Currency Crisis: First Sterling, Now the Euro, and Then...?

Commodities / Gold & Silver 2009 Feb 05, 2009 - 12:01 PM GMTBy: Adrian_Ash

How to get a jump on the big central banks as interest rates race towards zero worldwide...

How to get a jump on the big central banks as interest rates race towards zero worldwide...

OF SIX CENTRAL BANKS voting on interest rates this week, only the European Central Bank in Frankfurt failed to reduce its cost of money to either record or multi-year lows, holding rates steady at 2.0%.

- The market's reaction? Forex traders trashed the Euro vs. those currencies now paying way less than inflation...

- The result for Eurozone investors? Gold leapt to a new record high by the PM Gold Fix in London, recording a new all-time high above €719 an ounce...

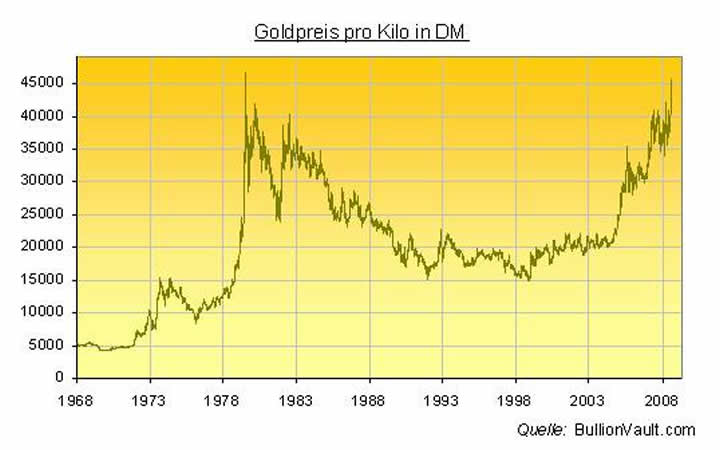

- Big picture? That puts the Gold Price right back at its long-term high for European cash savers, as measured by the old pre-Euro war-horse, the lost and lamented German Deutsche Mark...

Gold in 2009 has already hit new record highs for Australian, Canadian, Indian and even Swiss gold buyers.

British gold buyers saw the price surge to £662 an ounce in January – up by 100% from just 18 months earlier. Because as the UK Pound Sterling slid on the forex market, gold proved itself as the ultimate hedge amid a currency crisis.

Now the Euro looks ripe for coming under "speculative attack" from currency traders trying to get even. The Dollar-Yen shock starting in summer 2008 whacked pretty much all asset classes. But the biggest losers by far were those currency gamblers still backing the favorites – those fillies sporting the best rates of return – as the going switched from 'good' to 'heavy'.

During the previous half-decade, the interest-rate gap had paid time and again. Sell the Dollar – and dump the Yen! – in exchange for anything bearing a strong or rising interest rate payment. But the bottom fell out of this strategy in mid-2008. Racing first to the bottom, the Japanese Yen ( zero-hour: May 2001) was then first out of the blocks when debt needed redemption, and currency gamblers all scrambled to cover their shorts. Close on its tail came the almighty Dollar ( zero-hour: Dec. 2008)...and thus a new form-guide emerged amongst currency traders.

Low yield good, zero yield better. Because in a world of deflation, destroying savers and cutting debt-service costs might just help spark an economic recovery.

That's why, when early in Prague today the Czech central bank slashed its interest rates to an all-time low, the Czech Koruna actually bounced vs. the Euro...

That's why today's 100-basis point cut to South African rates worked to stem the slide in the Rand – now trading one-third below its US-Dollar value of last February despite paying fully 1,050 basis points more...

That's why, midday here in London, the Bank of England took its base rate further into record-low territory at 1.0%...yet currency traders pushed the Pound Sterling to a two-week high above $1.4650...

That's why on Tuesday, when the Reserve Bank of Australia cut its interest rate to a 45-year low, the Aussie Dollar bounced from near-6 year lows in response...

That's why on Wednesday, after the central bank of Norway cut its target interest rate by 50 basis points to 2.50%, the Norwegian Krone turned higher after losing one-third of its value vs. the Dollar since July last year...

And that's also why, on Thursday – when the world's No.2 behind the Fed, the European Central Bank (ECB), opted to keep its rates flat – the Euro lost 2¢ from this week's high to trade below $1.2850...despite paying returns to cash fully 200 basis points above the Dollar.

Priced in Euros, the value of gold – which yields nothing already, but also carries no counter-party or inflation risk – rose to €720 an ounce, more than 14% higher for 2009 to date.

In short, Thursday's foreign exchange action confirms the currency markets' perverse verdict on falling premiums. First seen last year as the US Fed and Bank of Japan cut their rates to zero and their currencies leapt, this deflation-bent view of lower interest rates says that rewarding savers – rather than debtors – is beneficial to a currency's future. Whereas failing to cut is a negative.

So if we were in the business here at BullionVault of making short-term calls on the currency markets ( which we're not; we just enable private individuals to buy and sell gold, securely, at the tightest possible prices ), we'd expect the Euro to suffer right up until the ECB next meets in March....or until currency traders start taking ECB chief Jean-Claude Trichet at his word and begin pricing in record-low Eurozone rates ahead.

"I don't exclude that we could reduce interest rates at our next decision," Trichet told a new conference after today's "No change" decision.

Asked whether he'll go for a half- or quarter-point cut, M.Trichet replied "It would probably more be the first figure."

You tell 'em Jean-Claude...and you tell 'em straight!

But once the Euro starts paying "probably more" like zero than anything better, what next for the currency markets to kick around? The Yen...? The Dollar...? Everything and everyone all at once...?

In this race to the bottom – which even the "inflation-vigilant" European Bank now says it will join – private investors with something to lose might want to get a jump on the currencies, and move straight into zero-yielding Gold Bullion .

After all, gold has already proven its value as a "currency crisis" defense for UK investors this year. And if all currencies tipped into crisis together, we'd guess that defense would soon trade sharply higher from here.

By Adrian Ash

BullionVault.com

Gold price chart, no delay | Free Report: 5 Myths of the Gold Market

City correspondent for The Daily Reckoning in London and a regular contributor to MoneyWeek magazine, Adrian Ash is the editor of Gold News and head of research at www.BullionVault.com , giving you direct access to investment gold, vaulted in Zurich , on $3 spreads and 0.8% dealing fees.

(c) BullionVault 2009

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

Adrian Ash Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.