The Sum of the Stock Market Bull is Larger than its Parts

Stock-Markets / Financial Markets 2009 May 19, 2009 - 04:40 AM GMTBy: PaddyPowerTrader

Ask enough smart money and you’ll get plenty of well reasoned arguments for why risk bounced, but most of them require a leap of faith that their sum is bigger than the individual parts. The list includes: stronger global economic data (Japan consumer confidence, Eurozone exports -16% from -23% the previous month; NAHB builders index off the bottom); home improvements chain Lowe’s earnings which supported the homebuilders and real estate stocks; Geithner’s comments that the US economy has stabilised, a fall in the VIX to 30; Goldman Sachs, Morgan Stanley and JP Morgan apply to repay TARP money and a 17.3% surge in the Indian Sensex.

Ask enough smart money and you’ll get plenty of well reasoned arguments for why risk bounced, but most of them require a leap of faith that their sum is bigger than the individual parts. The list includes: stronger global economic data (Japan consumer confidence, Eurozone exports -16% from -23% the previous month; NAHB builders index off the bottom); home improvements chain Lowe’s earnings which supported the homebuilders and real estate stocks; Geithner’s comments that the US economy has stabilised, a fall in the VIX to 30; Goldman Sachs, Morgan Stanley and JP Morgan apply to repay TARP money and a 17.3% surge in the Indian Sensex.

Early cyclicals were in the lead again, sending a broad message that even if this market rally is running out of gas it’s not about to roll rapidly backwards. I’d maintain that emerging markets are now overbought (up 60% on average since October 2008, the Indian Sensex is up a staggering 86%, more slumdog millionaires then!). The S&P 500 is now trading at 17 times forward earnings, so its anything but cheap by historic standards.

Today’s Market Moving Stories

- The Chinese government have issued a directive instructing the nation’s steelmakers to immediately reduce output (as exports have plunged, domestic demand is flat and inventories have risen). The AUD initially dipped on the news as such reports bring into question the sustainability of the recovery in China and thus the outlook for commodity prices.

- The FT reports that the UK government is sounding out selling its stakes in the part-nationalised UK banks such as Lloyds and RBS, with the sale hopefully within a year.

- The average UK estate agent sold 10 houses in April, the highest pace since October 2007.

- More chit chat about the Dollar’s demise. There is renewed focus on the USD’s role as a reserve currency, with Brazil and China reportedly keen to use their local currency in transactions rather than USD, and Russia on the wires yesterday indicating a growing proportion of EUR in their foreign exchange reserves. In isolation, these stories might not drive USD lower, but if they come in tandem with further equity market strength and a diminished USD safe haven bid, then they may provide additional impetus.

- Media reports this morning speculate that the Irish government are set for an 11th hour postponement of the plan to double betting taxes to 2% which was announced in October’s budget. Instead a study into the viability of taxing online and phone betting, which are not subject to any levy at present, is set to be undertaken. Pending the outcome of the study, which the government want the bookmaking industry to participate in, a new taxing structure will be implemented or the original doubling of the levy will come into effect.

- Famed UK retail Marks & Spencer’s is off 5% plus this morning after it stated that it will rebase its dividend to 17.8p from 22.5p after profits collapsed 38%. But there was better tidings from Vodafone whose full years earnings rose on a weak GBP and increasing market share in emerging markets particularly India. Retailer Boots announced 1,500 job losses across the chain in plans to shed 10% of its workforce.

Another Reason For The Banking Crisis: Testosterone

Anne Sibert has an interesting column in Vox, in which she asks the question why bankers were behaving so badly. She cites three reasons: (1) They committed cognitive errors involving biases towards their own prior beliefs. (2) Too many male bankers high on testosterone took too much risk. (3) A flawed compensation structure rewarded perceived short-term competency rather than long-run results. Points one and three are known, but less so point number two.

Here is more: “In a fascinating and innovative study, Coates and Herbert (2008) advance the notion that steroid feedback loops may help explain why male bankers behave irrationally when caught up in bubbles. These authors took samples of testosterone levels of 17 male traders on a typical London trading floor (which had 260 traders, only four of whom were female). They found that testosterone was significantly higher on days when traders made more than their daily one-month average profit and that higher levels of testosterone also led to greater profitability – presumably because of greater confidence and risk taking.”

Bank of Ireland Full Year Results Inline With Expectations

Bank of Ireland increased its loans loss expectations to €6 billion compared to the €4.5 billion forecast for the 2009-2011 period. Risk Weighted Assets at the group fell by more than expected, taking pressure off capital requirements. Richard Boucher, the new CEO at the bank, indicated that while he could not speculate on the haircut that NAMA would impose, the bank sees €12.2 billion in assets coming under NAMA, and sees the transfer in a phased basis. This is a positive as it avoids the “big bang”. The group CFO, John O’Donovan also stated that further losses will be absorbed by future profits and that nationalisation was not “inevitable” The stock is up 23% this morning.

Sterling Moving Up

Sterling has been bid across the board on the open. Buy stops have been tripped on route to a new 2009 high for GBPUSD. Yesterday there were a number of bullish factors for GBP - relatively positive UK Rightmove HPI, a Bloomberg piece titled the Pound is a ’screaming buy’ and sovereign wealth demand. This morning GBP is benefiting from increased risk appetite (global stock market gains). The FT writes that UK property sales reached an 18-month high in April. “Credit crunch has ended, according to Ted and Libor” is the headline of an article in The Times today.

Technically GBPUSD has a completion of a 7-day bull pennant through a key m-term pivot at 1.5374 (2009 peak - 8 Jan) towards the 1.5600 area. A sustained move through 1.54 opens up the psychological 1.55 mark. Targets include 1.55, 1.5535 (Nov 25 top) and 1.5724 (Dec 17 peak). EURGBP looking to test the recent low at 0.8765 with below there opening up 0.8732 and the 2009 low at 0.8641.

Data Ahead Today

UK CPI and RPI Inflation for April is out at 9:30. The consensus forecast for CPI is 0.4% mom and 2.4% yoy. Core yearly inflation should edge back down to 1.6%. RPI is forecast to fall further into deflationary territory, to -0.9%, with RPIX down to 1.8%.

German May ZEW Survey is released at 10:00. The current situation index is forecast to be at -91.6 and the expectations series at 25.0.

In the US April’s Housing Starts is due at 13:30. I expect housing starts may have inched up slightly in April, perhaps to around 520,000.

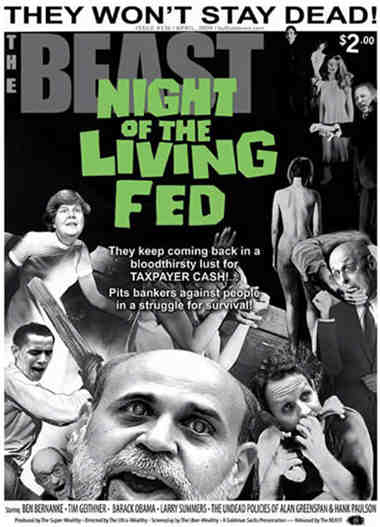

And Finally… Just Incase Yesterdays Rally Has Gotten You All Bullish

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.