Welcome to the AI AgeTech Stocks

Companies / AI Oct 28, 2023 - 12:15 AM GMTBy: Stephen_McBride

A lucky guy in California recently snagged the winning ticket for the $1.7 billion Powerball lottery.

A lucky guy in California recently snagged the winning ticket for the $1.7 billion Powerball lottery.

Overnight billionaire. That’s the dream, I guess.

Americans spend more on lottery tickets than sporting events… books… movie tickets… music… and video games combined. Wild!

Of course, the odds of winning the Powerball are 1 in 292 million.

A much surer way to get rich is investing in great businesses profiting from disruption.

You only need to invest in one Amazon (AMZN), Nvidia (NVDA), or Microsoft (MSFT)—stocks that have surged 50,000% or more—to change your life.

Finding one early on isn’t easy… but it’s certainly doable.

Here’s what’s happening…

- Did you fall for the “Tesla trap?”

Electric vehicle (EV) pioneer Tesla (TSLA) just announced lackluster earnings results.

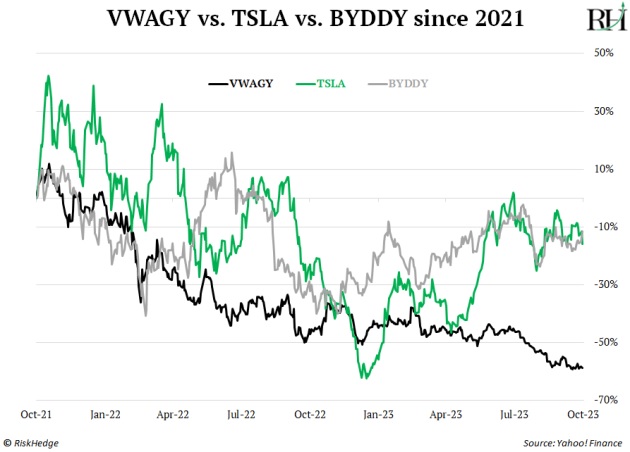

Tesla’s stock is down 40% over the past two years.

Herein lies the danger of investing in the EV revolution.

Sales of battery-powered cars more than doubled in the past two years. So buy the top EV makers to profit, right?

This strategy has been a disaster lately. Here’s how the top three EV stocks have fared:

Anyone can invest in fast-growing trends like EVs. But you must pair this with great businesses.

And unfortunately, there are no great EV businesses yet. Making battery-powered cars is cutthroat. Even Tesla makes less money on every car than it did five years ago!

This is why we only buy stocks that hit the “sweet spot.” Only great businesses profiting from megatrends qualify for our Disruption Investor portfolio.

There are backdoor winners to the EV megatrend. More on these opportunities soon.

- The world’s fourth-richest man breaks his silence.

Larry Ellison, founder of software giant Oracle (ORCL), announced on Twitter he’s funding “a new approach to clean nuclear energy.”

Guys, the nuclear renaissance I’ve been writing about is really picking up steam.

Imagine (friendly) aliens land on Earth tomorrow. They discover nuclear power plants that generate the cleanest, safest, most reliable energy known to man.

They’re told America has only built one new reactor in the past 40 years and instead burns dirty coal and gas to keep the lights on.

They’d think we’re a bunch of clowns!

The single-worst decision America made in the last 100 years was turning its back on nuclear energy. Thankfully, we’re righting those wrongs and reembracing nuclear.

Larry Ellison is in. So is Microsoft.

It just announced it plans to build a fleet of nuclear reactors to power its data centers.

I’ll say that one more time.

Microsoft’s data centers—which power artificial intelligence (AI) tools like ChatGPT—could soon run on clean, green, atomic energy.

Nuclear-powered AI superintelligence. Our future’s so bright, I gotta wear shades.

This renaissance will cause demand for the “fuel” powering nuclear plants—uranium—to spike. In fact, uranium prices are breaking out to 15-year highs as I type.

Uranium miners like Cameco (CCJ) are going higher—much higher.

- Is this the iPhone for the AI age?

Someone on Twitter uploaded a video of themselves learning to play the piano through Meta’s new Quest 3 headset.

You can now learn to play the piano (or any instrument) without taking expensive lessons… or even owning a piano!

Here’s what it looks like through the headset:

This is a total game-changer for wearable tech.

New devices catch fire only when they allow you to do something brand new. PC sales took off when the internet burst onto the scene. iPhone sales rocketed when killer apps like Instagram emerged.

AI is the “killer app” for wearables.

There’s no way we’ll interact with AI tools through a six-inch glass screen.

Instead, we’ll get piano lessons from our AI robo-tutor through wearable technology.

Meta’s Quest 3 isn’t AI’s “iPhone moment.” But it’s coming. Have you seen the speed at which wearable tech is improving?

It’s obvious a major breakthrough is approaching.

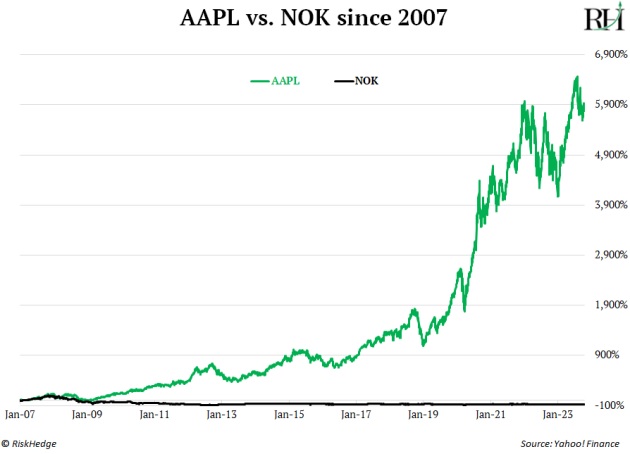

Like always, there will be new winners and losers. Look at Apple (AAPL) vs. Nokia (NOK) since the iPhone launched:

Three companies are vying to create the iPhone for the AI age:

- ChatGPT creator OpenAI is reportedly working with Apple’s former superstar designer, Jony Ive, to create a new AI device.

- Meta Platforms (META) leads the pack with its AI sunglasses and Quest 3 headset.

- Apple creates the world’s sleekest hardware, and you can’t count it out.

- Today’s dose of optimism…

I was teaching my daughter to ride her bike with a stabilizer (training wheel to Americans) yesterday.

At first, she fell over. She cried, sulked, and wanted to give up. There’s so much we must teach our kids (and grandkids). How to ride a bike, swim, read, and spell.

But first… they need to know this: Never give up.

After falling off the bike a few times, my daughter got the hang of it. Happy with her achievement, she turned and said, “We don’t quit.”

That’s right—we don’t quit. She does listen to me!

One incredibly proud dad here. Teach them early; teach them often.

Stephen McBride

Chief Analyst, RiskHedge

To get more ideas like this sent straight to your inbox every Monday, Wednesday, and Friday, make sure to sign up for The RiskHedge Report, a free investment letter focused on profiting from disruption.

Expect smart insights and analysis on the latest breakthrough technologies, the big stories the mainstream media isn't reporting on, and much more... including actionable recommendations.

Click here to sign up.

© 2023 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.