Stock Market Rushing Headlong

Stock-Markets / Stock Market 2022 Jan 28, 2022 - 09:51 PM GMTBy: Monica_Kingsley

Glass half full call on S&P 500 yesterday was vindicated – this yet another reversal has the power to go on, and credit markets appear sniffing out the upcoming reprieve. While rates have justifiably risen, they have done so quite fast in Jan – time to calm down and reprice the excessively hawkish Fed fears. Even if it was just energy and financials that rose yesterday, the table is set for gains across many assets – just check the progress from yesterday‘s already optimistic upturn, or the already fine early view of yesterday‘s market internals.

VIX is calming down, Fed is unlikely to rock the boat too much – such were my yesterday‘s thoughts about:

(…) seeing a rebound on Wednesday‘s FOMC (I‘m leaning towards its message being positively received, and no rate hike now as that‘s apart from the Eastern Europe situation the other fear around).

The sizable open profits – whether in S&P 500 or crude oil – can keep on growing while gold slowly approaches $1,870 again (look for a good day today), and copper stabilizes above $4.50 to keep pushing higher even if not yet outperforming other commodities. More dry firepowder and fresh profits ahead anywhere I look – even cryptos are to enjoy the unfolding risk-on upswing.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

This is what a tradable S&P 500 bottom looks like – just as it was most likely to turn out. After the 200-day moving average, 4,500 point of control is the next target.

Credit Markets

HYG reversed, but isn‘t in an uptrend yet – this is how a budding reversal looks like, especially since the selling hasn‘t picked up ahead of the Fed. Turning already.

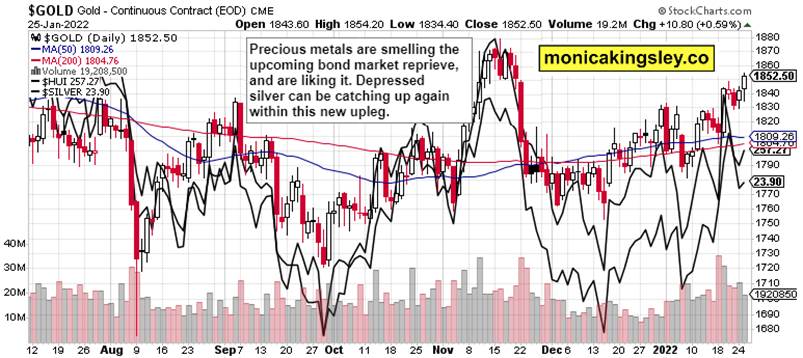

Gold, Silver and Miners

Gold and silver pause was barely noticeable – it‘s a great sight of upcoming strength in the metals while miners unfortunately would continue underperforming to a degree, i.e. not leading decisively.

Crude Oil

Crude oil bulls are back, how did you like the pause? The ride higher isn‘t over by a long shot, and I like the volume of late being this much aligned.

Copper

Copper looks to be catching breath before another (modest but still) upswing. The buyers aren‘t yet rushing headlong.

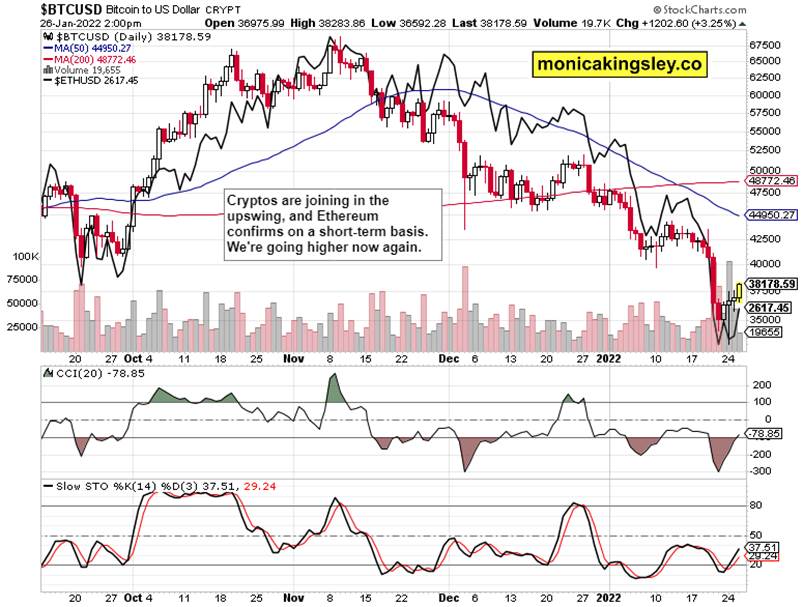

Bitcoin and Ethereum

Bitcoin and Ethereum reversed, and are participating in the risk-on upturn, with Ethereum sending out quite nice short-term signs. From the overall portfolio view and upcoming volatility though, I would prefer to wait before making any move here.

Summary

- S&P 500 bulls withstood yesterday‘s test, and are well positioned to extend gains, especially on the upcoming well received FOMC statement and soothing press conference. It had also turned out that a tech upswing is more likely to be continued today than yesterday – the Fed‘s words would calm down bonds, and that would enable a better Nasdaq upswing.

- As I wrote yesterday, the table is set for an upside FOMC surprise – the tantrum coupled with war fears bidding up the dollar, is impossible to miss. Best places to be in remain commodities and precious metals – and I would add today once again in a while that real assets upswing would coincide with the dollar moving lower later today (check those upper knots of late). So far so good in risk-on, inflation trades – and things will get even better as my regular readers know (I can‘t underline how much you can benefit from regularly reading the full analyses as these are about how I arrive at the profitable conclusions presented & how you can twist them to your own purposes).

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.