Inflation and Stock Market SPX Record Highs. PPI, FOMC Meeting in Focus

Stock-Markets / Stock Market 2021 Jun 15, 2021 - 04:45 PM GMTBy: Paul_Rejczak

Everyone (and I mean everyone) has been talking about inflation. We finally got the CPI print on Thursday: 0.6% vs. 0.4% expected! The S&P 500 didn’t seem to care, though. Record highs! What’s next?

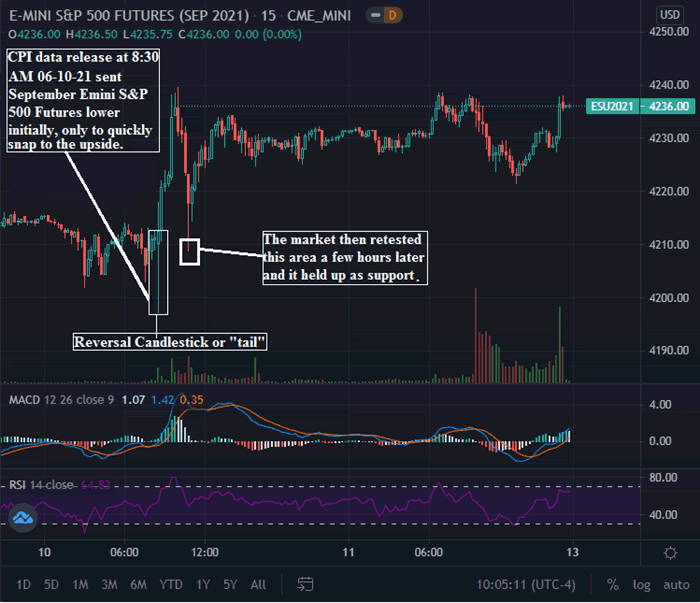

Inflation is real, folks. Two monthly prints in a row now, with the most recent June print showing the largest increases in used cars/trucks, transportation services, fuel oil, and apparel. Initially, the CPI data release was sold in futures trading at 8:30 AM on Thursday, but price action quickly reversed to the upside. This price action stuck out to me. Markets do not always react as expected when data releases come out. In a bull market like this, sometimes the data doesn’t matter. This price action tells us a story.

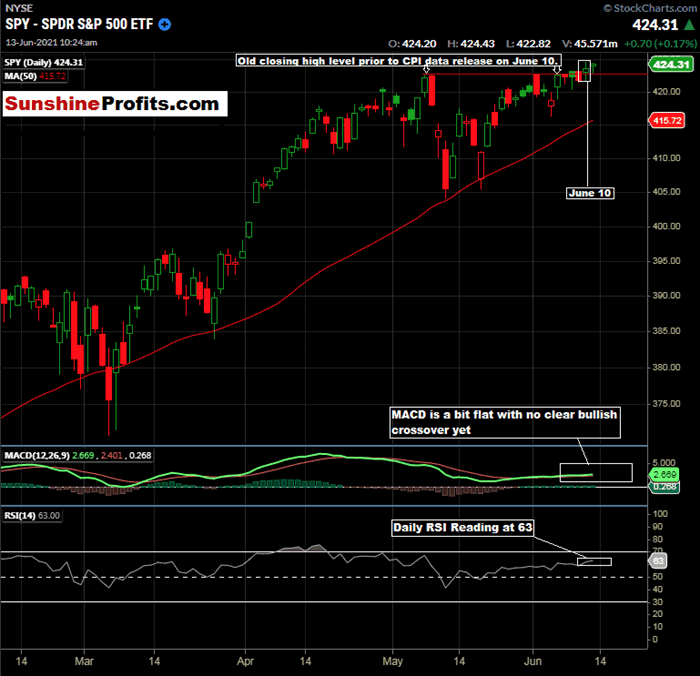

Figure 1 - SPDR S&P 500 ETF February 13, 2021, 8:45 PM - June 11, 2021, Daily Candles Source stockcharts.com

Notice the long “tail” or “wick” on the 8:30 AM candle above. The initial reaction was to sell the big CPI number, but it was quickly bought and ended up just being liquidity for the long/buy-side to gobble up and take the market higher. The retest that occurred hours later held up, and a new range was established for the remainder of the week.

The S&P 500 closed at an all-time closing high level on Friday.

What can this tell us? This market wants to move higher. Perhaps the higher inflation trickles into stocks as well; if used trucks cost more, couldn’t shares of stocks cost more too? It is plausible and also somewhat concerning. Higher inflation should not be construed as a bullish event, but as we know, markets can remain irrational - and for extended periods.

Drilling down to the intraday candles, we can see the price action that occurred when the CPI data was released. The September S&P 500 Futures quickly moved lower on the release, but within minutes, snapped back and reversed to the upside. The price area was retested hours later (see below), and this area held up very well as support.

Figure 2 - September Emini S&P 500 Futures June 9, 2021, 8:45 PM - June 11, 2021, 15-minute Candles Source tradingview.com

So, we have a bit of a conundrum on our hands in the US equity indices, in my opinion. We have the S&P 500 closing at all-time highs on Friday. The breakout (if you want to call it that) is a bit anemic as of now, and the other major indices have yet to close at all-time highs.

The Week Ahead

The major event this week: the FOMC meeting on June 15-16, with the Fed statement coming out on Wednesday at 2:00 PM ET. Prior to the Fed statement, we do have PPI and Retail Sales data coming out on Tuesday at 8:30 AM ET. The retail sales data will give us some additional insight into the US consumer, and the PPI is known to be a leading indicator of consumer inflation.

While Retail Sales and PPI could provide a spat of movement in the indices, I am expecting a quiet week leading up to the Fed decision on Wednesday afternoon. This type of quiet trade has been the prevailing theme lately; last week was quiet leading up to CPI, and the week prior was quiet leading up to Non-Farm Payrolls. Both of those numbers were anything but bullish by the way, but here we are at all-time highs in the S&P 500.

What is Working

While a pullback in the S&P 500 to the 50-day moving average would catch my attention for a potential long entry, there seem to be better places to focus on at this moment. The US infrastructure plays have been playing out well, even with the back and forth negotiations by the two parties.

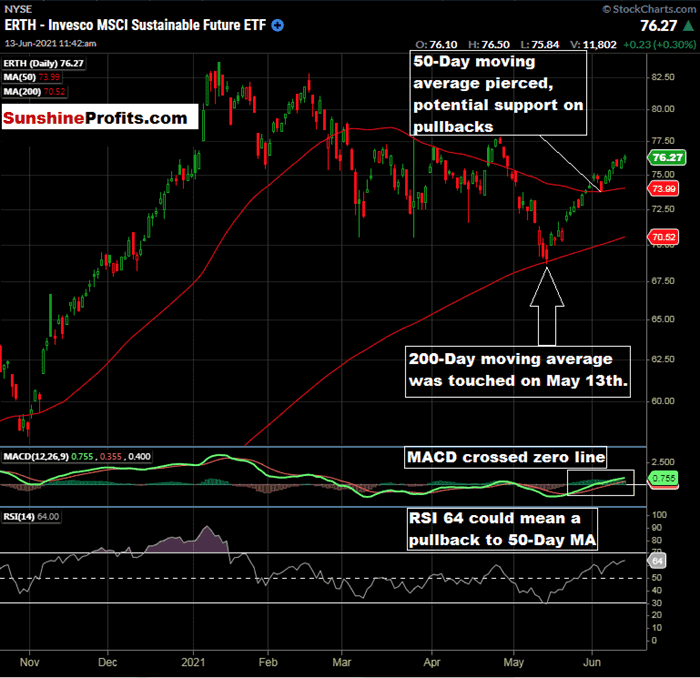

ERTH Invesco MSCI Sustainable Future ETF has been working well since we identified it for a long entry near its 200-day moving average in our May 10th publication , and it is still in the middle of its 2021 range.

Figure 3 - Invesco MSCI Sustainable Future ETF (ERTH) Daily Candles October 21, 2020 - June 11, 2021. Source stockcharts.com

I think that this name has legs over the long run given the current US administration and the fact that ERTH seeks to track the investment results of MSCI Global Environment Select Index. You can read more about ERTH here. If we get a pullback, I will be monitoring the 50-day Moving average level. I do think there is still time to get on board this one, and the holding period could be extended. Remember to monitor the 50-day moving average level, as it changes each day!

Now, for our premium subscribers, let's review the eight markets that we are covering, and see if anything changed upon the close of last week. Not a Premium subscriber yet? Go Premium and receive my Stock Trading Alerts that include the full analysis and key price levels.

thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter - it's absolutely free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts.Sign up for the free newsletter today!

Enjoy your day! And remember to be patient with your entries.

Rafael Zorabedian

Contributor

* * * * *

This content is for informational and analytical purposes only. All essays, research, and information found above represent analyses and opinions of Rafael Zorabedian, and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. You should not construe any such information or other material as investment, financial, or other advice. Nothing contained in this article constitutes a recommendation, endorsement to buy or sell any security or futures contract. Any references to any particular securities or futures contracts are for example and informational purposes only. Seek a licensed professional for investment advice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Information is from sources believed to be reliable; but its accuracy, completeness, and interpretation are not guaranteed. Although the information provided above is based on careful research and sources that are believed to be accurate, Rafael Zorabedian, and his associates do not guarantee the accuracy or thoroughness of the data or information reported. Mr. Zorabedian is not a Registered Investment Advisor. By reading Rafael Zorabedian’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Trading, including technical trading, is speculative and high-risk. There is a substantial risk of loss involved in trading, and it is not suitable for everyone. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment when trading futures, foreign currencies, margined securities, shorting securities, and trading options. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Rafael Zorabedian, Sunshine Profits' employees, affiliates, as well as members of their families may have a short or long position in any securities, futures contracts, options or other financial instruments including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. Past performance is not indicative of future results. There is a risk of loss in trading.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.