Why You Should Focus on Growth Stocks Today

Commodities / Gold and Silver Stocks 2020 Oct 16, 2020 - 11:01 AM GMTBy: John_Mauldin

By Justin Spittler : My friend who’s a novice investor asked for advice recently. He was “bargain hunting” for cheap stocks, and trying to decide between buying Kohl’s (KSS) or ExxonMobil (XOM).

I cringed. “Listen,” I told him. “You’re thinking about this all wrong.”

I get where my friend is coming from. From childhood we’re taught to be financially prudent. To seek bargains and avoid spending money on expensive things.

In most areas of life this is smart advice. Drive a reasonable car, live in a reasonable house, book reasonable vacations with your family. But there’s one big problem.

Most people, like my friend, apply this same mindset to the stock market: and it’s totally wrong! In this issue, I’ll show you which stocks to buy instead.

“Cheap” Stocks Are Often The Worst Stocks You Can Own

By “cheap,” I mean stocks that have a low stock price in relation to their sales or earnings. If a stock trades for $20/share and earns $4/share, it’s cheap. If it trades for $200/share and earns $4/share, it’s not cheap.

People are drawn to “cheap” stocks for the same reason they flock to the Macy’s clearance rack. It feels good to get a deal. Americans love nothing more than getting lots of “bang for their buck.”

But in investing, this is a dangerous mistake. These stocks are cheap for a reason! They’re usually in dying industries. So they’re either barely growing, or shrinking.

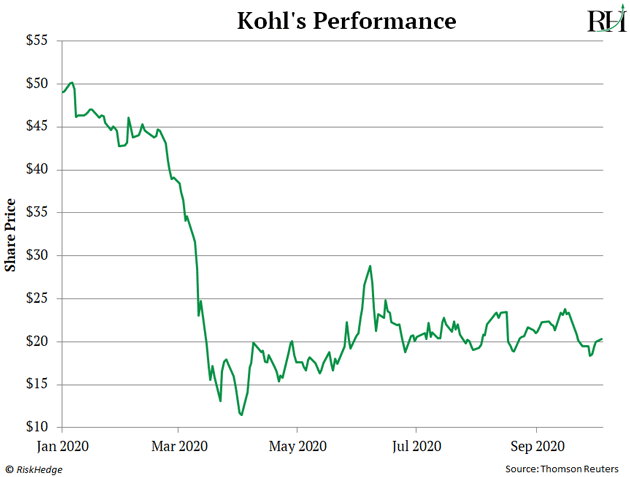

Consider Kohl’s (KSS), which is getting eaten alive by online shopping. Its sales have shrunk 25% over the past three years. It’s one of the cheapest stocks in the S&P 500. And its stock has plunged 60% so far this year.

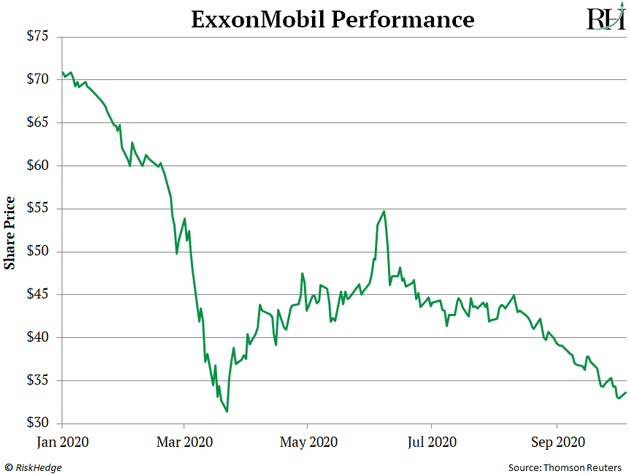

ExxonMobil (XOM) is an “old energy” dinosaur. It currently pays a 10% dividend, leading some folks to believe it’s a bargain. It’s not. The stock has been pummeled 52% since the start of the year.

And it’s not just Kohl’s and Exxon. With all the craziness and uncertainty going on with coronavirus, you’d assume investors would be taking shelter in “cheap” companies that’ve demonstrated they can survive uncertain times.

Names like Coca Cola (KO), Johnson & Johnson (JNJ), and 3M Company (MMM). Yet these “value stocks” are all down more than 10% in 2020! In other words, we’re in the middle of a global pandemic… and these cheap, “safe” stocks aren’t doing their job.

I know this is a controversial take, and it flies in the face of how Wall Street would like you to think. But when you look at the evidence, it’s crystal clear: “Cheap” does NOT equal “safe” in the stock market.

That’s Why I Focus Almost Exclusively On Growth Stocks

Unlike the cheap stocks I showed you above, these stocks are growing like crazy. And their share prices are going through the roof!

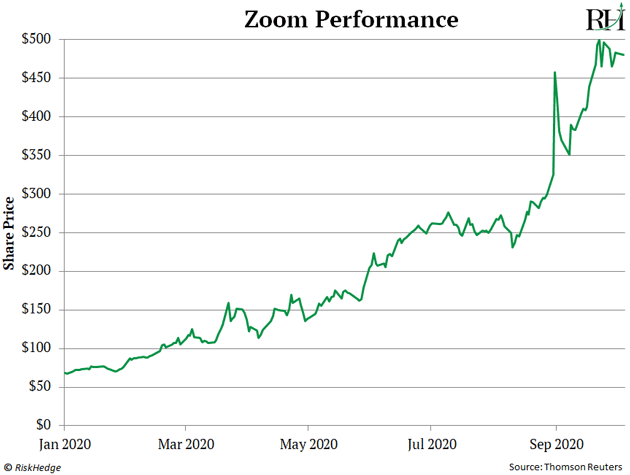

Take Zoom Video (ZM). Zoom, as I’m sure you’re aware, brought teleconferencing to the masses. Now, its shares aren’t cheap. In fact, by some metrics, they’re 20 times more expensive than the “average” S&P stock.

But that hasn’t kept money from pouring into Zoom’s stock. As you can see, it’s raced more than 640% higher this year.

This incredible move caught many investors by surprise. But it shouldn’t have. Zoom is one of the fastest-growing companies on the planet.

Last quarter, it reported a 148% spike in sales. That’s staggering growth for a company as big as Zoom, which is valued at $132 billion. Of course, it’s not the only growth stock that’s done phenomenally this year.

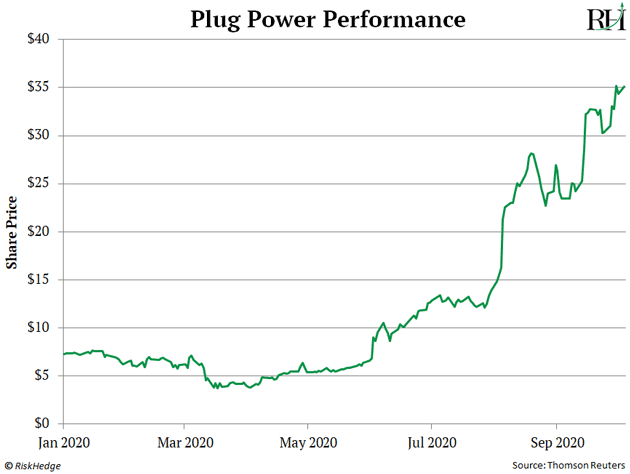

Plug Power (PLUG) has skyrocketed 267% this year. Its sales have grown 29% per year for the past five years.

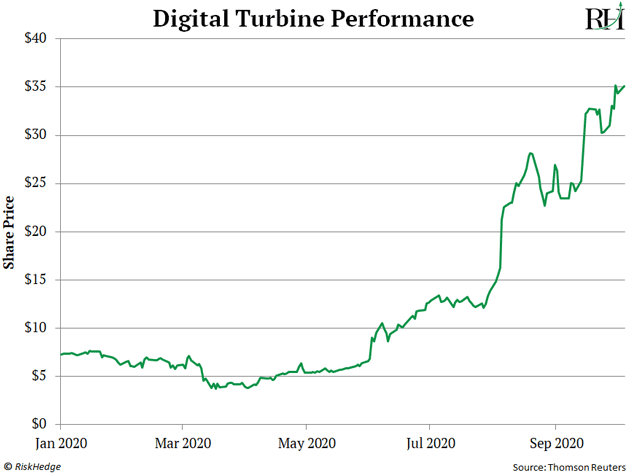

Digital Turbine (APPS) is another example. The company is at the forefront of the booming digital advertising revolution. As a result, its sales soared 93% last quarter, and 38% per year since 2015. Despite that breakneck growth, APPS is an expensive stock. By one metric, it’s nearly five times as expensive as the S&P 500. Digital Turbine has surged 392% this year.

I could go on and on with examples. But you get my point. Fact is, the average S&P stock grows sales at a sluggish 3.5% per year. The right growth stocks can grow 100%+ a year

See, my friend was asking the wrong question. Sorting through “cheap” stocks is a loser’s game. Instead, you should be looking for the next great growth stock.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get our latest report where we reveal our three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Justin Spittler

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.