The Death Of Hedge Funds At A Time We Will Need Them

Stock-Markets / Hedge Funds Nov 25, 2019 - 12:16 PM GMTBy: Avi_Gilburt

With the latest news of Louis Bacon’s closing down his hedge funds, we are seeing further evidence of the difficulties hedge funds have been having during recent years.

But, if you think about the counter-intuitive nature of this trend, it is actually quite interesting. Let me take a step back and walk you through what I am thinking.

For those that follow the market, you know that as prices go up, more and more people want to buy into the market. In other words, higher prices beget higher prices, and this is how the herding principle drives stock markets to their all-time highs.

However, there comes a point when the money runs out. When all buyers have bought into the market, there is no more money left to push it higher. So, it is not “selling” which ends a bull market, but simply the lack of buying. When we reach a bullish extreme when all buyers have bought all they have wanted, stock markets end their bull phase, and begin to transition into a bear phase. This is simply the nature of the stock market.

When we look to hedge funds, we expect they will outperform the market, which is why we would consider paying them their high fees. Of course, this makes sense during a bear market, which is the ideal environment during which an investor turns to hedge funds. Hence, the name “hedge fund.”

However, when the market is in a strong bull phase, most investors believe all they have to do is put their money into an index fund or any one of the new ETF’s being paraded before the market, which means the demand for hedge funds dry up as the bull market matures. Remember, hedge funds are designed to hedge risks, and when investors do not perceive any risk in the market, then the demand for hedge funds must decline.

In fact, we have been seeing this happen in real time of late. In the last three quarters, more hedge funds have closed than have opened.

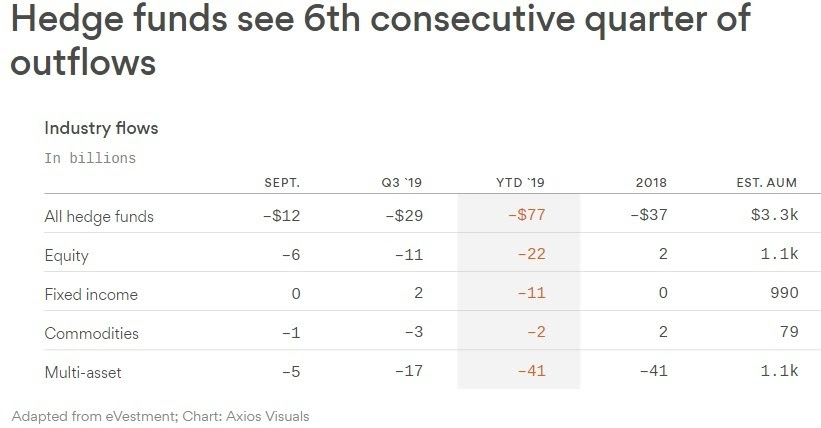

In the following chart, you will see that hedge funds have experienced their 6th consecutive quarter of net outflows.

In fact, it would seem that viewed risks in the market began to subside in 2011 as we see the demand for hedge funds have been on a decline since that year.

My expectation is that this bull market will likely continue for several more years, and likely take us up towards the 4000 region in the S&P 500. (See our chart on the SPX illustrating how the Elliott Wave counts get us there.) That likely means that we will see greater net outflows from hedge funds, along with many more closings.

In fact, when we get to the end of this long-term bull market which began in 2009, my expectation is that we will have the lowest number of active hedge funds over the prior decade, as I expect this current trend to continue until the end of the bull market. Yet, will that not be the exact point in time where demand for hedge funds should increase rather than decrease?

This demand for hedge funds works no differently than the stock market itself. It is all driven by investor sentiment. Just as investor sentiment for stocks reaches a bullish extreme, which will eventually cause the end to this bull market, so too will the demand for hedge funds likely decrease to the lowest levels seen since the start of the bull market. But, as I noted above, good contrarian investors should be looking at this in the exact opposite way in which the great majority of the market often does.

So, now is the time to begin doing your homework on hedge funds. Those that were able to outperform the market during the 2007-2009 financial debacle, and then also do well during the last 10 years of the bull market should be moving to the top of your list as we head towards the end of this long-term bull market cycle within the next few years.

Avi Gilburt is a widely followed Elliott Wave analyst and founder of ElliottWaveTrader.net, a live trading room featuring his analysis on the S&P 500, precious metals, oil & USD, plus a team of analysts covering a range of other markets. He recently founded FATRADER.com, a live forum featuring some of the top fundamental analysts online today to showcase research and elevate discussion for traders & investors interested in fundamental rather than technical analysis.

© 2019 Copyright Avi Gilburt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.