Challenges and Implications for Energy Sector Investing

Commodities / Energy Resources May 14, 2009 - 03:12 PM GMTBy: Joseph_Dancy

The U.S. Department of Defense published a report late last year that provides a global perspective on future trends and the implications for future joint force commanders, leaders, and professionals involved in national security issues. The report, entitled “The Joint Operating Environment: Challenges and Implications” focuses on long term global trends.

The U.S. Department of Defense published a report late last year that provides a global perspective on future trends and the implications for future joint force commanders, leaders, and professionals involved in national security issues. The report, entitled “The Joint Operating Environment: Challenges and Implications” focuses on long term global trends.

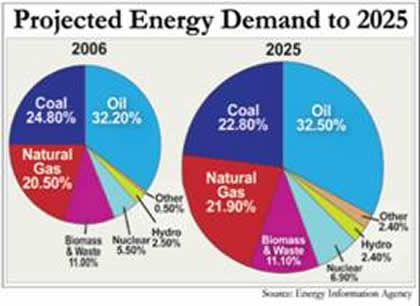

The report had a separate section dealing with global challenges in the energy sector. “Trends Influencing the World’s Security” included an interesting and sobering summary of the energy sector: “To generate the energy required worldwide by the 2030s would require us to find an additional 1.4 million barrels per day every year until then. During the next twenty-five years, coal, oil, and natural gas will remain indispensable to meet energy requirements.

The report had a separate section dealing with global challenges in the energy sector. “Trends Influencing the World’s Security” included an interesting and sobering summary of the energy sector: “To generate the energy required worldwide by the 2030s would require us to find an additional 1.4 million barrels per day every year until then. During the next twenty-five years, coal, oil, and natural gas will remain indispensable to meet energy requirements.

The discovery rate for new petroleum and gas fields over the past two decades (with the possible exception of Brazil) provides little reason for optimism future efforts will find major new fields. . . . By 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 MBD.

To avoid a disastrous energy crunch, together with the economic consequences that would make even modest growth unlikely, the developed world needs to invest heavily in oil production.

There appears to be little propensity to consider such investments. Although as oil prices increase, market forces will inexorably create incentives. But the present lack of investment in this area has created major shortages in infrastructure (oil rigs, drilling platforms, etc.) necessary for major increases in exploration and production.” [emphasis supplied]

The report also included an estimate of global economic growth rates over the next two decades, the results of which are set out at right. The relevant fact to note is two of the areas expected to grow the quickest – China and India – also have economies that are not as energy efficient as the developed world.

The report also included an estimate of global economic growth rates over the next two decades, the results of which are set out at right. The relevant fact to note is two of the areas expected to grow the quickest – China and India – also have economies that are not as energy efficient as the developed world.

As the emerging Asian economies grow they will need substantial incremental amounts of energy to fuel that growth – mainly provided by crude oil, coal, and natural gas according to the report (see chart at right).

The Department of Defense report concludes as follows:

“None of the above provides much reason for optimism. While it is difficult to predict precisely what economic, political, and strategic effects such a shortfall might produce, it surely would reduce the prospects for growth in both the developing and developed worlds.

Such an economic slowdown would exacerbate other unresolved tensions, push fragile and failing states further down the path toward collapse, and perhaps have serious economic impact on both China and India. At best, it would lead to periods of harsh economic adjustment. One should not forget that the Great Depression spawned a number of ferocious totalitarian regimes that sought economic prosperity for their nations by ruthless conquest, while Japan went to war in 1941 to secure its energy supplies.”

Cantarell Field

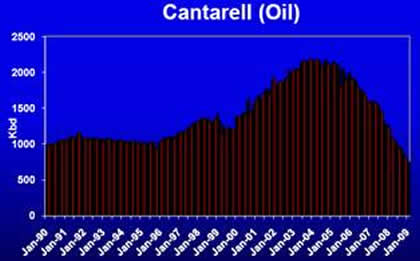

As if to highlight the Department of Defense findings last month it was announced that first quarter production from Mexico’s Cantarell field – the second largest producing oil field in the world four years ago – declined 34% from year earlier levels. Crude oil exports – a significant source of government revenue – declined in March by 25.5%. Production forecasts for 2009 were cut once again by Pemex, the state-owned oil company.

The Cantarell field was discovered in 1979 in the Gulf of Mexico. As an interesting aside the Cantarell reservoir was formed 65 million years ago by an asteroid that slammed violently into the earth. The collision created a dust storm with high levels of iridium – an element not widely distributed on earth – which settled in a geologic layer called the “KT barrier.” Ninety percent of life on earth was destroyed on impact, including the dinosaurs, but the massive Cantarell reservoir had been formed - and the fractured reservoir began to fill with crude oil.

By 1981 Cantarell was producing 1.1 million barrels per day – one of the largest fields in the world. Development continued and by 1999 total production from the complex was 1.4 million bbl/day. But the reservoir pressure began to decline rapidly, and with declining pressure the amount of oil that could be squeezed out of the formations begin to slow. Engineering studies were conducted as to methods that might improve production rates. Based on a study of the Yates field in West Texas, Pemex decided to inject nitrogen gas into the Cantarell field.

By 1981 Cantarell was producing 1.1 million barrels per day – one of the largest fields in the world. Development continued and by 1999 total production from the complex was 1.4 million bbl/day. But the reservoir pressure began to decline rapidly, and with declining pressure the amount of oil that could be squeezed out of the formations begin to slow. Engineering studies were conducted as to methods that might improve production rates. Based on a study of the Yates field in West Texas, Pemex decided to inject nitrogen gas into the Cantarell field.

This was no ‘average’ nitrogen injection program. A massive plant had to be constructed onshore to generate the nitrogen – five times larger than any nitrogen plant in existence at that time. A power plant was built specifically for the nitrogen generation facility, and the gas is piped offshore for injection which began in early 2000.

Engineers have described the Cantarell field as one with a gas cap and water drive mechanism. The gas sits above the oil in the reservoir pushing downward. The water sits below the oil pushing upward. As the injected nitrogen has expanded it is now entering the producing wells in increasing volumes – and creates serious production issues for the operator.

Engineers have described the Cantarell field as one with a gas cap and water drive mechanism. The gas sits above the oil in the reservoir pushing downward. The water sits below the oil pushing upward. As the injected nitrogen has expanded it is now entering the producing wells in increasing volumes – and creates serious production issues for the operator.

From the 1.4 million bbl/day rate in 1999 production jumped to 2.1 million bbl/day in 2004, only to decline to 1.5 million bbl/day in 2007 (see chart courtesy Matthew Simmons, Simmons & Company). Production estimates for 2009 are in the 0.6 million bbl/day range – a massive decline.

In a sense the field has been on ‘steroids’ – and while performance gains were impressive the production declines are equally shocking. The field may be uneconomic to produce as early as 2014 according to some studies.

The shocking element is that most large fields have similar type production profiles – steady gains in production, a peak, and then the inevitable decline. Note that the fact that oil prices increased from 2004 to 2008 did not alter the Cantarell decline curve.

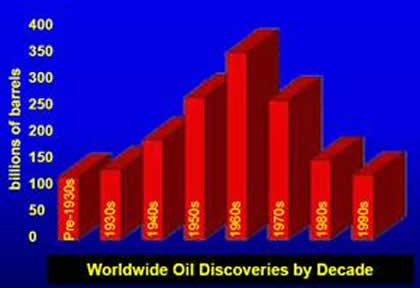

And also note that the Cantarell field is the ‘baby’ of all the major global fields as it was discovered 30 years ago. Many major fields are 40-50 years of age or older. With age and ongoing production inevitably these fields will decline. Discoveries peaked in the 1960’s (see chart from Simmons & Company), so many of these large fields have now been producing for roughly 40 years.

Natural Gas

Natural Gas

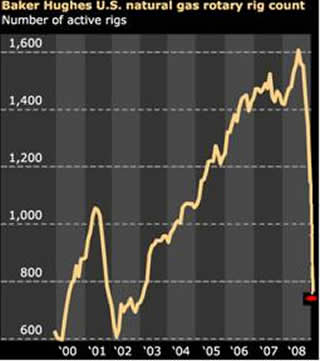

The number of natural gas drilling rigs operating in the U.S. fell to 741 last month, the lowest level in six years. The rig count is 54 percent below a peak of 1,606 on Sept. 12th (see chart from Bloomberg). Some reputable studies conclude a rig count of 1,100 to 1,200 is needed to maintain production deliverability. Many shale wells have large initial declines in production. Some estimate the average Barnett shale well drilled in the Fort Worth basin declines by 65% in the first year, 40% in the second year, 30% in the third year, and 20% every year thereafter.

Due to the decline in drilling the U.S. Energy Department projects a decline in U.S. natural gas production in the fourth quarter of 2009 of roughly 5.4% versus year earlier levels. There is little question that natural gas production will begin to decline at this reduced level of drilling activity – some say the decline is ‘inevitable’. The question is when will the decline begin, and how severe will it be. With the stunning decline in drilling our short answer is ‘soon’ and ‘large’.

Reversing the decline in drilling activity is not as easy as some would expect. With volatile commodity prices, lack of drilling capital, a shortage of experienced drillers, and the time it takes to assemble drilling prospects it will take quite an effort for drilling activity to ‘spool up’ in response to higher prices. Even after drilling recovers models indicate it will take at least two years for production to recover to previous levels – most likely longer.

Due to the extreme nature of the drilling decline, and the lag time between the slowdown and decline in production, it is not inconceivable that the U.S. market could see much higher natural gas prices 18 to 24 months out – some have referred to this as the ‘slingshot effect’. Demand is soft now due to the contracting economy and new wells continue to add to production, but production declines over the next year could correspond with increasing economic activity. This could drive natural gas prices much higher. We are in this ‘slingshot’ camp.

Due to the extreme nature of the drilling decline, and the lag time between the slowdown and decline in production, it is not inconceivable that the U.S. market could see much higher natural gas prices 18 to 24 months out – some have referred to this as the ‘slingshot effect’. Demand is soft now due to the contracting economy and new wells continue to add to production, but production declines over the next year could correspond with increasing economic activity. This could drive natural gas prices much higher. We are in this ‘slingshot’ camp.

Several studies were also issued last month that claim the breakeven cost of drilling in shale formations is much higher than previously thought. Current natural gas prices of roughly $4 a thousand cubic feet are well below the breakeven levels calculated at anywhere from $7 to $9 a thousand cubic feet.

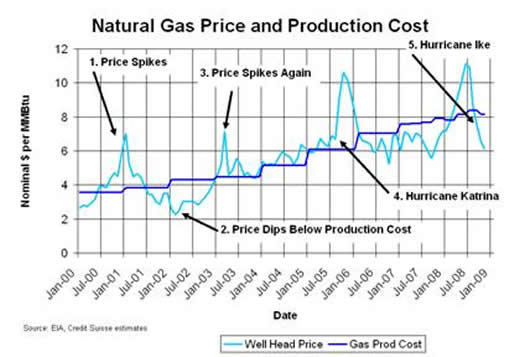

The fact that the industry does not have long term historical data on these shale wells means that assumptions on which costs are calculated are not well established. The chart at right from Credit Suisse illustrates the fact that production costs are slowly escalating. Natural gas prices have oscillated around those costs.

With the Edison Electric Institute generation data indicating that the U.S. is generating roughly 2.2% less electricity as compared to a year ago, with the potential for a mild summer in the Midwest according to long term forecasters, and with the ongoing recession, we don’t see natural gas demand picking up soon. Heating season is nine months away and natural gas storage facilities should easily fill this summer.

Summary

Regardless of the short term movements of the market and economy several long term trends are clear: (1) Depletion of crude oil and natural gas reserves is relentless and substantial; (2) Easy to find and producible oil and gas reserves have for the most part already been exploited and production from these fields is now declining; and (3) Crude oil, coal, and natural gas will be the primary energy source for global economies for decades to come.

Longer term we think these investment themes, coupled with quantitative stock selection techniques, will serve investors well.

By Joseph Dancy,

Adjunct Professor: Oil & Gas Law, SMU School of Law

Advisor, LSGI Market Letter

Email: jdancy@REMOVEsmu.edu

Copyright © 2009 Joseph Dancy - All Rights Reserved

Joseph R. Dancy, is manager of the LSGI Technology Venture Fund LP, a private mutual fund for SEC accredited investors formed to focus on the most inefficient part of the equity market. The goal of the LSGI Fund is to utilize applied financial theory to substantially outperform all the major market indexes over time.

He is a Trustee on the Michigan Tech Foundation, and is on the Finance Committee which oversees the management of that institutions endowment funds. He is also employed as an Adjunct Professor of Law by Southern Methodist University School of Law in Dallas, Texas, teaching Oil & Gas Law, Oil & Gas Environmental Law, and Environmental Law, and coaches ice hockey in the Junior Dallas Stars organization.

He has a B.S. in Metallurgical Engineering from Michigan Technological University, a MBA from the University of Michigan, and a J.D. from Oklahoma City University School of Law. Oklahoma City University named him and his wife as Distinguished Alumni.

Joseph Dancy Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.