Bending the Inflation Curve

Economics / Inflation Apr 21, 2020 - 02:27 PM GMTBy: John_Mauldin

Our responses to the coronavirus threat, necessary though they may be, are creating massive supply and demand shocks, the rapidity of which is like nothing seen in centuries, if ever.

The Federal Reserve and other central banks are doing unprecedented things. Some think inflation will be the result. While that may happen eventually, I believe we will first go through the most massive deflationary shock of all time.

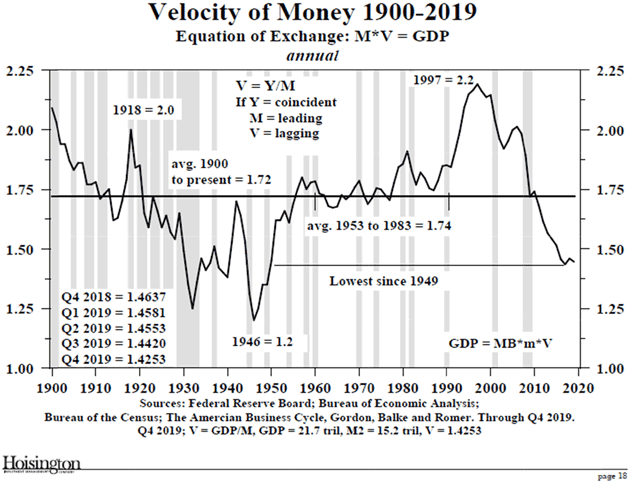

Milton Friedman famously said, “… inflation is always and everywhere a monetary phenomenon.” During the timeframe in which he and his colleague Anna Schwartz did their famous study, there was clearly a correlation between money supply and inflation. What is not often noted is that the velocity of money (i.e., the rate at which money changes hands) was stable during that time.

When the velocity of money is falling, monetary policy which would otherwise cause inflation doesn’t seem to do so.

Here is Lacy Hunt’s latest velocity chart. You have to go back to 1949 to find a time when it was lower than today, and it was actually rising rapidly off the postwar lows. This was before the coronavirus shutdowns. Let me crawl out on a limb and suggest that the velocity of money is now going to drop even further. Deflation is not your friend.

Source: Hoisington Investment Management

Let me offer Mauldin’s corollary to Milton Friedman’s famous statement:

Inflation Is Always and Everywhere a Function of Demand

We have simply destroyed demand by locking down the country. And it should be clear that we cannot turn a switch to bring it back. How soon will we feel like going back into large crowds, restaurants, movie theaters, sporting events, hotels, vacation destinations, and all the other areas where we congregate as human beings? Certainly, some of the economy will start looking normal. But how many workers will it need?

How have our buying patterns changed? We are learning that we can work from home. Zoom and other services have had their weaknesses exposed, but they will improve. This is going to make working from home easier and more common.

Multiplied across thousands of large companies, that means the demand for office space will drop, which means prices for office space will drop. That is deflation, gentle reader. Even if the Federal Reserve decides to buy office space (which it won’t), that is not going to increase demand. Ditto for 100 other industries. Think about restaurant buildings. Builders and tenants go to tremendous expense to create the kitchens, which means if a restaurant goes out of business, the property owner typically has to find another restaurant. How likely is that to happen today?

At some point supply and demand will balance, but I don’t think it will be in three months. Three years? Maybe. Lacy Hunt thinks it will be a few years longer. So do some of my other economically brilliant friends.

But whether it is three months or three quarters or 3+ years, it will happen. At that point we have the potential for an inflationary episode if the Federal Reserve keeps stimulating and the government keeps running massive deficits. If they act responsibly, inflation could rise to the 2 to 3% level and hopefully not higher. If they don’t act responsibly? All bets are off.

But understand this: Demand has to come back, and in size, in order to spark inflation. Yet in this situation people will want to save, perhaps more than they ever have in their lives. Purchases are going to be put off if they can be.

Now, many economists would not talk about supply and demand so much as about the “output gap.” As businesses go away, potential output also drops. How will that take? No one knows.

We have never seen anything like this. Nor have we seen the last of it, and we probably won’t until there’s a vaccine.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could be triggered in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.