How to Move the Stock Market Using Hacks and Morons

Stock-Markets / Mainstream Media May 21, 2009 - 02:06 AM GMTBy: Mike_Stathis

I just ran across a news headline by CNBC so I knew it would provide a learning point. As the VIX Continues to Drop, Is S&P at 1,000 Far Behind?

I just ran across a news headline by CNBC so I knew it would provide a learning point. As the VIX Continues to Drop, Is S&P at 1,000 Far Behind?

First of all, don't be fooled by the seemingly neutral tone of the article. While there are statements that one could conclude are cautious, if you read it from a neutral position, you will come away with a bullish stance. This is a lesson in psychology more than anything.

First, notice the title. In itself sets the tone of the piece as far as I am concerned. Why couldn't the title be "Will the S&P sell off to retest new lows?" Remember, the intermediate to long term trend is what matters. And that trend is still down. To focus on the short-term plays into the hands of Wall Street and online brokers, who will make more money when investors are focused on short-term trading.

If you still don't see my point, just look at the bullish versus bearish comments:

BULLISH:

"...fueling optimism that the recent rally had further to go."

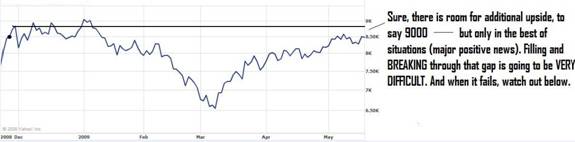

"(VIX) fell below 28 after closing below 30 on Tuesday for the first time since September, when the collapse of Lehman Brothers triggered the dizzying selloff in stocks." -- implies we are coming off a bottom STILL!! There is more downside risk than upside.

"...stocks have followed suit, jumping 30% from their recent lows."

"This is certainly a positive for the market." --Says a guy whose bonus grows when the market does well

"It's apparent investors believe this market is headed higher at least in the short term.." --Ibid

"If the VIX falls to 25, that could propel the Standard & Poor's 500 (Chicago: .spx) to 1,000." --says another guy who makes more money if the market does well. Schaefer's Research is a JOKE by the way. The guy is one of these "Sign up now for HUGE Profits" newsletter clowns, and he has NO Wall Street experience.

"I would consider the trend to be in place and not see a reason why the market can't continue higher." --Ibid

"The 30 percent rally off the March lows has come on mostly low volume. Monday's surge of nearly 3 percent across the board saw barely 1.3 billion shares traded on the New York Stock Exchange, numbers associated more closely with mid-summer than the tail end of earnings season. Volume is traditionally slow in the summertime, and market pros say this year is unlikely to be any different." -- an attempt to explain away a hallmark bearish warning sign.

"Investors are tip-toeing back into risky assets." --this from a mutual fund guy, and we know they're perma-bulls.

"I almost see (the low volume) as a positive because it shows there's not overwhelming optimism in the market. That means its' not being overdone." --another speculative statement meant to create optimisn from an email newsletter company that bombards your email with all kinds of trash meant to target the sheep.

BEARISH:

"...albeit with days that you're going to see the market sell off with a little bit of profit-taking."

"Yet even with the VIX continue to decline, the state of the market remains uncertain." --not really a bearish statement, more like neutral, but I'm being generous here.

"The volume was not heavy enough for the bulls to declare an out-and-out victory. The breadth was very good, but for the bulls to declare victory the volume needs to pick up." --only a mildly bearish statement. This is a great example of media spin to downplay a critical indicator.

_____________________________________________________________________________

Okay, now you tell me that article wasn't meant to alter investor sentiment. Of course, only sheep pay attention to CNBC. And they are setting them up once again to hold the bag when it empties.

Now to the real clincher. The fact is that the VIX is a coincident technical indicator. Only rookies think it is a predictive tool. And believe me, 99.99% of investment pros who use technical analysis actually think it's a predictive tool. Shocking but true. But it shouldn't be hard to believe when you consider everyone on Wall Street missed this collapse. While on occasion it is predictive, that is more the exception than the rule.

You should ask yourself why these so-called experts who spend most of their time on TV preaching the same doom phrase (and who only tell you to buy gold) aren't coming out with the analysis I just detailed. You should also noticed when they publish pieces online, it's the same BS - "we are spending too much and not producing enough"...."Greenspan got us into this mess"...etc....the same Humpty-Dumpty lines that don't provide any real guidance to investors. All they do is draw the sheep in. Maybe if some of these guys spent more time analyzing the markets and less time as a media whore, they might actually develop a an expert understanding of what's going on and how to profit. Lord knows their clients have suffered. Do I need to mention any names?

If you liked this brief analysis (which took me all of 15 minutes to write) you are going to love the newsletter because it will be much more insightful. This is something I wouldn't even bother to cover in the newsletter because it's too elementary (in my view).

NOTE: I continue to face widespread censorship for the cold hard truth I speak, as I see it. My intention is to wake the people up so they will realize just how useless and deceitful the mainstream media is. I ask that you do your part to help with this mission by emailing my articles to your friends and adding the articles to the various online syndication options provided at the top right-hand side of each article. Together, we can make a difference.

I want to encourage all who seek the truth and valuable guidance to follow me to my new site www.avaresearch.com . You won't see me pitching gold or investments to you like others. You will continue to receive nothing but unbiased top-tier insight, education and commentaries.

By Mike Stathis

www.avaresearch.com

Copyright © 2009. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

Mike Stathis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.