670,079 VEF/USD. That gap results in a whopping black market premium of 2,584%. It also produces huge profits for Maduro’s cronies who have access to the official rate. They can purchase greenbacks for peanuts and sell them on the black market for an instantaneous profit of 2,584%.

In the days leading up to Venezuela’s currency reform, which is set for August 20th, the bolivar has taken yet another deep dive. The chart below shows the bolivar’s free fall and the massive gap between the official exchange rate of 248,521 VEF/USD and the black-market (read: free-market) exchange rate of 6,670,079 VEF/USD. That gap results in a whopping black market premium of 2,584%. It also produces huge profits for Maduro’s cronies who have access to the official rate. They can purchase greenbacks for peanuts and sell them on the black market for an instantaneous profit of 2,584%.

The Fall in the Value of the BolivarProf. Steve H. hanke

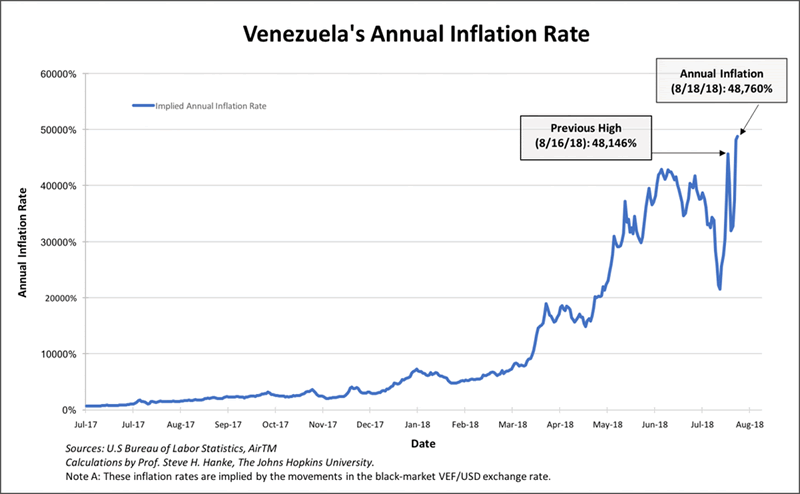

With the collapse of the bolivar, inflation, by my measure, has surged. Indeed, Venezuela’s inflation rate has just reached an all-time high. The annual rate now sits at 48,760 % (see the chart below). Venezuela’s hyperinflation, which started in November 2016, has legs.

Venezuela's Annual InflationProf. Steve H. Hanke

On Monday, Venezuela will launch a currency reform that it claims will put an end to Venezuela’s hyperinflation nightmare. A new sovereign bolivar will replace the old bolivar. The conversion rate will be 100,000 old bolivars to 1 sovereign. This currency redenomination will result in five zeros being lopped off of Venezuela’s official unit of account. To put this into perspective, 100,000 old bolivars, at the current free market exchange rate, are worth USD 1.5 cents.

In addition to lopping five zeros off of Venezuela’s unit of account, the sovereign bolivar is supposed to be linked to the petro, Venezuela’s cryptocurrency, which is supposed to be anchored to a barrel of oil. So, if the sovereign bolivar works as advertised, Venezuela would move from issuing an irredeemable fiat currency to issuing a commodity-backed redeemable currency. But, since Venezuela’s petro is dysfunctional and considered a scam, not a currency, I will focus solely on the reality of Monday’s redenomination of the bolivar.

The bolivar’s redenomination will be like going under the knife of one of Caracas’s famed plastic surgeons. Appearances change, but, in reality, nothing changes. That’s what’s in store for the bolivar: a face lift.

These face lifts always accompany episodes of hyperinflation. Indeed, the greatest hyperinflation on record was Hungary’s, where the daily inflation rate reached 207% in July of 1946. This was followed by a currency reform on August 1, 1946. The pengő was replaced by the forint, and the conversion rate was 400 octillion (4 followed by 29 zeros) pengő to one forint. So, Hungary lopped 29 zeros off of its unit of account. This was the biggest lopping off of zeros in history.

But, there have been other spectacular currency redenominations. Allow me to take a trip down memory lane for a first-hand account of my days as the Personal Economic Advisor to the Deputy Prime Minister of the Socialist Federal Republic of Yugoslavia from 1990 until June 1991, when the civil war broke out. I first met Deputy Prime Minister Zivko Pregl in late 1989 at a dinner in Vienna, Austria. The dinner, which Mrs. Hanke and I attended, was arranged by our good friend, the late-great Daniel Swarovski from Wattens, Tyrol. The day following our most pleasurable dinner, Pregl – the person responsible for developing economic reforms for the Yugoslav government led by the late Ante Marković – requested a meeting. We discussed his reform ideas and he invited me to become his advisor. I indicated that I had reservations because I was a classical liberal, free-market economist, and he was a leader of the Communist League of Yugoslavia. Pregl then surprised me when he said my qualifications were exactly why he invited me to be his advisor. He asserted that he wanted to implement free-market reforms and didn’t want watered-down advice. Pregl persisted and, after I learned that he had a hand in the dissolution of the Communist League of Yugoslavia in January 1990 and was committed to real free market reforms, I agreed to become his advisor.

I had just arrived in Belgrade in January 1990 when I was faced with, what I considered to be, a major Yugoslav policy blunder. Yugoslavia had just initiated a currency reform in which the old dinar was replaced by a convertible dinar. With that face lift, four zeros were removed. I concluded that the convertible dinar would never survive and argued that the only thing that could save the dinar would be a currency board in which the dinar traded freely at a fixed rate with the Deutschemark and was backed 100% by Deutschemark reserves.

I was so convinced that the Yugoslav currency reform of 1990 would end in disaster that I co-authored a book with Kurt Schuler on what Yugoslavia should have done with the dinar, namely make it a clone of the Deutschemark. Our book, Monetary Reform and the Development of a Yugoslav Market Economy, was published in London by the Centre for Research into Communist Economies in 1991. It was also published in Serbo-Croatian (Monetarna Reforma I Razvoj Jugoslovenske Trzisne Privrede) by the Ekonomski Institute Beograd.

Alas, my advice was not followed, and the dinar’s zeros just kept coming off in one cosmetic currency reform after another. In 1992, another zero was removed. Then, in 1993, six were removed in October and another nine came off in December. When the monthly inflation rate reached 313,000,000% in January 1994, another seven zeros were lopped off. In total, from 1990 through 1994, five new dinars were issued and 27 zeros were removed from the hapless dinar.

Unless Venezuela adopts a completely new currency regime—like a currency board, or dollarization—the bolivar will face the same fate as did the Yugoslav dinar. Hyperinflation will soar and the bolivar will more frequently come under the knife.

By Steve H. Hanke

www.cato.org/people/hanke.html

Twitter: @Steve_Hanke

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2018 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.