The Stock Market Trend and the Policy Behind it

Stock-Markets / Stock Market 2023 Nov 28, 2023 - 07:16 PM GMTBy: Gary_Tanashian

An excerpt from this week’s edition of Notes From the Rabbit Hole, NFTRH 785 on the state of the US stock market bubble as developed and sustained by another bubble (in policy-making)

NFTRH 785 started off with a lot of opinions (based on facts and indicators) before settling in to a more normal report covering key markets as usual. Meanwhile, the opening segment is more an unvarnished screed than actual market analysis, which is NFTRH’s normal mode and which we do reliably each week.

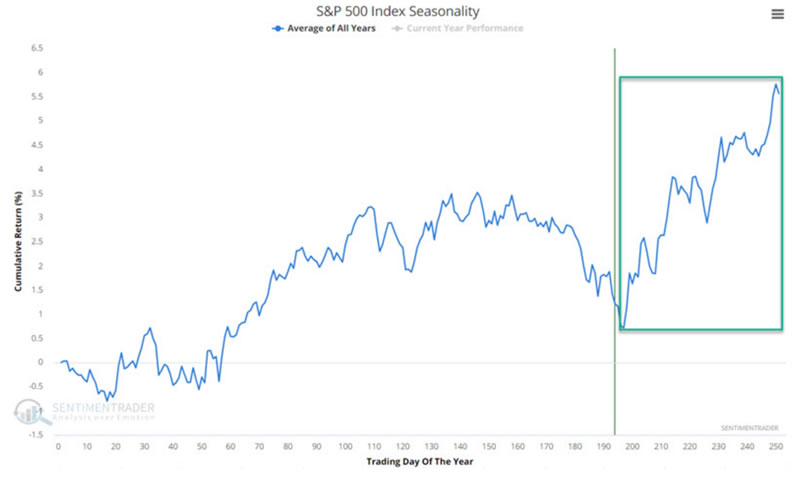

A reminder that on average, the seasonal pattern for SPX rises into year end, pulls back, ticks a new high early in the year, pulls back and then rallies into the ‘sell in May/June’ time frame. If only a seasonal average were a predictor. But it isn’t. It’s a historical average, a long-term bias, subject to failure in any given year.

But it is supportive of the idea that stock rally going on now, which a year ago I’d originally projected as a Q1-Q2, 2023 thing, could actually eat up the first half of 2024 before the bear begins. Due to this and other indicators not yet signaling imminent trouble (while our big picture macro indicators signal plenty of trouble), I’ve somewhat vaguely been labeling the projected end of the bull/start of the bear as sometime in H1, 2024. Not exactly a finely tuned target.

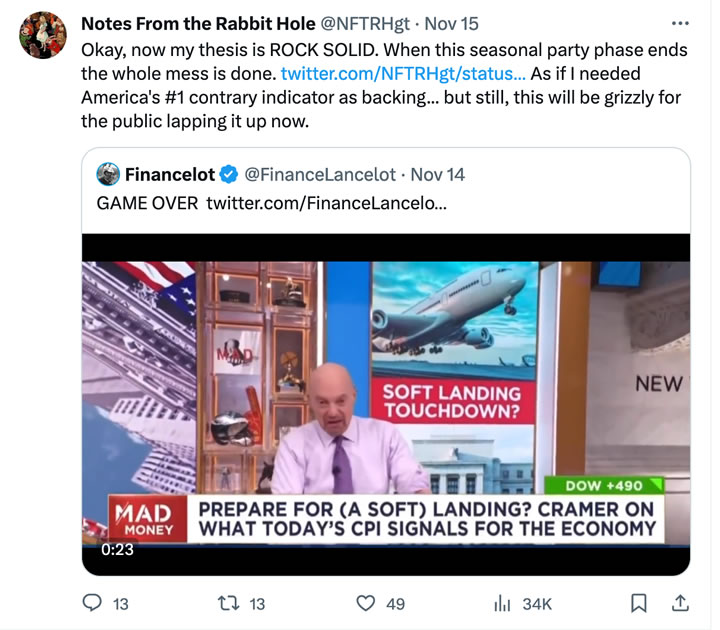

A lot will depend on how long the message of this contrary indicator holds sway. I believe Cramer on CNBC is a cartoon that regular people don’t think is a cartoon. Sort of like the old Kudlow cartoons they used to show on the same channel. Just biased, buffoonish and trend-following the headlines; CPI is soft, so of course that means a Goldilocks “soft landing”!

Well, just remember the paragraph above is written by someone who anticipated Goldilocks a year ago. Hence, right or wrong, I will reiterate the view that Goldilocks is likely to eventually morph into market liquidity problems and/or a deflationary problem.

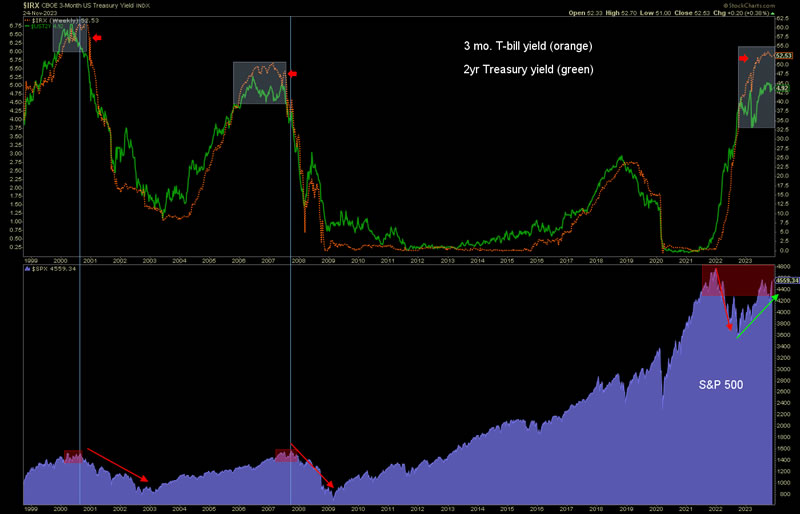

What we cannot control is the persistence of Goldilocks and touts like an economic “soft landing”. But this big picture macro chart is a ticking time bomb. The more I consider it, the more credence I give to the idea that when a major bubble bursts only a grand exit will do. A pictorial image of that concept would be the red shaded areas on SPX, where two small double tops preceded the last two semi-organic (unlike 2020) bear markets while the one developing now, will be a whopper when it plays out.

A double top can come at a lower or higher high to the previous, in this case all-time, high. The yield comp in the upper panel argues that this is not just a TA trying to guess that a double top is forming on SPX. It argues that something like that should be forming on SPX.

If this view is correct we’ll have a front row seat to an epic disaster in the making. The rally going on now is the FOMO (fear of missing out) that drags ’em back in and it will extend long enough to convince ’em that they should be back in because happy days are here again and James Cramer says “soft landing” while patting the heretofore hawkish Fed chief on the back.

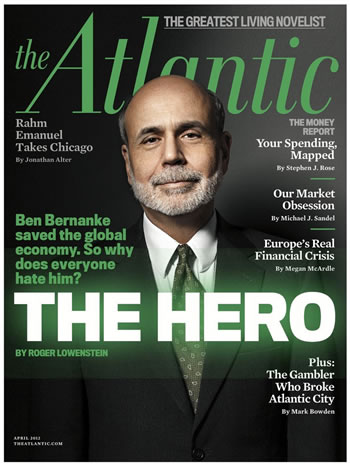

The Atlantic

In all the years I’ve heard the media tout soft landings, I’ve never actually seen one. What I have seen are liquidation events that were turning disastrous for bubble participants (which if we own a home or equities, are most of us) until this guy, his predecessor and those who followed him sprang into (inflationary) action, fighting the dreaded deflation monster heroically until victory – and bubble maintenance – were secured.

The problem is that this policy was not heroic on the big macro picture. Quite the contrary, this “victory” was destructive… of the middle and lower classes and by extension, society itself. This policy of micromanaging the markets and the economy through various means of money printing (inflation) and debt leverage has made the poor (pay-check to paycheck, at best) poorer and the rich (asset owner class) exponentially richer.

That may sound like a commie or a socialist (or just plain old Robin Hood), but what I actually am is a former manufacturing person who had to manage the economy from a nuts and bolts perspective, then fell down the rabbit hole of finance and found a pit of grift, lies, ignorance, mass herding and swindling on a large scale macro level.

The mechanics of this perverse macro came courtesy of our financial Maestros and heroes (monetary), along side both entrenched aisles of government (fiscal). In other words, they did all they could to inflate (at will) and sustain an economy and associated markets with policy that punished savers and sound risk management, and rewarded asset (paper and otherwise) owners and risk taking.

Despite that, the charter here is to manage the market as we see it. That means not trying to will the stock bull to end, but to (personally) play it and manage risk into its end, currently projected for H1. On the flip side of that coin, a real end of the bubble (in policymakers’ ability to ably remote-control markets and the economy) will, theoretically at least, boost the ANTI-bubble in the eyes of the herds that now listen to the likes of the cartoon character shown above along with other less obvious cartoons.

NFTRH 785 then went on to analyze and update the macro status of the ANTI-bubble, gold, and the precious metals sector along with global stock markets, currencies, commodities and in our current Summary segment, sentiment and macro indicators.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed interim market updates and NFTRH+ dynamic updates and chart/trade setup ideas. You can also keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter ;@NFTRHgt.

By Gary Tanashian

© 2023 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.