The Big Short Guides us to What is Next for the Stock Market

Stock-Markets / Stock Markets 2020 Apr 08, 2020 - 12:42 PM GMTBy: readtheticker

There is nothing new in WallStreet, it is only the players that change. Sometimes a market player or an event gets ahead of the crowd and WallStreet has to play catch up.

Previous Post Dow 2020 Crash Watch , Dow, Three strikes and your out!

It is important to understand major WallStreet players do not want to miss out on a money making moves.

In the movie 'The Big Short' some market players got ahead of the crowd and shorted the US housing market.

When the US housing market began to crumble the majority of WallStreet was long and wrong, and losses on the longs were going to be incredible, they had to get short. WallStreet needed to load up on shorts to participate in the money making down trend.

There is a scene in the movie where Dr Michael Burry is on the phone expressing his frustration as to why the banker had marked up the housing bond index when the mortgages themselves were crashing, the index should have been marked down, of course this was banker fraud to allow the bankers themselves to short the same index as Dr Michael Burry. POINT: Wallstreet does not want to miss out on major market moves.

Roll forward to 2020 and the SP500 suffers its worst 30% down move since 1929 (Wyckoff terms this as a 'Sign of Weakness'). Wallstreet has not made any money on this move, if fact like the housing market they are long and wrong, and like 2008 they need to get short. The question is how?

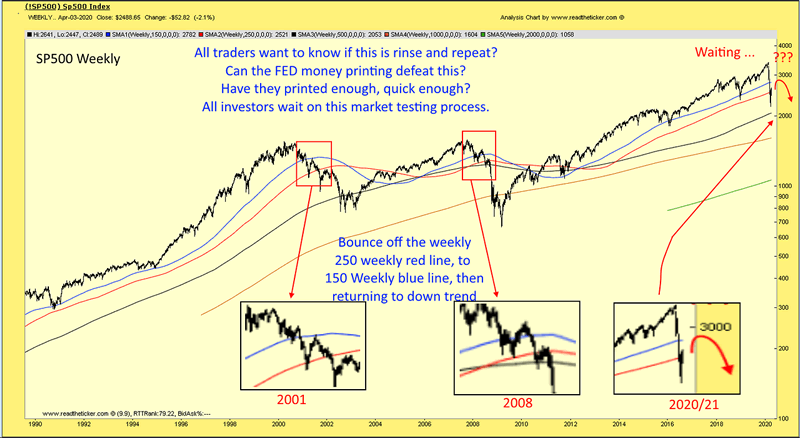

The answer is simple, re look at 2001 and 2008 SP500 price actions (chart below), after price had fallen to the red line (250 weekly SMA), a bounce was organised to near the blue line (150 weekly SMA) to allow WallStreet market players to short the coming down trend.

The stock market has not had all the bad news yet, earnings slump, supply chain issues, derivative blow ups, bank risk news, c19 news. There is plenty of ammo for WallStreet to blame a down trend on while they profit with shorts. The chart below shows how we can expect a rinse and repeat of 2001 and 2008 organised bounce.

Of course the FED is printing and TRUMP is trying to get trillions passed to stimulate the economy, however will it be enough or quick enough. Some say the FED balance may need to go to $10 to $20 trillion, some say modern money theory is required. The doubt and delay around these programs will add to the market uncertainly.

The next play to watch for is the WallStreet bounce to allow shorts to be loaded up.

In Wykoff terms a low volume weak bounce (like 2001 and 2008) will be named the 'Last point of Supply', and if a price slump follows, price will break the ice near the 2200 level to lower lows. Of course if we get price strength shown by high volume and wide spread the 'sign of weakness' can be discounted as abnormal.

We are waiting and watching.

Watch this live, with Wyckoff, Gann and Cycles inside readtheticker.com, sign up to RTT Plus.

Fundamentals are important, and so is market timing, here at readtheticker.com we believe a combination of Gann Angles, Cycles, Wyckoff and Ney logic is the best way to secure better timing than most, after all these methods have been used successfully for 70+ years. To help you applying Richard Wyckoff and Richard Ney logic a wealth of knowledge is available via our RTT Plus membership. NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.net Investing

NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.net

Readtheticker

My website: www.readtheticker.com

We are financial market enthusiast using methods expressed by the Gann, Hurst and Wyckoff with a few of our own proprietary tools. Readtheticker.com provides online stock and index charts with commentary. We are not brokers, bankers, financial planners, hedge fund traders or investment advisors, we are private investors

© 2020 Copyright readtheticker - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.