Will Central Banks Prevent Recession and Push Gold Down?

Commodities / Gold & Silver 2019 Oct 26, 2019 - 02:39 PM GMTBy: Arkadiusz_Sieron

Trade wars, geopolitical tensions and slowing economic indicators. Both the ECB and the Fed have recently cut interest rates to stimulate slowing growth, hoping to escape possible recession. Will they succeed? After all, they don’t have the most reliable record when it comes to preventing busts. Let’s get into the central flaw of central banking and what it implies for gold.

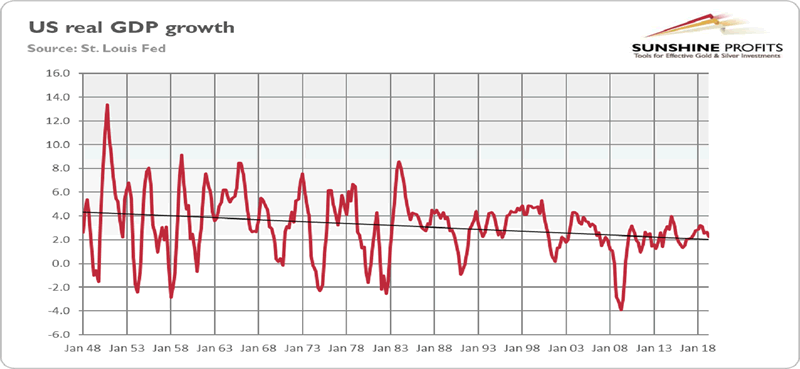

Both the ECB and the Fed have just cut interest rates to stimulate slowing growth and to escape possible recession. Will they succeed? The question is, of course, rhetorical. The recovery from the Great Recession has been the slowest postwar recovery, despite the massive monetary (and fiscal) stimulus, as the chart below shows.

Chart 1: US real GDP growth (as % change from year ago) from Q1 1948 to Q2 2019

Neither ZIRP, NIRP nor quantitative easing provided any significant boost to the economy. And each tightening cycle preceded the recession. So, it would be foolish to believe that this time the central banks’ actions would stimulate the economy and prevent the next slump. Gold bulls can sleep peacefully.

The fatal flaw in the central banks’ thinking lies in the belief that the interest rate is a central lever by which they can exert their influence over the economy. On surface, it seems to make sense. Lower interest rates imply lower borrowing costs, so people will borrow more to finance additional investments projects and stronger consumption. With higher investment and consumption spending, the GDP growth will be faster.

However, it is very simplified reasoning. In reality, lower interest rates do not have to stimulate economy. Why? First of all, the central bankers can lead a horse to water, but they can’t make him drink. We mean here that easy monetary policy can create favorable conditions to expand business and consumer spending, but the final decision rests with the banks, entrepreneurs and households. When they try to deleverage and repair their balance sheets, they are not interested in taking more debt, no matter the costs. Or when they are afraid of the trade wars or the next recession, they will simply not invest, and several basis points will not change it. Other issues are the limited importance of the manufacturing sector (so lower rates do not importantly affect the capital spending) and the fact that the U.S. consumer debt is mainly in the form of fixed-rate mortgages that are by definition not sensitive to interest rate cuts.

Moreover, the monetary easing may actually be counterproductive, hampering economic growth. Why? First of all, although it might be surprising or even unpleasant for Keynesian economists, there are not only borrowers but also savers in the economy. And guess what: ultralow interest rates reduce the income generated by savings. So, people can save even more (technically speaking, income effect may counterweight the price effect). While this is bad news for people saving money for retirement, it’s actually good news for the yellow metal. When bank accounts do not provide people with decent interests, some of them may switch fund into gold. In the environment of ultralow interest rates, all assets – not only gold – become practically the non-interest bearing assets.

Second, the cut in interest rates may negatively affect expectations in two ways. When interest rates are at ultralow levels, people expect that they will rise soon. And they can interpret the monetary policy easing as a sign that central banks are desperate because something ugly is unfolding in the economy. So they will not increase their spending.

Third, the monetary easing may spur excessive risk-taking, as people seek yield in the environment of ultralow interest rates. It supports risky assets, so it’s negative for the safe haven such as gold – until, of course, the bubble bursts.

Fourth, ultralow interest rates can zombify the economy, as interest rates at or even below zero lose their signal and allocation function. In other words, at ultralow interest rates even zombie companies can survive. However, they are not viable companies, so their existence lowers the productivity growth of the economy. More sluggish economic growth is positive for the gold prices.

Last but not least, ultralow interest rates, in particular the negative yields, hit the banks’ profitability. Call it a strange idea, but we insist that you cannot have a healthy economy without healthy banks, so weakening banks is not a wise course of action.

The key takeaway is that the major central banks eased their monetary policies in an attempt to stimulate growth and shield the global economy from recession. However, the history of central banking teaches us that they will fail. You cannot solve the supply-side problems with demand-side stimuli. The central banks will, thus, not kill the bull market in gold. Actually, they can strengthen it. This is because the ultraeasy monetary policy is not only impotent but it entails serious counterproductive effects. So, yes, in a sense the monetary policy is a very powerful – but a perverted tool. This is great news for the yellow metal – the central banks’ panic reactions can only aggravate economic situation, making gold to shine more brightly.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.