Cashback Credit Cards in Countdown to Christmas Shopping

Personal_Finance / Credit Cards & Scoring Nov 20, 2018 - 05:49 PM GMTBy: MoneyFacts

Now that there are only five weeks to go until Christmas Day, consumers may be wondering how they will cover the cost and how they can make the most of every purchase, be it gifts or groceries.

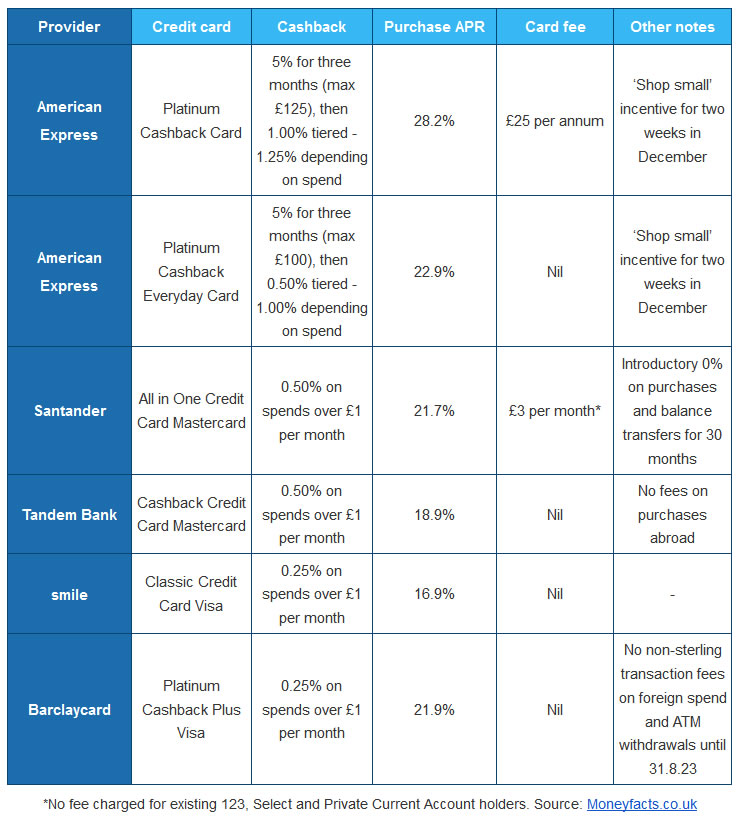

The latest research from Moneyfacts.co.uk compares some of the best cashback credit cards around, as well as looking at other ways to make the festive season more rewarding.

Rachel Springall, Finance Expert at Moneyfacts.co.uk, said:

“The cost of Christmas will no doubt be on the minds of many consumers now that just five weeks remain until the big day. With a plentiful amount of sales already in full swing, consumers will no doubt feel the pressure to grab some bargains this year and could be looking to credit cards for their festive spend.

“There is still time to get a credit card to use for Christmas shopping, as it typically takes between seven to 10 days to receive a card in the post when applying online. However, consumers will need to be quick, as there are some newly launched offers and extra cashback deals to take advantage of this year.

“Barclaycard launched a brand-new cashback card last week paying 0.25% for each purchase, and entering the Moneyfacts Best Buys for cashback cards as a result. The best deal, though, remains with American Express, which offers an Everyday Cashback Card paying 5% cashback for the first three months, plus the provider is once again running its ‘shop small’ incentive for two weeks in December. If shoppers spend £10 or more, they can get £5 back on single transactions, but consumers must register their card to be eligible.

“Consumers would be wise not to let any points go to waste on their loyalty cards or reward cards. Shoppers can download the Stocard app for free and load all their loyalty cards for quick use to make the most of every transaction, which is great for those who may forget the physical card. This time of year, shoppers should also take advantage of any points they have accumulated over the past 12 months on reward credit cards, such as with Sainsbury’s Nectar and Tesco Clubcard schemes, if they haven’t already.

“If shoppers are already super-organised and have all their gifts ready for wrapping, then there are other ways to get a bit of free cash, such as by switching current accounts. Halifax is still offering a switching incentive of up to £135, plus a £2 monthly reward and up to 15% cashback if certain criteria are met. Shoppers can also get £185 in gift cards from M&S Bank if they switch and stay for 12 months with the bank. Cashback websites are a fantastic choice for consumers who don’t want to change any of their financial arrangements, for example TopCashback, where shoppers can earn a little extra on different purchases.

“The cost of Christmas has been estimated to be £1,206 per person, according to American Express, so the pressure is on for households who may not have any means to cover the expense. However, there is help out there for those who may struggle this year, so they would be wise to seek out advice to ensure financial pressure doesn’t ruin any festive joy.”

moneyfacts.co.uk is a financial product price comparison site, launched in 2000, which helps consumers compare thousands of financial products, including credit cards, savings, mortgages and many more. Unlike other comparison sites, there is no commercial influence on the way moneyfacts.co.uk ranks products, showing consumers a true picture of the best products based on the criteria they select. The site also provides informative guides and covers the latest consumer finance news, as well as offering a weekly newsletter.

MoneyFacts Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.