Stock Markets Get Stimulated

Stock-Markets / Financial Markets Dec 09, 2008 - 07:28 AM GMTBy: PaddyPowerTrader

Equity markets continue to put a remarkably positive spin on last Friday's calamitous jobs numbers. Indeed since the low of 741 on November 22nd, the S&P 500 has rallied 22% . Does this then qualify as a bull market? Or merely the seasonal media friendly Santa Claus rally? And all this despite more layoffs from Dow Chemical, UBS and MMM and profit warnings from stocks as diverse as Texas Instruments, FEDEX and trucking company Con-Way.

Equity markets continue to put a remarkably positive spin on last Friday's calamitous jobs numbers. Indeed since the low of 741 on November 22nd, the S&P 500 has rallied 22% . Does this then qualify as a bull market? Or merely the seasonal media friendly Santa Claus rally? And all this despite more layoffs from Dow Chemical, UBS and MMM and profit warnings from stocks as diverse as Texas Instruments, FEDEX and trucking company Con-Way.

The buy side spin is that the numbers were a wake up call to officialdom. It also guarantees the mother of all fiscal stimulus packages post Xmas in the form of an unprecedented $500bn (3.5% of GDP) public works program. The theory is that the government will spend the monies directly rather than relying on the consumer (via tax cuts) who might have chosen to save instead.

Today's Market Moving Stories

- Japan's economy shrank 0.5% q-o-q in Q3 , more sharply than the government initially estimated, due to a contraction in business investment and large destocking. This continues the pattern of very weak Asian data. Might we see intervention to weaken the Yen sooner rather than later?

- The BRC (British Retail Consortium) reported a 2.6% decline in like for like sales last month. Excluding April 2005 this is the biggest fall since January 1995. Consultancy firm Verdict will release a report today warning that 2009 will be the worst year for the High Street since 1965. I wouldn't exactly be going long any household retail names on the back of all that doom and gloom as some of them may not make it to Xmas 2009. Added to this is the prediction from the RICS that the UK commercial property slump won't end until 2011.

- Chinese exports are on the slide . No wonder they are thinking of letting their currency go.

- Swiss bank Credit Suisse, in a new research piece, is predicting that the US will experience 8.1 million foreclosures by 2012. That represents 16% of the housing stock! Ouch.

- The UK Pension Protection Fund (PPF) has just released its latest PPF7800 Index. This shows the aggregate funding position of pension funds has deteriorated to a deficit of £136bn at the end of November, a widening in the deficit of £38.7bn over the past month. Only 1047 of the 7737 schemes in the survey were in surplus.

- In news of the pantomime that is set to run and run we learn that bailout nation is close(r) to rescuing Detroit (yawn). Joe the Plumber may end up owning a considerable chunk of two of the Big 3 at punitive rates.

- Sony is to cut 8k jobs, close plants and reduce investments as sales stall.

- The Irish government, who played their trump guarantee card foolishly without getting anything in return, seem finally to have copped it that the banks are all take and no give. Thay are now resisting demands to extend the bank guarantee . For more on the Irish banks predicament, check out What's Next For The Irish Banks .

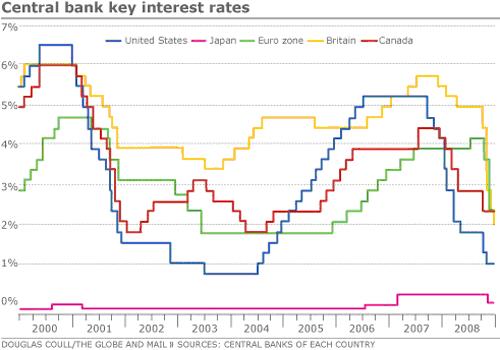

Who Will Win The Race To Zero And Then What?

The race to zero is on .

Data Today

The German ZEW survey will be the focus of the European morning. Market forecasters have generally not been negative enough when estimating survey data during the financial crisis and so there are downside risks to the consensus again. That said monetary and fiscal stimulus action over the past few weeks may brighten expectations.

In the UK, industrial production is likely to shrink 1% m-o-m in October, consistent with indications from the CBI industrial trend survey.

In the US, pending home sales data for October should mark a further sharp monthly contraction (2% m-o-m), continuing the negative news from the initial source of all our woes.

The global rate cutting frenzy will continue apace with the Bank of Canada loping another ½% from the current 2.25% base rate to 1.75%.

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2008 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.