Consumer Demand For Everything Crashes: Trade Deficit At 6 Year Low

Economics / Recession 2008 - 2010 Mar 13, 2009 - 12:34 PM GMTBy: Mike_Shedlock

Many were of the belief that the trade deficit would widen as the US recession strengthened. The only way that could have happened is if oil prices stayed stubbornly high. While the price of oil may have bottomed, odds of it shooting up towards $100 again in the near future are slim.

Many were of the belief that the trade deficit would widen as the US recession strengthened. The only way that could have happened is if oil prices stayed stubbornly high. While the price of oil may have bottomed, odds of it shooting up towards $100 again in the near future are slim.

However it's is not just demand for (and price of) oil that has collapsed, the demand for everything has collapsed. Please consider U.S. Trade Gap Narrows to Smallest in 6 Years on Oil .

The U.S. trade deficit narrowed in January to the lowest level in six years on tumbling American demand for everything from OPEC oil to Japanese automobiles.

Imports fell faster than exports, shrinking the gap by 9.7 percent to $36 billion, the Commerce Department said today in Washington. Excluding petroleum, the deficit was little changed at $21.3 billion.

The credit crunch gripping the financial system is causing demand throughout the world to slump as consumers and businesses pull back. What's shaping up to be the biggest plunge in global trade in 80 years is adding to pressure on the Obama administration to rework international agreements and include protections for U.S. workers and the environment.

Imports slumped 6.7 percent to $160.9 billion, the fewest since March 2005, paced by a $4.3 billion plunge in purchases of crude oil. Demand for foreign automobiles dropped by $3.3 billion.

The deficit with OPEC dropped to $3.9 billion, the smallest since November 2003, and the gap with Japan shrank to the lowest level since January 1998, as U.S. imports fell to an almost 16- year low.

U.S. gross domestic product is forecast to contract again this quarter after shrinking at a 6.2 percent annual pace from October to December, the most since 1982. A collapse in U.S. exports led to a widening in the trade gap that subtracted a half percentage point from growth last quarter.

The trade gap with Canada, the U.S.'s biggest trading partner, narrowed to the lowest level since May 1999, and the deficit with Mexico was the smallest since January 2002. The shortfall with the European Union was cut in half from $7 billion in December to $3.5 billion the following month.

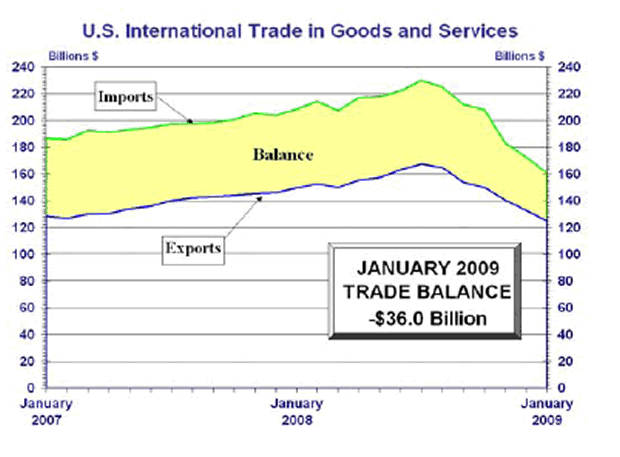

U.S. International Trade In Goods And Services January 2009

Inquiring minds are investigating the official press release: U.S. International Trade In Goods And Services January 2009 .

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that total January exports of $124.9 billion

and imports of $160.9 billion resulted in a goods and services deficit of $36.0 billion, down from $39.9 billion in December, revised. January exports were $7.6 billion less than December exports of $132.5 billion. January imports were $11.5 billion less than December imports of $172.4 billion.

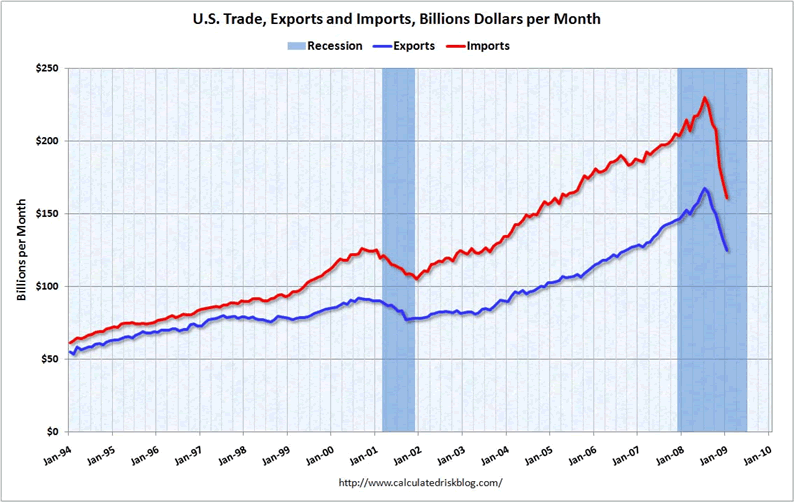

Those looking for detailed data can find table in the above release. Calculated Risk has a couple of interesting charts in his January Export Import Report .

Here is one of Calculated Risk's charts.

For Sale: Everything Including The Kitchen Sink

Here is a humorous anecdote from a Craigslist San Diego Listing that represents one person's demand for stuff.

Date: 2009-03-07, 7:37AM PST

HI EVERYONE! THE "EVERYTHING MUST BE SOLD" SALE IS BEING PUSHED BACK AND WILL NOT START UNTIL 10:00 DUE TO A VERY OVERWHELMING RESPONSE!!!!!!!!! WE CANNOT HAVE 50 PEOPLE AT OUR DOOR AT 8 AM SO PLEASE DO NOT COME UNTIL 10 THANKS. BUT WE WILL BE THERE TILL 6, IF THAT HELPS :)

MARBLE COUNTERTOPS (YOU REMOVE)

HOUSEWARE/DECOR

PICTURES

MIRRORS

NON-WORKING APPLE IPOD

WORKING APPLE IPOD CHARGER

COACH AND DOONEY PURSES

SIRIUS SPEAKERS

PRINTERS

FAXES

COPIERS

WINE REFRIGERATOR

CLOCKS

CANDLES

MONITORS/COMPUTERS

SINKS (YOU REMOVE)

SHUTTERS (YOU REMOVE)

TOP OF THE LINE DOORS AND MAILBOX AND FLAGPOLE (YOU REMOVE)

PLANTS/FLOWERS (YOU DIG)

PLANTERS

PALM TREES, LARGE MEDIUM AND SMALL (YOU REMOVE)

MARBLE

OUTSIDE SHOWER

TABLES

COUCHES

BRICKS (U HAUL)

FREE SAND

PALAPA BAR WITH SINK, FRIDGE AND KEGERATOR

LEATHER OFFICE CHAIRS

OFFICE STORAGE SPACE

GARAGE CABINETS

RUGS

ARTIFICIAL PLANTS

PURE SILVER BELT

POWER TRANSFORMERS OUTSIDE LIGHTS 900 AMP

2 BBQ SETS ( ONE HAS TO BE REMOVED FROM TILE)

OUTDOOR ICEMAKER

OUTDOOR SINK (YOU REMOVE FROM TILE)

FIRE PITS

BEACH CHAIRS

POLK AUDIO SPEAKERS

2 STORAGE SHEDS

2 TORO LAWN MOVERS

1 PUTTING GREEN MOWER

PIONEER TV COMPLETE WITH BOSE SUROUND-SOUND SPEAKERS

DINNETE SET

LEATHER CHAIR

CABINETRY ( YOU REMOVE)

TONS OF ELECTRONICS

WHIRLPOOL ELITE WASHER AND DRYER SET

POOL TABLE

QUEEN SIZED BEDROOM SET

You often hear the advertising expression " Everything must go ". That person clearly means it.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.