The Aftermath of the OFTs Credit Card Fee Capping Continues…

Personal_Finance / Credit Cards & Scoring Apr 18, 2007 - 01:01 PM GMTBy: MoneyFacts

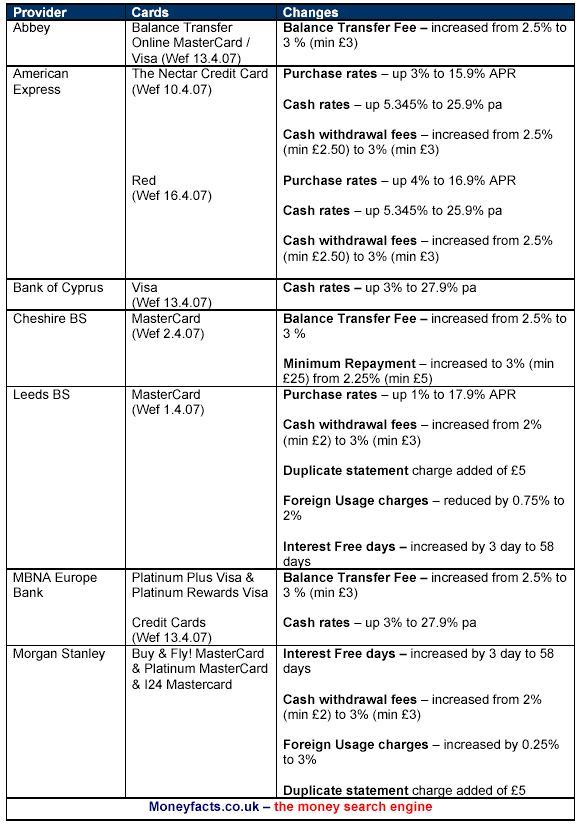

Michelle Slade, personal finance analyst at moneyfacts.co.uk – the money search engine, comments: “It’s now almost a year since the OFT capped credit card penalty fees at £12, but the repercussions are still rumbling on with little sign of letting up. In the last two weeks alone a further seven providers have increased rates or fees (see table below).

“While other factors, including levels of bad debts will have an impact, it cannot be disputed that the OFTs actions has spread the cost burden to a much wider customer base, with card providers continually seeking ways to recoup this lost revenue.

“And its not just rates which are increasing; balance transfer charges, cash withdrawal and foreign usage fees are rising, and card providers are introducing service charges, for example duplicate statements or tracking of address charges.

“Card providers are also making changes to their card terms, for example increasing interest free days. While this may sound great for the consumer who pays their balance in full each month, for anyone carrying over a balance, the credit card company gains interest revenue from these extra days.

“Here just some of tactics card providers have used:

• Increasing purchase interest rates

• Increasing cash withdrawal interest rates

• Raising balance transfer fees

• Raising cash withdrawal fees

• Raising foreign usage fees

• Introducing duplicate statement fees

• Introducing low usage charges

• Introducing monthly fees

• Introducing address tracking charges

• Decreasing the number of interest free days

• Amending the order of repayments

“Perhaps the OFT has realised the consequences of its actions, and may be the reason why it is not taking such a knee jerk reaction with the current account market.

“With these abundance of credit card changes afoot, it is even more important that you review your card regularly to ensure you are getting the best possible deal. And when your provider sends through revised terms and conditions, however tiresome it may be, take the time to read the changes being made, as there is a good chance that it could result in your card costing you more.

By Michelle Slade,

http://www.Moneyfacts.co.uk

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.