Why You Should Pay Attention to This Time-Tested Stock Market Indicator Now

Stock-Markets / Stock Markets 2024 May 08, 2024 - 08:45 PM GMTBy: EWI

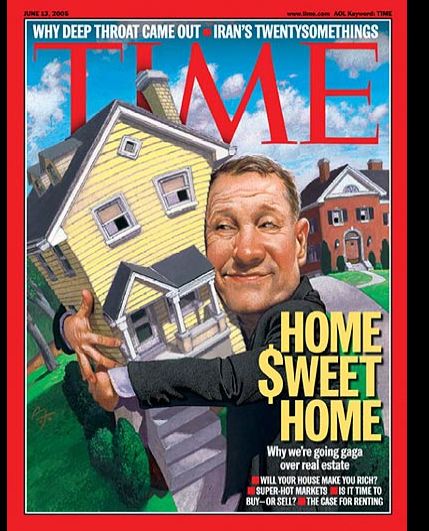

"How High Can Markets Go?" -- asks this magazine cover

Paul Montgomery's Magazine Cover Indicator postulates that by the time a financial asset makes it to the cover of a well-known news weekly, the existing trend has been going on for so long that it's getting close to a reversal.

A classic case in point is this Time magazine cover from June 13, 2005:

As you can see, it says, "Home $weet Home," followed by "Why we're going gaga over real estate."

Interestingly, this was published around the time that the S&P Supercomposite Homebuilding index was peaking. The housing bubble of that time was on the verge of bursting, and you'll likely remember that major crash.

Fast forward and here's what was shown on the March 2 -- 8, 2024 Economist cover:

As a large cluster of balloons carries a bull upward, it asks, "How High Can Markets Go?"

The March Elliott Wave Financial Forecast, a monthly publication which provides analysis of major U.S. financial markets, said:

It is a bearish signal for stocks. ... In the context of the multitude of other sentiment extremes ..., as well as a fully mature wave pattern, we think this cover is meaningful.

Just a few weeks after that was published, the Dow Industrials hit a high of 39,889 on March 21. The NASDAQ indexes also topped on that date.

As you probably know, the stock market has trended lower since. Only time will tell if the downward turn morphs into a major bear market.

Also know, from a technical analysis point of view, that the price pattern of the Dow Industrials is also sending a major message.

If you're unfamiliar with Elliott wave price patterns, read Frost & Prechter's Wall Street classic, Elliott Wave Principle: Key to Market Behavior. Here's a quote from the book:

Although it is the best forecasting tool in existence, the Wave Principle is not primarily a forecasting tool; it is a detailed description of how markets behave. Nevertheless, that description does impart an immense amount of knowledge about the market's position within the behavioral continuum and therefore about its probable ensuing path. The primary value of the Wave Principle is that it provides a context for market analysis. This context provides both a basis for disciplined thinking and a perspective on the market's general position and outlook. At times, its accuracy in identifying, and even anticipating, changes in direction is almost unbelievable.

Here's the good news: If you'd like to read the entire online version of Elliott Wave Principle: Key to Market Behavior," you can get complimentary access by following this link: Elliott Wave Principle: Key to Market Behavior.

This article was syndicated by Elliott Wave International and was originally published under the headline Why You Should Pay Attention to This Time-Tested Indicator Now. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.