More Stock Market Headwinds to Worry About

Stock-Markets / Stock Index Trading May 12, 2009 - 09:22 AM GMTBy: Guy_Lerner

On the way into the office this morning, I was listening to CNBC radio on Sirius Satellite. In that 7 minute drive, I think I heard the word "inflation" about 15 times. With year over year CPI virtually at zero, I am not sure what the worry is all about. This is the reality. Inflation is low.

On the way into the office this morning, I was listening to CNBC radio on Sirius Satellite. In that 7 minute drive, I think I heard the word "inflation" about 15 times. With year over year CPI virtually at zero, I am not sure what the worry is all about. This is the reality. Inflation is low.

On the other hand, with world central bankers making the cost of capital almost nil and their willingness to do "whatever it takes" to break the global slump and revive growth, the perception is that inflation is lurking around the next corner. If we can borrow the thinking of stock bulls, maybe we can say that inflation is so low that the only way it can go is up! It's a second derivative kind of thing.

All nonsense of course. But when it comes to the markets, perception always trumps reality.

However, what is worrisome from an equity perspective are the current trends in crude oil, gold, and 10 year Treasury yields. The prices in these assets are rising and gaining momentum, and this is a headwind for equities. So let's look at some data.

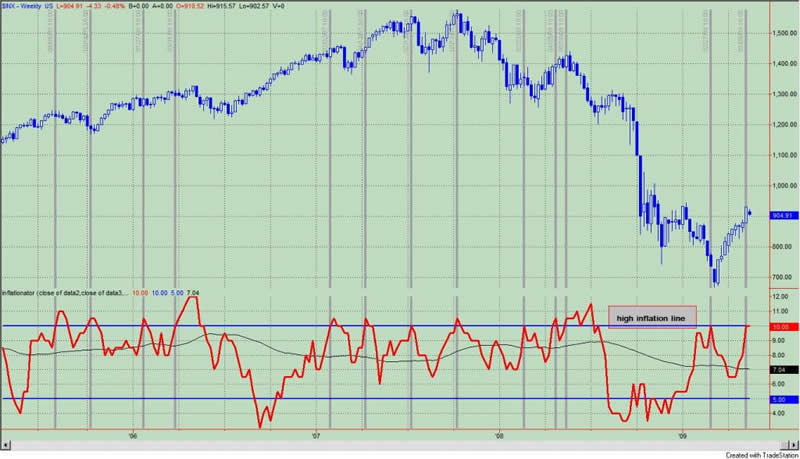

Figure 1 is a weekly chart of the S&P500 and the indicator in the lower panel is a composite indicator that assesses the strength of the trends in crude oil, gold, and 10 year Treasury yields. When the indicator is above the upper line (i.e., inflationary pressure line) that means that these trends are strong and inflationary pressures (real or perceived) are rising.

Figure 1. S&P500 v. Inflationary Pressures/ weekly

The question becomes: how do these inflationary pressures affect equities? So let's construct a study where we "short" the S&P500 during the time the indicator is at or above the high inflation line. The position is covered when the indicator drops below this line.

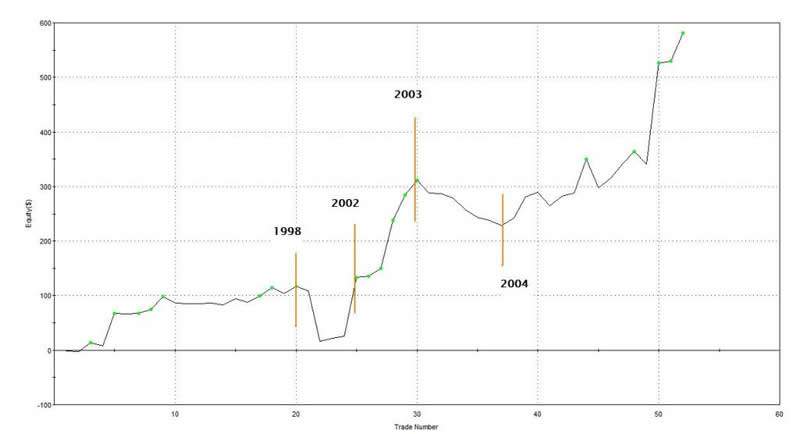

Since 1985, such a strategy has yielded 581 S&P500 points. There were 52 trades and 60% were profitable. The time spent in the market to get these 581 S&P500 points was an incredible 12%. Remember, this is a strategy that shorted the S&P500 through a bull market. Buy and hold S&P500 resulted in 736 S&P500 points. The equity curve for the strategy is shown in figure 2.

Figure 2. Equity Curve

I have tagged the equity curve with some dates, and in this age of asset bubbles, rising inflationary pressures (as measured by strong trends in crude oil, gold, and 10 year Treasury yields) is another headwind for equities. Note the rise in the equity curve since 2004. Whether inflationary pressures truly exist or not is another matter. The perception is that inflation does matter, and a stock market that has been pumped up on steroids (i.e., liquidity) will likely remain vulnerable to this dynamic for the foreseeable future.

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2009 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.