Sad Silver Price Lags Gold

Commodities / Gold & Silver 2023 Nov 03, 2023 - 09:27 PM GMTBy: Submissions

With the economic backdrop continuing to deteriorate, silver’s bull case has become increasingly fragile.

Ominous Signs Ahead

While silver has bounced off its recent lows, the white metal continues to underperform gold. And when volatile areas of the precious metals market showcase weakness (silver and mining stocks) it’s often an ominous sign for the entire sector.

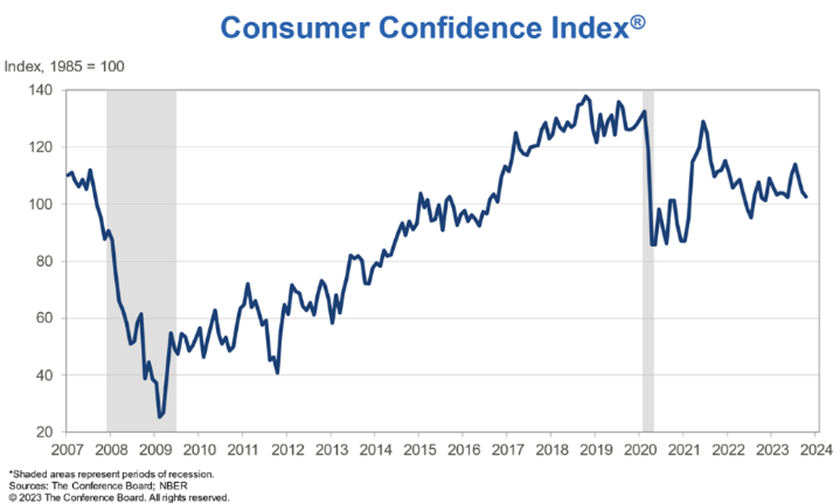

In addition, with recession winds likely to push silver off a cliff, lower interest rates are unlikely to help when the dust settles. For example, The Conference Board released its Consumer Confidence Index on Oct. 31. Dana Peterson, Chief Economist at The Conference Board, said:

“Consumer confidence fell again in October 2023, marking three consecutive months of decline. October’s retreat reflected pullbacks in both the Present Situation and Expectations Index. Write-in responses showed that consumers continued to be preoccupied with rising prices in general, and for grocery and gasoline prices in particular. Consumers also expressed concerns about the political situation and higher interest rates.”

Please see below:

To explain, the blue line’s pullback on the right side of the chart highlights how consumers are increasingly pessimistic about the economic outlook. And while we warned that higher long-term interest rates were much different than a higher FFR, it’s no coincidence the recent slide occurred alongside the rapid rise in Treasury yields.

In reality, higher long-term rates make consumers’ financing vehicles more expensive, and big-ticket items become unaffordable the longer the gambit persists. As a result, while gold remains the belle of the ball for now, it should mirror silver and mining stocks’ poor performances in the months ahead.

U.S. Growth Concerns

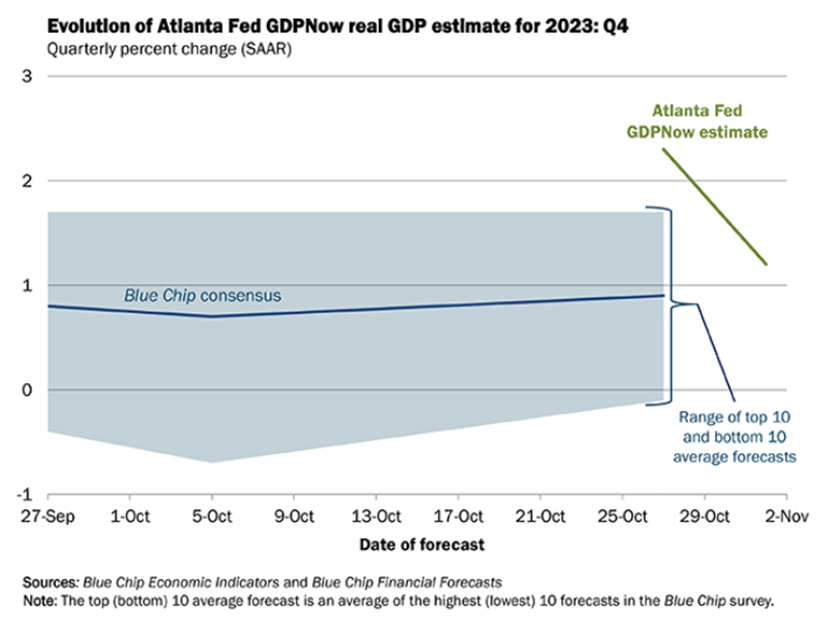

While we remain confident the Eurozone and Canada’s economic woes will eventually spread to the U.S., some scars emerged on Nov. 1. The Atlanta Fed cut its Q4 real GDP growth estimate from 2.3% to 1.2%, as recent data signals a much weaker outlook going forward.

Please see below:

To explain, the green line above tracks the Atlanta Fed’s Q4 real GDP growth estimate, while the blue line above tracks the Blue Chip (investment banks) consensus estimate. If you analyze the trajectory of the former, you can see a meaningful drop. And again, we’re not surprised the weakness occurred alongside higher long-term interest rates. Consequently, more pain should emerge as the Fed attempts to normalize the U.S. economy.

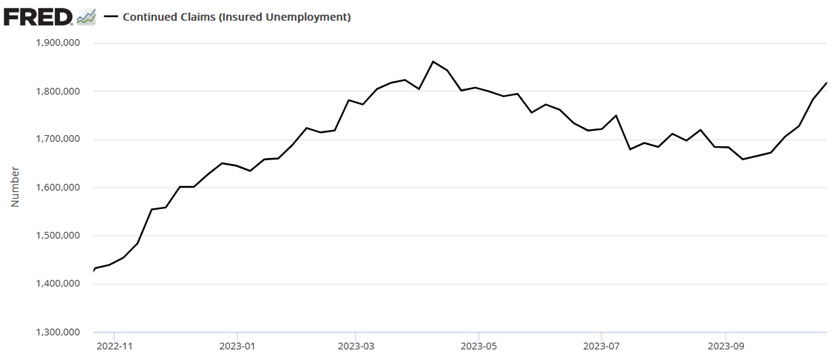

On top of that, continued jobless claims have risen for the last six weeks. For context, the metric tallies the number of Americans who file for unemployment more than once. The more this persists, the more trouble it spells for oil and the PMs.

Please see below:

To explain, while the metric had been in a downtrend since peaking in April 2023, the sharp spike on the right side of the chart has also occurred alongside higher long-term interest rates. Therefore, several metrics highlight the forming economic wounds, and the bearish trend should hurt consumer spending and the S&P 500.

Finally, the Dallas Fed released its Texas Manufacturing Outlook Survey on Oct. 30. The report stated:

“Labor market measures suggest slower employment growth and shorter workweeks in October. The employment index declined seven points to 6.7, a reading just below the series average of 7.9. Nineteen percent of firms noted net hiring, while 13 percent noted net layoffs. The hours worked index slipped back into negative territory, coming in at -2.3.”

So, while the crowd will celebrate the news as a soft landing in process, we see it more as a boom-and-bust cycle. During the pandemic, lawmakers overstimulated, and the U.S. economy roared much louder than expected.

But now, with higher long-term interest rates and quantitative tightening (QT) taking effect, the U.S. economy should cool much more than the consensus expects. As a result, several assets, including the PMs, should experience profound drawdowns before the next bull market arrives.

Overall, our fundamental thesis continues to unfold as expected. Inflation, a hawkish Fed, and higher interest rates helped boost the USD Index in 2021/2022. Next, a recession and heightened volatility should be the fundamental catalyst that pushes the dollar basket substantially higher in 2024. And if that occurs, the PMs are unlikely to sidestep the carnage.

To prepare for these likely events and much more, subscribe to our premium Gold Trading Alert. We’re on pace for our 12th-straight profitable trade, and our technical analysis has been extremely sharp. When analyzing the long-term health of various assets, the fundamentals are essential. However, the technicals are better for tactical trading, as they allow you to enter and exit with defined risk parameters. Consequently, joining our team can help you navigate the markets with much more clarity.

By Alex Demolitor

Alex Demolitor hails from Canada, and is a cross-asset strategist who has extensive macroeconomic experience. He has completed the Chartered Financial Analyst (CFA) program and specializes in predicting the fundamental events that will impact assets in the stock, commodity, bond, and FX markets. His analyses are published at GoldPriceForecast.com.

Disclaimer

All essays, research and information found above represent analyses and opinions of Alex Demolitor and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Alex Demolitor and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Alex Demolitor reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Alex Demolitor Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.