Why You Should Expect a Once-in-a-Lifetime Debt Crisis

Interest-Rates / Global Debt Crisis Oct 09, 2023 - 09:50 PM GMTBy: EWI

U.S. credit card debt surpasses $1 trillion

On a national level, a debt crisis occurs when a country is unable to pay back its government debt. This might result from government spending exceeding tax revenues for an extended period.

On an individual level, a crisis can result from too little income and too much debt -- that simple. This sometimes means defaulting on a car loan, for example, or even declaring bankruptcy.

Part 1 of the June Elliott Wave Theorist, a publication which covers major financial and cultural trends, said:

A debt crisis is brewing, and higher long term interest rates will add to the pressure.

Indeed, as Kiplinger noted on Aug. 18:

Credit Card Use Spikes for Cash-Strapped Consumers

Credit card use amps up as consumers reckon with inflation and higher interest rates; 39% of Americans living paycheck-to-paycheck, study shows.

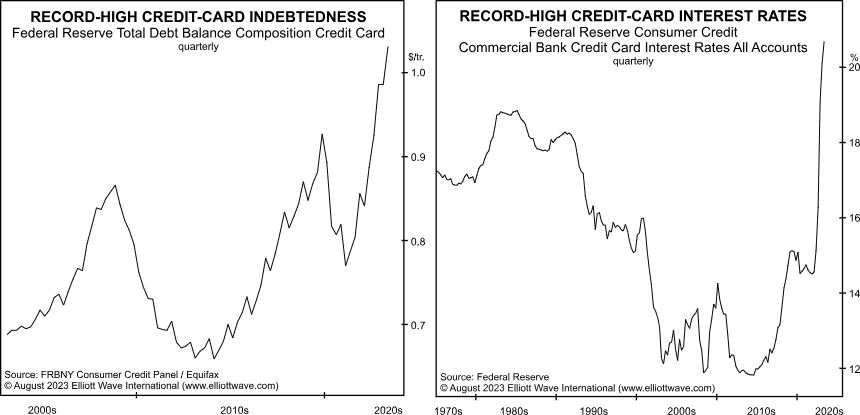

The August Elliott Wave Theorist had more to say about the looming debt crisis as it showed these side-by-side charts:

Excess savings US households built up during the pandemic are nearly gone. ...

At the same time, consumers are borrowing to stay alive, driving indebtedness to yet another milestone: Total credit card debt in the U.S. has just surpassed $1 trillion. Will consumers be able to pay it off?

They had better do it fast, because credit-card interest rates have just soared to a new all-time high above 20%!

And bond yields (and interest rates) continue to climb (Reuters, Sept. 21):

TREASURIES-Two-year yields hit 17-year highs ...

Elliott Wave International warned subscribers to prepare back in 2020 when interest rates were near zero.

Of course, a lot of people are wondering if rates are headed even higher.

Remember, it's the market which determines the direction of interest rates; the Fed merely follows.

A key way to keep tabs on widely traded financial markets is to employ the Elliott wave method.

If you'd like to delve into the details of Elliott wave analysis, read Frost & Prechter's book, Elliott Wave Principle: Key to Market Behavior. Here's a quote from this Wall Street classic:

"When you have eliminated the impossible, whatever remains, however improbable, must be the truth." Thus eloquently spoke Sherlock Holmes to his constant companion, Dr. Watson, in Arthur Conan Doyle's The Sign of Four. This advice is a capsule summary of what you need to know to be successful with Elliott. The best approach is deductive reasoning. By knowing what Elliott rules will not allow, you can deduce that whatever remains is the proper perspective, no matter how improbable it may seem otherwise. By applying all the rules of extensions, alternation, overlapping, channeling, volume and the rest, you have a much more formidable arsenal than you might imagine at first glance. Unfortunately for many, the approach requires thought and work and rarely provides a mechanical signal. However, this kind of thinking, basically an elimination process, squeezes the best out of what Elliott has to offer and besides, it's fun! We sincerely urge you to give it a try.

Club EWI members get free access to the entire online version of Elliott Wave Principle: Key to Market Behavior.

Club EWI is the world's largest Elliott wave educational community and is free to join. Besides the book, members also enjoy complimentary access to a wealth of other Elliott wave resources on investing and trading.

Get started now by following this link: Elliott Wave Principle: Key to Market Behavior -- free and instant access for Club EWI members.

This article was syndicated by Elliott Wave International and was originally published under the headline Why You Should Expect a Once-in-a-Lifetime Debt Crisis. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.