Economic Forecasts and Analysis For U.S. Financial Markets (Nov 3-7)

Economics / US Economy Nov 03, 2008 - 02:37 AM GMTBy: Joseph_Brusuelas

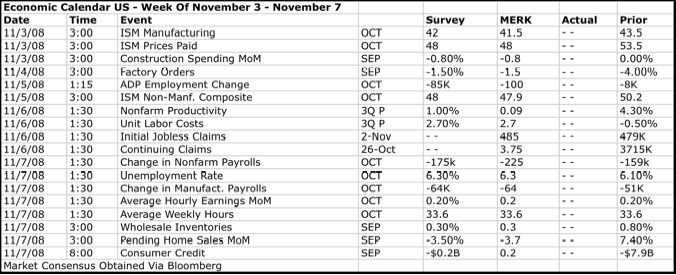

The first week of November will see another heavy week of data releases on the calendar that will feature the first significant look at the data from the real economy in October, when the credit markets seized up. The primary market-moving event will be the Friday publication of the October estimate of non-farm payrolls that we expect to contract by -225K. The week will kick off with the release of the October ISM survey of manufacturing conditions nationwide, total vehicle sales and the construction spending report for September.

The first week of November will see another heavy week of data releases on the calendar that will feature the first significant look at the data from the real economy in October, when the credit markets seized up. The primary market-moving event will be the Friday publication of the October estimate of non-farm payrolls that we expect to contract by -225K. The week will kick off with the release of the October ISM survey of manufacturing conditions nationwide, total vehicle sales and the construction spending report for September.

The following day will see the factory orders report for September published. Wednesday will see the ISM non-manufacturing survey released and Thursday will see the weekly jobless claims data and the Q3;08 non-farm productivity estimate announced. The week will conclude the release of pending home sales, consumer credit and wholesale inventories for September.

Fed Talk

Dallas Fed President Fisher will address the economic outlook on Tuesday, FOMC Governor Warsh will speak topic TBA on Thursday and the week will conclude with a glimpse into the economic outlook by Atlanta Fed President Lockhart on Friday.Domestic Vehicle Sales (October) Monday: Throughout Day

The initial estimate of Q3'08 GDP data implied that real personal disposable income contracted at a rate of -8.7%. This should provide another heavy dose of bad news for the auto industry, which as seen demand for its products severely diminished. Our forecast implies that domestic vehicle sales will increase by 9.1mln on an annual basis and that total vehicle sales will see a total of 12.0mln sold over that same time frame, with significant risk to the downside.

ISM Manufacturing (October) Monday 10:00 AM

Before credit markets seized up in October activity in the manufacturing sector was already well on its way towards signaling a national recession. The combination of the problems in the credit markets, the strike at Boeing and declining demand form the external sector should be sufficient to knock the headline estimate of national manufacturing activity to 41.5

Factory Orders (September) Tuesday 10:00 AM

The noticeable decline in industrial production on the back of falling demand from abroad and the strike at Boeing should be the primary catalyst behind what we think will be a -1.5% decline in factory orders for the month. Of interest, will be the forward looking indicator of growth inside the non-defense ex-aircraft category, which should provide a clear indication of an economy decelerating before the intensification of the credit crisis.

ISM Non-Manufacturing (October) Wednesday 10:00 AM

The service sector on the back of weak income and bleak job prospects among consumers, grew at an anemic rate of 0.6% according to the advance estimate of Q3'08 GDP. We expect that the service sector will continue to show signs of stress in October, when according to the latest consumer sentiment survey individuals have clear become quit bearish on the economy and their own individual economic situations. We expect the headline to fall to 47.9

Jobless Claims (Week Ending October 25) Thursday 08:30 AM

The week ending October 25 should start to pick up some of the recent reductions in the workforce and drive the headline higher back towards 485k. The return to work of workers in South Texas in the aftermath of Hurricane Ike will offset the ongoing culling of the workforce but that impact will continue to diminish and set the stage for a move above 500k on a continuing basis over the next few months.

Non-Farm Payrolls (October) Friday 08:30 AM

The October payrolls data should capture the pick-up of layoffs throughout the economy that have begun to build and will be a feature of the economic landscape over the next two years. The layoffs in the auto sector should be the primary catalyst for an increase in job destruction in the manufacturing sector, along with job losses in trade, retail, and financial and business services. The destruction of employment opportunities in the household estimate should send the unemployment rate up to 6.3% and the establishment estimate should show a loss of -225K.

Pending Home Sales (September) Friday 10:00 AM

Purchases of new and existing homes picked up during the traditional summer buying season on the back of favorable developments in the interest rate environment and further declines in the median price of homes. However, given the upcoming pending home sales report should see significant retrenchment due to funding problems due to the begging of problems in the credit markets and the visible increase in uncertainty over employment prospects for workers.

By Joseph Brusuelas

Chief Economist, VP Global Strategy of the Merk Hard Currency Fund

Bridging academic rigor and communications, Joe Brusuelas provides the Merk team with significant experience in advanced research and analysis of macro-economic factors, as well as in identifying how economic trends impact investors. As Chief Economist and Global Strategist, he is responsible for heading Merk research and analysis and communicating the Merk Perspective to the markets.

Mr. Brusuelas holds an M.A and a B.A. in Political Science from San Diego State and is a PhD candidate at the University of Southern California, Los Angeles.

Before joining Merk, Mr. Brusuelas was the chief US Economist at IDEAglobal in New York. Before that he spent 8 years in academia as a researcher and lecturer covering themes spanning macro- and microeconomics, money, banking and financial markets. In addition, he has worked at Citibank/Salomon Smith Barney, First Fidelity Bank and Great Western Investment Management.

© 2008 Merk Investments® LLC

The Merk Hard Currency Fund is managed by Merk Investments, an investment advisory firm that invests with discipline and long-term focus while adapting to changing environments. Axel Merk, president of Merk Investments, makes all investment decisions for the Merk Hard Currency Fund. Mr. Merk founded Merk Investments AG in Switzerland in 1994; in 2001, he relocated the business to the US where all investment advisory activities are conducted by Merk Investments LLC, a SEC-registered investment adviser.

Merk Investments has since pursued a macro-economic approach to investing, with substantial gold and hard currency exposure.

Merk Investments is making the Merk Hard Currency Fund available to retail investors to allow them to diversify their portfolios and, through the fund, invest in a basket of hard currencies.

Joseph Brusuelas Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.