Stocks Rise on G20 and FASB Hopes, Can Pigs Really Fly?

Stock-Markets / Market Manipulation Apr 30, 2009 - 09:30 AM GMTBy: Rob_Kirby

The Fed / Treasury first announced that banks would be subject to stress tests back on Feb. 10, 2009. This WSJ account is the earliest mention we’ve been able to find:

The Fed / Treasury first announced that banks would be subject to stress tests back on Feb. 10, 2009. This WSJ account is the earliest mention we’ve been able to find:

FEBRUARY 10, 2009

Banks to Get Stress Test Before Aid

As Part of Revamped Bailout, Cash Will Go to Those Deemed Healthy Enough to Lend

By DEBORAH SOLOMON and DAMIAN PALETTA

WASHINGTON -- Many U.S. banks will be subjected to rigorous examinations to see if they are healthy enough to lend before receiving additional financial aid, according to people familiar with the matter.

The stress tests will be part of the bailout revamp to be announced Tuesday by Treasury Secretary Timothy Geithner. In addition to fresh capital injections into banks, the new approach will include programs to help struggling homeowners; a significant expansion of a Federal Reserve program designed to jump-start consumer lending; and a private-public partnership to relieve banks of bad assets……

So…. as of the date of the article above – WHEN STRESS TESTS WERE CLEARLY PLANNED and ANTICIPATED – FASB [Financial Accounting Standards Board] rules CLEARLY stipulated that mark-to-market accounting was the measuring stick for prudently gauging the true financial health of any banking institution.

Benedict Benny’s Ballsy Bait & Switch

Something happened to the methodology for how stress tests would be conducted on the way to the recent G20 Central Banker confab, as this Reuters article dated April 2, 2009 reveals;

US STOCKS-Wall St climbs on G20, FASB hopes

Thu Apr 2, 2009 10:23am EDT

By Chuck Mikolajczak

NEW YORK, April 2 (Reuters) - U.S. stocks rose for a third straight session on Thursday on optimism the G20 meeting in London will agree on ways to temper the economic crisis and that new U.S. accounting guidance will favor banks.

World leaders will triple the war chest of the IMF to fight the worst economic crisis since the 1930's and impose curbs on financial markets, monetary sources at the G20 summit said. For details see [ID:nL1230573].

In the United States, the Financial Accounting Standards Board said new mark-to-market accounting guidance will be effective for the second quarter, with early application allowed for the first quarter, and not be retroactive.…

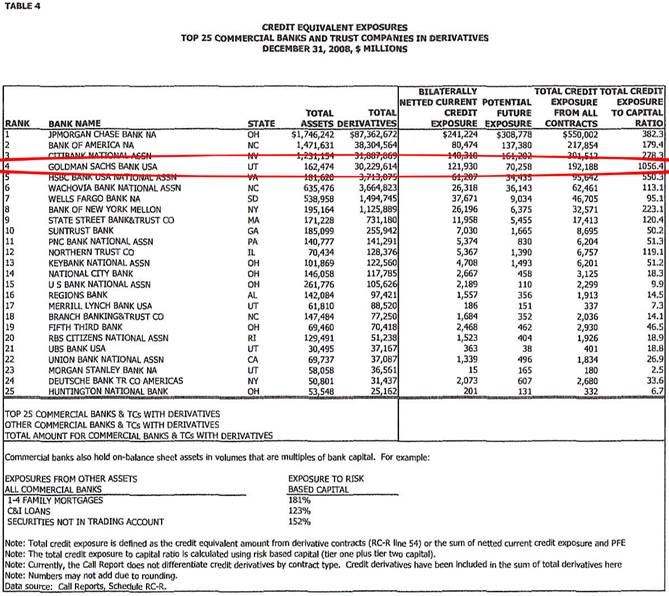

We can only surmise that the TRUE reason for this accounting chicanery is to obfuscate the true condition of institutions such as Goldman Sachs – which recently, for the first time – was subject to minimal transparency requirements when, as a bank for the first time, they were required to report to the Office of the Comptroller of the Currency [OCC] and their financials were subject to the OCC’s Q4/08 Quarterly Derivatives Reporting:

Ladies and gentlemen, the Total Credit Exposure to Capital ratio is one of the most telling capital adequacy ratios known to man. If ever there was a failing grade on a “stress test” – HERE IT IS IN SPADES!!! The aforementioned measure of capital adequacy, [1,056.4] in Goldman’s case, is so TOXIC – in fact; one can only wonder if regulators might have required radiation suits and Geiger Counters to safely measure the TOXICITY of Goldman’s books. Goldman’s figures stand out almost 5 times worse than those of Citibank and Bank of America and 11 times those of Wells Fargo.

Of course, with the discarding of real accounting standards in the United States, the true extent of this toxicity will now conveniently be obfuscated from the general public in further OCC reports,

“..new mark-to-market accounting guidance will be effective for the second quarter, with early application allowed for the first quarter, and not be retroactive.

Not retroactive????? “Effective for the second quarter, with early application allowed for the first quarter??????” Who are these CLOWNS trying to kid? From this time forward, this shall no doubt become known as “the Goldman Clause”.

It’s hard to believe that the Chairman of the Federal Reserve would be involved in such a low-down-good-for-nothing traitorous act, ehhh? Then we’re sure it will be even more difficult for the commoners to wrap their heads around this treasonous tid-bit:

According to testimony from the Bank of America CEO's February sit down with Andrew Cuomo, Lewis was "urged to keep quiet while the two sides negotiated government funding to help BofA absorb Merrill and its huge losses," apparently for the good of the financial system and the country, and since he *is* head of America's Bank, [Lewis] felt urged to comply (plus the bit about harm to his body if he failed to do so).

Q: Were you instructed not to tell your shareholders what the transaction was going to be?

A: I was instructed that 'We do not want a public disclosure.'

Q: Who said that to you?

A: [Hank the Hammer] Paulson...

Q: Had it been up to you would you [have] made the disclosure?

A: It wasn't up to me.

Q: Had it been up to you.

A: It wasn't.

Oh, and there was also the matter of Paulson threatening to take Lewis out (of office) if he didn't do exactly as he was told.

During his testimony, Mr. Lewis described a conversation with Mr. Paulson in which the Treasury secretary made it clear that Mr. Lewis's own job was at stake. Mr. Lewis still was considering invoking his legal right to terminate the Merrill deal. Mr. Paulson was out on a bike ride when Mr. Lewis phoned to discuss the matter, according to the transcript.

"I can't recall if he said, 'We would remove the board and management if you called it [off]' or if he said 'we would do it if you intended to.' I don't remember which one it was," Mr. Lewis said. "I said, 'Hank, let's de-escalate this for a while. Let me talk to our board.' "

In a follow-up interview by Mr. Cuomo, conducted with Mr. Paulson’s office, this account of Cuomo's interview was reported by Tom LIndmark at Seeking Alpha,

“In an interview with this Office, Secretary Paulson largely corroborated Lewis’s account……”

“Secretary Paulson has informed us that he made the threat at the request of Chairman Bernanke. After the threat, the conversation between Secretary Paulson and Lewis turned to receiving additional government assistance in light of the staggering Merrill Lynch losses……..”

These Cads Have Other Dirty Tricks….

Now admittedly, Sir Benedict of Bernanke was not the “lone shooter” sitting all-by-his-lonesome on the sixth floor of the Book Depository in Dealey Plaza – he had help. Rumor has it that none other than Tiny Turbo-Tax Timmy Geithner was spotted on the grassy knoll, armed with the only known copy of “The Crown Jewel” which was reported “swiped” from the Book Depository [or Fortus Knoxus, perhaps?] later on that evening;

You see folks; a rising gold price historically acts a canary-in-the-coal-mine – alerting all that things are “not right” in the monetary system. Additionally, gold has historically served as the-go-to flight to quality / wealth preservation trade. In the current environment, the powers that be desperately need U.S. Bonds to serve that function. This is why gold has been auspiciously stifled [murdered] so many times at the EXACT moments of U.S. Dollar and Bond negative news. The current Obama Administration is being “coached” by none other than Paul Volcker, who is clearly and factually on the record regarding the rising gold price circa 1980 – [excerpted from Volcker’s memoirs published in The Nikkei Weekly, November 15, 2004];

“That day, the U.S. announced that the dollar would be devalued by 10%. By switching the yen to a floating exchange rate, the Japanese currency appreciated, and a sufficient realignment in exchange rates was realized. Joint intervention in gold sales to prevent a steep rise in the price of gold, however, was not undertaken. That was a mistake.”

Fool me once, shame on you. Fool me twice………

Maybe pigs really can fly?

By Rob Kirby

http://www.kirbyanalytics.com/

Subscribers to Kirbyanalytics are learners, educating themselves; not only about the merits of ownership of gold and precious metals - but valuable know-how on the merits of different forms of ownership as well as tips and guidance on the acquisition of physical precious metal. In the members only section you'll find other subscriber only articles and the balance of this article with sections titled, Physical Bullion Buyers Guide, More on Madoff and Is War in the Cards?

Copyright © 2009 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.