The myth of PH’s bankruptcy and “Chinese debt slavery”

Interest-Rates / Asian Economies Apr 18, 2022 - 05:06 PM GMTBy: Dan_Steinbock

In 2017, Forbes reported that President Duterte will force Philippines into China’s debt slavery and bankrupt the economy by 2022. The fake story was promoted heavily by international and Philippine media. The question is, why?

In 2017, Forbes reported that President Duterte will force Philippines into China’s debt slavery and bankrupt the economy by 2022. The fake story was promoted heavily by international and Philippine media. The question is, why?

In May 2017, Forbes released a column that claimed that “New Philippine Debt of $167 Billion Could Balloon To $452 Billion: China Will Benefit.” It was written by Anders Corr, who was portrayed as an “independent” geopolitical risk analyst.

“Over 10 years,” Corr boldly predicted, “that could balloon Philippines’ debt-to-GDP ratio as high as 296%, the highest in the world.” Fueled by expensive loans from China," he said, "Dutertenomics will put the Philippines into virtual debt bondage.”

At the time, I argued that Corr’s prediction was idiotic and up to 240-250 percentage points off. Yet, it was quoted widely both internationally and in the Philippines.

Dumb assumptions, idiotic predictions

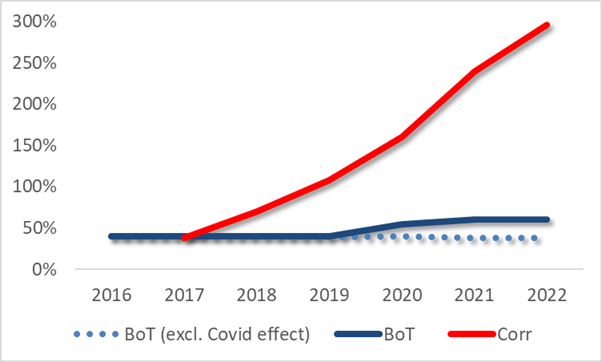

Around 2016/7, Philippine authorities, including the Bureau of Treasury (BoT), expected the debt to mildly decline between 2017 and 2022.

In retrospect, the pandemic devastation caused debt levels to soar worldwide. But did the Philippine debt-per-GDP soar to 300%, as Corr predicted? No, it did not. It is today around 60% of GDP and sustainable (Figure 1).

Figure 1 Philippines government debt, 2016-22 (% of GDP)

Sources: Forbes/Corr; Philippine Bureau of Treasury (BoT)

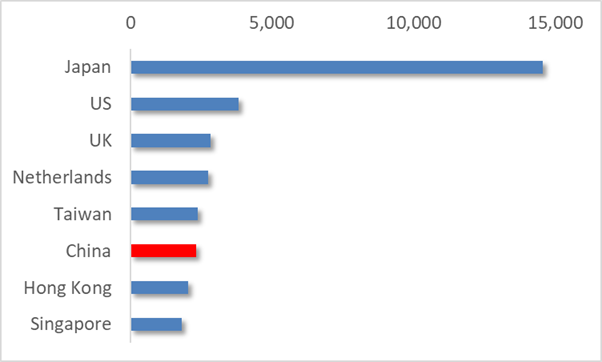

Does China account most of that debt, as Corr projected? No, it doesn’t. Over 70% of the debt is domestic. Does China dominate the external debt? No, it doesn’t.

Eight foreign creditors account for three-fourths of all Philippine external debt. Dominating one third of that debt, Japan is in a class of its own. It is followed by the US, UK and Netherlands. Even Taiwan is a bigger creditor than China whose role in the external debt is about 5% of the total (Figure 2).

Figure 2 Major foreign creditors ($ million, Dec. 2021) *

* Total Philippine external debt by creditor country. As of 31 Dec. 2021

Source: BSP

So, Corr’s 2017 “predictions” have absolutely nothing to do with economic realities. His Forbes commentary was thoroughly flawed, as I argued half a decade ago.

In light of his own numbers, Corr is off by almost 240 percentage points.

Experts for geopolitical hatchet jobs

Anders Corr has a very peculiar background. Most of his clients are linked with Pentagon, its military allies and defense contractors. And he has been an associate for Booz Allen Hamilton in Hawaii, like Ed Snowden when he still worked for CIA.

Furthermore, Corr served half a decade in US military intelligence. He has conducted "research" for US Army in Afghanistan, at US Pacific Command and US Special Operations Command Pacific. By his own testimony, he seems to specialize in destabilization efforts. Hence, his activities and clients in the Philippines, Taiwan, Pakistan and, more recently, Ukraine.

In 2017, Corr offered no evidence to substantiate his Philippine debt assertions. Yet, the commentary was quickly recycled across the Western media. Even though Corr was subsequently fired from Forbes.

When investment analysts commit such gross failures in markets, they are usually fired, banned or, in case of foul play, fined and detained. That has not been the case with Corr.

Despite disastrous projections, Corr continues to be used as an “expert” by major international media, such as Bloomberg, Fox, CNBC, New York Times, Nikkei Review, Al Jazeera, and UPI. In a 2022 report, the Congressional Research Service still portrays Corr as an expert of South China Sea and ‘Chinese strategies.’”

Leading Philippine observers proved even more gullible.

How Corr’s fake news prevail in PH

When Forbes published Corr’s rant, GMA News, one of the major networks, headlined boldly: “CHINA WILL BENEFIT: Duterte's P8.2T infra program may force PHL into ‘bondage’.”

Rappler rushed to interview Communist leader Jose Maria Sison, who remains in the Netherlands and has been classified as "person supporting terrorism" by the US since 2002. Sison claimed “Chinese loans might trap PH to give up West PH Sea.” Rappler used a PhD candidate to foster the tale of how the country “fell for China’s infamous debt trap.” And it portrays Corr as a "Xinjiang 'concentration camp' expert."

Rappler has been funded by the secretive US billionaire Pierre Omidyear who has cooperated with the State Department and the National Endowment for Democracy.

ABS-CBN News, another major news network, often releases Corr’s comments warning that the country “risks sovereignty with loans from China,” portrays him as a Covid lockdown expert,” and recently quoted his rants the Ukraine crisis will incite China “to tighten grip in Asia.”

ABS-CBN is owned by the Lopez family, a powerful Filipino dynasty.

Philippine Star released an op-ed suggesting that the Duterte government’s infrastructure building spree would “hock Philippines to China.” Federico D. Pascual Jr. quoted Corr in verbatim warning that “Duterte apologists” cannot dismiss the Forbes/Corr truths.

The Star's key owner is MediaQuest Holdings, Inc., an affiliate of telecom company PLDT, controlled by Hong Kong-based First Pacific; which, in turn, is chaired by Indonesian oligarch Anthoni Salim and headed by Manuel Pangilingan, a critic of Duterte and China, like his board member ex-foreign secretary Albert Del Rosario.

Subsequently, Rosario’s Stratbase ADR Institute released a research paper on the Chinese BRI globalization warning about “proposed Chinese investment in the Philippines.” To ADRi, Corr’s piece proved the point.

These outlets share a common denominator: they rely on foreign funding, or are owned by the Philippine 1% elite, or both. Oddly, their Corr promotion fosters a perception that journalistic integrity is not their primary goal.

Fatal fictions courtesy of economic hit men

Corr’s predictions have no predictive power. His activities are more reminiscent of those of “economic hit men”; that is, “highly paid professionals who cheat countries around the globe out of trillions of dollars,” as John Perkins once put it.

The real question is, why are such economic hitmen still used as “independent analysts” by some of the world’s most powerful international media?

And why do Philippine media owned by foreign interests and/or domestic oligarchs still promote Corr’s tales, knowing fully well that these fatal fictions are fake news?

Dr. Dan Steinbock is the founder of Difference Group and has served at the India, China and America Institute (US), Shanghai Institute for International Studies (China) and the EU Center (Singapore). For more, see http://www.differencegroup.net/

© 2022 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.