Defense Spending Is Recession Proof - Defense Dividend Stocks

Companies / US Military May 15, 2019 - 10:39 AM GMTBy: Robert_Ross

We’ve recently got some bad news about Social Security.

We’ve recently got some bad news about Social Security.

A new report says the program will cost more than it takes in by 2020. By 2035, its back-up trust fund will also run dry.

This makes sense: America is greying.

We’re having fewer children, living longer, and wages are growing at a slower pace.

That means there are fewer workers, those workers are making less money, and they’re supporting more retirees.

When Social Security was introduced in 1935, there were 42 workers for every retiree. Today, there are only 2.9.

And that number is set to drop to 1 within the next decade.

This means the government will have no choice but to cut Social Security benefits. There is, however, a far more stable government-backed system that can boost your retirement plans.

I’m talking about the global defense industry. Here I’ll show you the safest and most profitable way to tap into it.

Profiting Off the World’s Largest Employer

The US military is a behemoth. It employs 2.2 million active military personnel.

The US Department of Defense, which manages the military, is the largest employer on the planet. Its workforce equals the entire population of Nevada in size.

No surprise, it takes a ton of cash to keep this machine running.

The US military budget is nearly $700 billion this year alone. That’s more than twice the military budgets of China, Russia, Saudi Arabia, and India combined.

But here’s the kicker: The US spends 90% of its military budget on US companies. That means billions of dollars flow into publicly traded US companies every year.

And it happens no matter what…

Defense Spending Is Recession Proof

When the economy slows—as I expect it to in the next 18 months or so—people spend less and businesses scale back.

Consider the global financial crisis, for example. Between 2008 and 2009, US consumer spending fell 8.2% and domestic investment plunged 30.1%.

At the same time, the US hiked military spending by 12.2%.

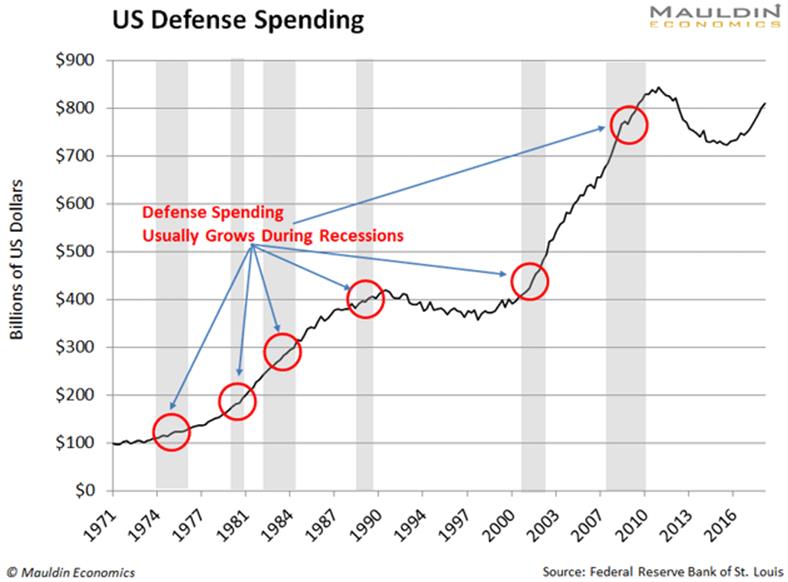

This was not an anomaly. Defense spending grew during five of the six last recessions.

You can see this in the next chart, which tracks US defense spending since the 1970s (recessions are highlighted in grey).

There’s a good reason for this.

A solid 70% of the US economy relies on consumer spending. That means everything from people buying groceries to paying their energy bills. During a recession, consumers feel the pinch and spend less.

The defense industry, however, is immune to this.

There’s no shortage of reasons to spend money on the military. From countering threats abroad (both real and imagined), to supporting veterans and defense-linked jobs, it’s politically toxic to cut military spending. No one wants to touch that hot potato.

This makes defense spending unusually stable. It also means companies that benefit from it earn very stable profits.

Safe and Secure Defense Industry Dividends

Dividend-paying stocks are my specialty. These are often the stocks of boring yet stable businesses. Stability is why they can pay dividends every quarter.

And, while the defense industry is certainly stable, it’s not known for its dividends.

Consider the iShares US Aerospace & Defense ETF (ITA), for instance. The ETF holds a basket of large defense stocks. But it only pays a 1.0% dividend yield. That’s only half of the 1.9% dividend yield on the S&P 500.

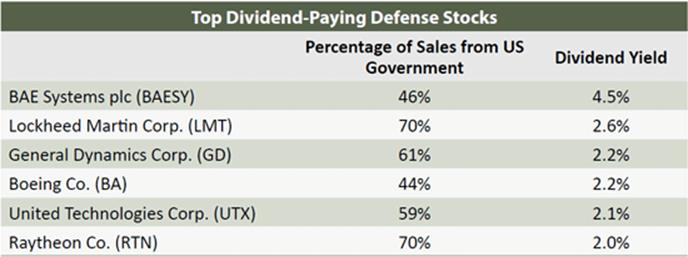

Nevertheless, there are individual defense stocks that pay great dividends. But you have to dig.

Let’s take a look at some of the best options.

Of these, Lockheed Martin Corp. (LMT), which makes a wide range of aircraft, naval ships, missile systems, and other defense-related gismos, enjoys the most stability from government spending.

The company is basically an unofficial wing of the US military. It also has the second-highest dividend yield on the list.

BAE Systems plc (BAESY), a UK-based defense and aerospace company, relies a bit less on US government spending. But its dividend yield is almost twice as high as Lockheed Martin’s.

If you’re looking for reliable income from the defense sector, I think buying individual companies is the way to go.

If and when Social Security dries up, you’ll be glad you’re collecting safe and reliable dividend payments from the recession-proof defense industry.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

By Robert Ross

© 2019 Copyright Robert Ross. - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.