Gold, Oil and Natural Gas ETF Trading Report & Forecasts

Commodities / Exchange Traded Funds Jun 18, 2009 - 01:43 AM GMTBy: Chris_Vermeulen

Gold has provided two excellent trades for us this year; both had less than 3% downside risk. With any luck we will have another trade soon. Gold has been forming a large reverse head and shoulder pattern since early March and currently trying to form the right shoulder. If this pattern completes and the price breaks the neck line at the $99 level we should see a nice rally towards the $120 - $130 level.

Gold has provided two excellent trades for us this year; both had less than 3% downside risk. With any luck we will have another trade soon. Gold has been forming a large reverse head and shoulder pattern since early March and currently trying to form the right shoulder. If this pattern completes and the price breaks the neck line at the $99 level we should see a nice rally towards the $120 - $130 level.

The sochastic indicator turned up in the lower reversal zone this week providing more power to Wednesday’s reversal candle. We could see the price bounce here, but until momentum turns back up I will be watching and waiting for a proper low risk setup.

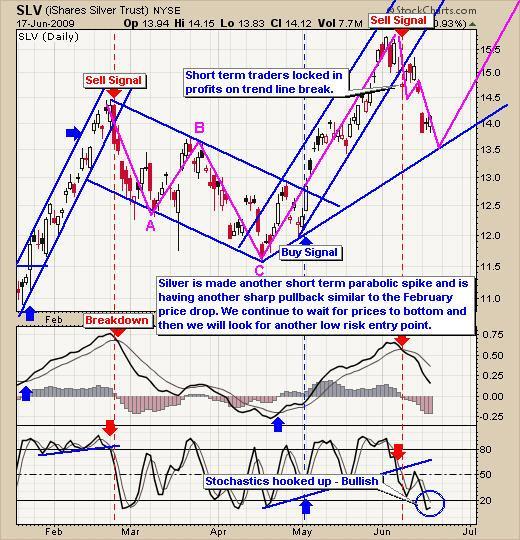

Silver Trading Chart

Silver pulled back just as we expected it would. The stochastic indicator is starting to turn up and the price of silver is near support. I think we will see some sideways/bounce at this level. Again I am not jumping on the train yet. I prefer to wait for the downward momentum to shift to the upside before putting my hard earned money to work.

USO Oil Trading Chart

Oil has been on a crazy run since the breakout back in May. The oil price is currently at a pivot point and could go either way quickly. A break of this support trend line will trigger speculate traders to sell and that will sent oil tumbling quickly. Those of you long oil should be ready to jump if we see continued weakness. If you are a long term oil bull, then taking some profit at this level and still holding a core position could be a good idea. You can always buy back the shares you sell and if we see lower prices you will benefit even more.

UNG Natural Gas Trading Chart

UNG made a breakout this week from its pennant formation. Volume is telling us that this could very well be the start of a trend reversal (higher prices). This trade setup carried a high risk level which was 12% on Monday. I focus on trades with 3% or less so I was not buying on this breakout. Instead I am waiting for a consolidation which should provide us with a low risk setup in the near future.

Trading Conclusion:

This month commodities are under selling pressure along with most stocks. I continue to wait for the charts to generate low risk buy signals for these funds. On a side note we may get some trading signals for some other sectors which are becoming hot like the biotech and health care funds. I will keep you posted.

Hello, I'm Chris Vermeulen founder of TheGoldAndOilGuy and NOW is YOUR Opportunity to start trading GOLD, SILVER & OIL for BIG PROFITS. Let me help you get started.

If you would like more information on my trading model or to receive my Free Weekly Trading Reports - Click Here

I have put together a Recession Special package for yearly subscribers which is if you join for a year ($299) I will send you $300 FREE in gas, merchandise or grocery vouchers FREE which work with all gas stations, all grocery stores and over 100 different retail outlets in USA & Canada.

If you have any questions please feel free to send me an email. My passion is to help others and for us all to make money together with little down side risk.

To Your Financial Success,

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.