Buy Silver NOW!

Commodities / Gold & Silver 2020 Dec 29, 2020 - 04:48 PM GMTBy: The_Gold_Report

Peter Krauth provides the investment case for silver.

In many ways, most of us can't wait to put 2020 behind us and call it last year.

We've experienced a once-a-century global pandemic, infecting almost 80 million people. Lockdowns caused businesses to shutter and soaring unemployment, with massive economic consequences.

If you dig a little deeper, other costs include soaring debts and deficits worldwide. We're approaching an unfathomable $280 trillion in global debt. Governments and central banks have facilitated tens of trillions in stimulus spending this year alone, and it's far from over.

The U.S. is now passing its latest $900 billion stimulus bill, promising new stimulus checks, boosting unemployment, small business aid and funds for schools and universities.

It's little wonder that some asset classes have been riding this wave, not the least of which is silver. And looking ahead, the metal appears primed for another great year in 2021.

Debt, Deficits and Stimulus Boosting Silver

2020 was good to some investors. Stocks gained, with the S&P 500 ahead about 13%, while the Nasdaq is up some 17%.

Precious metals investors fared even better. Gold has gained around 23%. Yet silver outshone all of these with an outstanding 44%. But as I'll explain, I think gold's cheaper cousin is set for another year of outsized gains.

I believe we're entering a perfect storm for silver. Not only are central bank balance sheets exploding, but major economies are passing stimulus bills that, just a few years ago, would have been near-scandalous. What's more, they're doing so not just with relative ease, but outright encouragement.

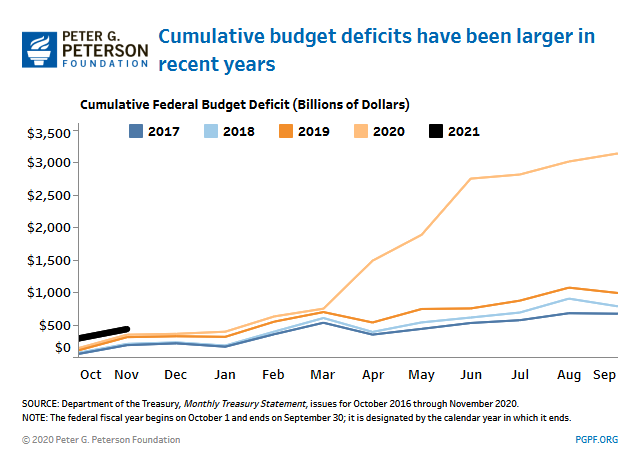

The Fed's balance sheet was $4.2 trillion at the start of the year. Today, it's $7.3 trillion and growing. This year the U.S. Federal deficit will be triple that of 2019.

And yet, almost no one seems to care. Until…inflation.

I think inflation will be the dark horse of 2021. As vaccination rates climb and the visible effects of the pandemic subside, I expect our wild rates of money printing will start to take effect. Currencies, in particular the U.S. dollar, are likely to weaken.

That's what gold and silver have been sensing, especially since massive stimulus programs and a Fed promise of near-zero rates until at least 2023 appeared.

Not only is silver demonstrating its ability to hedge against expected inflation, it's also flexing its industrial-metal muscle. Fifty percent of silver is consumed in industry, plus 10% goes into solar technologies. Factor in exploding investment demand, and the metal's outlook is robust.

What's more, silver's technical picture is providing a terrific setup.

Silver's Bullish Technical Setup

The gold/silver ratio is a useful gauge to assess silver's relative value against gold.

In March, the ratio spiked over 125, meaning it took an astounding 125 ounces of silver to buy one of gold. That's a historic high which quickly reverted.

For most of the last 20 years, this ratio has bounced around between 50 and 70. Typically, when the ratio runs up above 80 and reverses, it tends to run down to 50 or even lower. Currently, the gold/silver ratio is near 73, and has been trending down. That's what it does during precious metals bull markets. I think it has further to fall, even if gold moves higher, which is likely. As a result, I expect silver's gains will easily outpace gold's in 2021.

What's more, the silver chart is confirming bullish price action.

Silver "tested" support at $23 several times since September, and has just broken out above resistance. It's now trading well above its 200-day and 50-day moving averages, and the latter has just turned up. The RSI and MACD momentum indicators are both trending higher and are not yet overbought. All of these are bullish signals.

The same holds true for silver stocks.

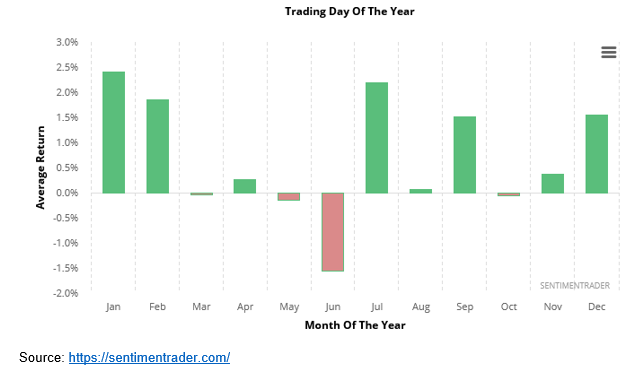

Layer on top of that the seasonal trend for silver, and it becomes difficult to paint a more favorable outlook.

As you can see, silver tends to perform particularly well from December through February.

So here's how I see it.

Ignore the daily noise in silver prices. One day traders buy the rumor, the next they sell the news. Instead, we need to focus on the bigger trend: silver has already more than doubled since March. It's in a bull market.

Most of us are anxious to welcome 2021. And those who invest in silver and silver stocks are likely to find next year particularly rewarding.

It's time to buy silver.

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in energy, metals and mining stocks. He has been editor of a widely circulated resource newsletter, and contributed numerous articles to Kitco.com, BNN Bloomberg and the Financial Post. Krauth holds a Master of Business Administration from McGill University and is headquartered in resource-rich Canada.

Disclosure: 1) Peter Krauth: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.