No for Brexit Deal, Yes for May. And What for Gold?

Commodities / Gold & Silver 2019 Jan 17, 2019 - 03:45 PM GMTBy: Arkadiusz_Sieron

71 days. That’s all that separates us from the Brexit deadline. And the UK has still no clear path forward exiting the EU. Does gold have one?

71 days. That’s all that separates us from the Brexit deadline. And the UK has still no clear path forward exiting the EU. Does gold have one?

Today's analysis features possible scenarios for the UK and for gold along with their likelihood. In the current political situation, it's a must-read.

Parliament Rejects May’s Brexit Deal

On Tuesday, the UK Parliament voted on Theresa May’s Brexit deal for leaving the EU. As expected, the MPs rejected her proposition. What was really surprising was the scale of defeat. The parliament voted 432-202 against May’s divorce deal, marking the worst defeat in modern British history.

The reason for that humiliating loss was the split within the Conservative Party. May’s plan was a compromise attempting to soften the divorce with the EU. But, as it often happens with compromises, it did not satisfy anyone. Some Tories wanted a more decisive split with the EU, while others wanted to remain closer or not leave at all. Both groups joined forces, crushing the deal.

What Next?

Now, the key question is what will happen next. It’s hard to say, as – we agree here with May’s post-vote statement – “it is clear that the House does not support this deal, but tonight’s vote tells us nothing about what it does support.”

Generally speaking, there are several options. The first scenario is that May will quickly deliver a new and better deal, which will be accepted by the Parliament. This plan B will pave way for a formal and an orderly exit. Given that the EU is not eager to make concessions that would please Tories, it’s not a likely scenario.

The second option is that there is no deal at all. It means that by March 29th, 2019, the UK will crash out of the EU without a formal plan in place. The consequences could be substantial, as the disorderly Brexit would disrupt supply chains and bring chaos, at least initially. Trade with the EU would switch then to World Trade Organization rules, hitting the economy. Given that the country will face unprecedented uncertainty in that scenario, gold should shine.

The third option is that there will be a second referendum on Brexit, as many British people call for it. We agree that it could undermine the idea of a referendum, but it would not be unprecedented course of action, actually. As the Remainers would have higher chances during the second vote, gold bulls should not like that scenario. We have suggested a long time ago that the UK will never exit the EU, so we would not be very surprised. However, as Theresa May – who is against the idea of the second referendum – won the no-confidence vote yesterday, that scenario is also unlikely, at least for now.

The last option we would like to analyze is the most probable one in my view. As May won the no-confidence vote, she will try to delay Article 50 and come up with a new deal (or a way to not deliver Brexit), perhaps similar to the Norwegian model, which is allegedly gaining momentum among the Conservatives. It would be the least damaging form of Brexit, as it would allow the UK to retain the full access to the single market. But the country would have much less say in shaping its rules than it does now as an EU member. However, it’s not an easy path, as the EU would agree to extend the deadline in exchange for further concessions. And May would probably have to cooperate with the Labor Party as well to gain the support for plan B.

Implications for Gold

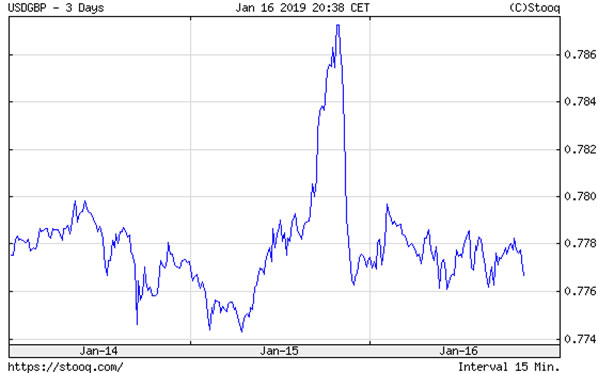

What does it all mean for the gold market? Well, it seems that markets have already priced in the worst. Why do we think so? Just look at the chart below, which shows that USD/GBP exchange rate.

Chart 1: USD/GBP exchange rate

As one can see, sterling lost before the vote, but rallied after it, on expectations that the defeat would force the British government to buy more time and continue their negotiations. In other words, investors believe that on March 29th, the UK will still remain within the EU. As the US dollar weakened against the pound sterling, gold prices inched up yesterday, as one can see in the chart below.

Chart 2: Gold prices from January 14 to January 16, 2019.

However, gold failed to jump above $1,300. It’s a rather bearish signal given the fact that the United Kingdom is now in the deepest political crisis in half a century, while the US government is partially closed for almost a month. It suggests that gold needs even more serious trigger to rally.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.