UK Savers Lock in Cash to Beat Inflation Erosion

Personal_Finance / Savings Accounts May 23, 2019 - 03:07 PM GMTBy: MoneyFacts

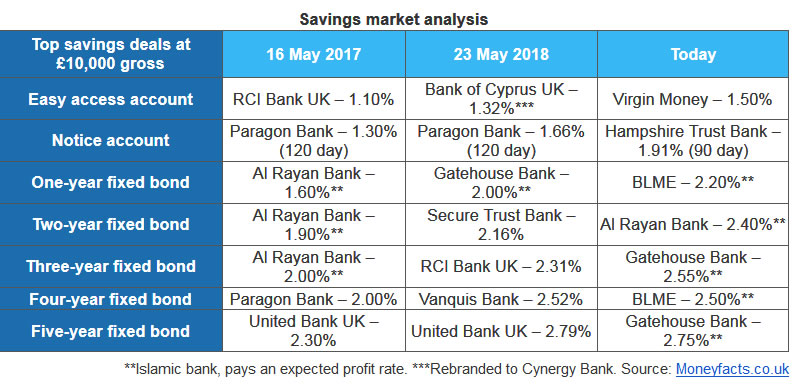

Savers looking to beat the eroding impact of inflation will find that fixed bond rates have risen in the past 12 months, so they can now get a better true return on their cash. Not only this, but easy access and notice account rates are also increasing, however none of the rates on offer in these sectors are currently able to beat inflation.

Despite the fact that inflation has now risen above the Government target of 2%, the latest research from Moneyfacts.co.uk shows that it still remains lower than the level seen in both May 2017, when the Consumer Prices Index (CPI) for April was announced at 2.7%, and May 2018 when inflation was 2.4%. Better still, savings rates have risen over both time periods.

Statistics released today show the CPI rose to 2.1% during April, meaning 108 fixed rate bonds and seven fixed rate ISAs (based on a £10,000 deposit) can now match or beat inflation*. Within that, 91 fixed bonds and three fixed ISAs pay more than 2.1%. In May 2017, there were no standard savings accounts that could outpace 2.7% and in May 2018 just 13 deals (all fixed rate bonds) could beat 2.4%, with today’s figures highlighting a definite improvement.

Rachel Springall, Finance Expert at Moneyfacts.co.uk, said:

“In keeping to our analysis a month ago, inflation is still at a beatable level if savers lock in their cash. In fact, savers will be earning a truer return of interest today thanks to competition within the savings market over the past 12 months. Still, not one easy access or notice account on the market can beat 2.1%, the current level of inflation.

“Indeed, just a year ago only 13 standard savings accounts (all fixed rate bonds) could outpace the eroding impact of inflation (paying over 2.4%), whereas today 91 fixed rate bonds can beat it, in addition to three fixed rate ISAs (all paying over 2.1%). Inflation may not be the first thing to come to mind when searching for a savings account, but its impact can mean savers lose out in real terms. Higher inflation means the purchasing power of cash falls, so it is vital savers find a deal to outpace it.

“This month savers will once again find the top fixed bond rates are available from the more unfamiliar brands, such as with Islamic banks, with it possible to find several short-term accounts that match or beat the current inflation rate. A year ago however, savers wouldn’t have been able to find any 12-month fixed bonds paying in excess of 2.1% and would instead have had to tie in their cash for two years or more, while in 2017 they would have had to tie up their funds for at least five years to beat 2.1% – a stark difference to today.

“Despite this improvement, savers who want instant access to their cash may still be disappointed, as there are still no easy access accounts that can outpace the rate of inflation. Regardless, the recent spate of competition from providers looking to retain a prominent place in the market means savers will find better returns available.

“It remains to be the case that savers will need to look towards the challenger brands for the top rates, so as long as the provider has the same protection as a well-known high street bank, there is little reason why savers should overlook them.”

*Data note: Please note that these savings product numbers only include deals that are available to all UK residents and excludes regular savers and children’s savers (this figure does not count each interest payment option for each account), based on a £10,000 deposit.

moneyfacts.co.uk is a financial product price comparison site, launched in 2000, which helps consumers compare thousands of financial products, including credit cards, savings, mortgages and many more. Unlike other comparison sites, there is no commercial influence on the way moneyfacts.co.uk ranks products, showing consumers a true picture of the best products based on the criteria they select. The site also provides informative guides and covers the latest consumer finance news, as well as offering a weekly newsletter.

MoneyFacts Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.